Harris County, located in Texas, has its own unique form of accounting index known as the Harris Texas Form of Accounting Index. This accounting index is specifically designed to cater to the financial and accounting needs of Harris County and its various departments, organizations, and entities. The Harris Texas Form of Accounting Index serves as a systematic and structured framework that outlines the guidelines, procedures, and classifications for recording financial transactions within Harris County. It is a comprehensive system that ensures accurate and consistent financial reporting across all departments and agencies of the county. This form of accounting index incorporates various key elements such as a chart of accounts, general ledger, financial statement preparation guidelines, and budgeting procedures. These elements work together to provide a standardized accounting system that facilitates efficient financial management and decision-making. The Harris Texas Form of Accounting Index includes different types or modules tailored to specific aspects of accounting within Harris County. Some of these modules may include: 1. General Ledger Module: This module focuses on the creation and maintenance of the general ledger, which is the central repository of all financial transactions within Harris County. It includes guidelines for recording revenue, expenditures, assets, liabilities, and other financial activities. 2. Budgeting Module: This module deals with the preparation, monitoring, and control of budgets within Harris County. It outlines the budgeting process, guidelines for creating budget proposals, and procedures for budget revisions. 3. Accounts Payable Module: This module focuses on the management of accounts payable, including the recording and processing of invoices, payments to vendors, and reconciliation of accounts. 4. Accounts Receivable Module: This module deals with the management of accounts receivable, including the invoicing, tracking, and collection of payments from clients, agencies, or other entities. 5. Fixed Assets Module: This module is responsible for the tracking, valuation, and management of fixed assets owned by Harris County. It includes procedures for recording acquisitions, disposals, depreciation, and inventory control. 6. Reporting Module: This module encompasses the generation of various financial reports, such as balance sheets, income statements, cash flow statements, and other customized reports required by Harris County. The Harris Texas Form of Accounting Index ensures uniformity in financial reporting by adopting Generally Accepted Accounting Principles (GAAP) and complying with relevant laws and regulations. It not only promotes transparency and accountability but also assists in financial analysis, auditing, and planning processes. Overall, the Harris Texas Form of Accounting Index is a vital tool that enables Harris County to maintain accurate financial records, make informed decisions, and effectively manage its financial resources.

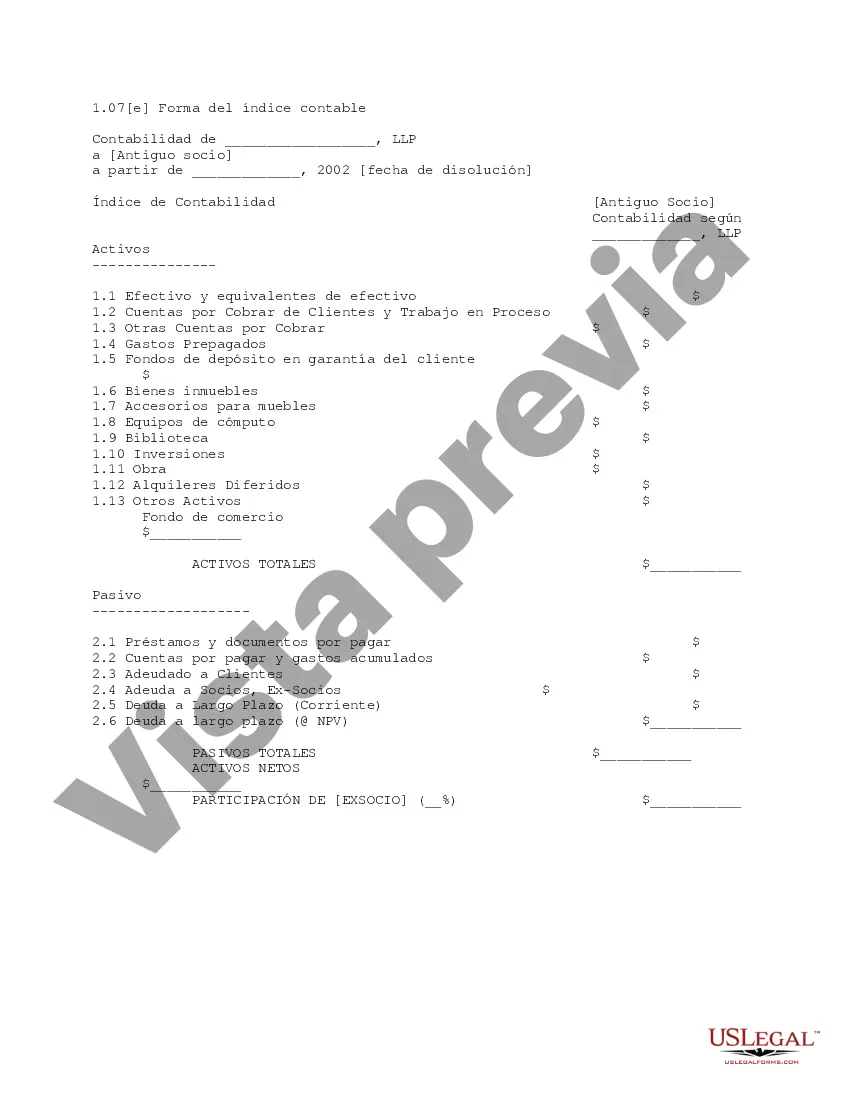

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Forma de Índice Contable - Form of Accounting Index

Description

How to fill out Harris Texas Forma De Índice Contable?

Whether you plan to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Harris Form of Accounting Index is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to obtain the Harris Form of Accounting Index. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Harris Form of Accounting Index in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!