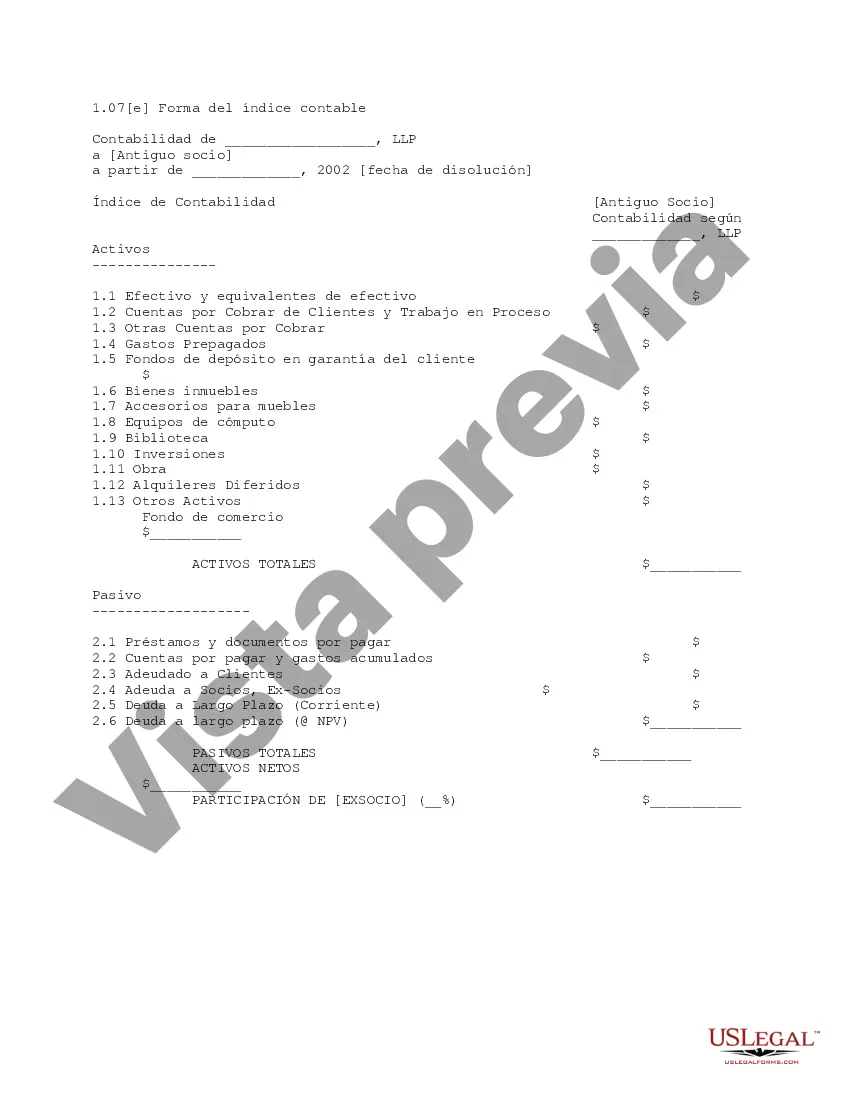

Miami-Dade Florida Form of Accounting Index is a comprehensive financial reporting system used by the Miami-Dade County government in Florida. This index serves as a standardized framework for recording, organizing, and presenting financial information systematically for various departments and agencies within Miami-Dade County. It ensures transparency, accountability, and consistency in financial reporting practices. The Miami-Dade Florida Form of Accounting Index is designed to comply with Generally Accepted Accounting Principles (GAAP) and Governmental Accounting Standards Board (GAS) requirements. It consists of various forms that capture and classify financial transactions and activities across different funds, programs, and departments. These forms help categorize revenues, expenditures, assets, liabilities, and equity based on their nature, source, and purpose. There are several types of Miami-Dade Florida Form of Accounting Index forms, each serving a specific purpose: 1. Revenue Forms: These forms capture all sources of income or revenue received by the county, such as taxes, fees, grants, and fines. 2. Expenditure Forms: These forms record all payments and expenses made by the county for salaries, utilities, supplies, contracts, and other expenditures. 3. Asset Forms: These forms document and track all assets owned by the county, including infrastructure, buildings, equipment, and investments. 4. Liability Forms: These forms record all debts, obligations, and liabilities owed by the county, such as loans, bonds, and pension obligations. 5. Equity Forms: These forms provide an overview of the county's financial position and any changes to its net assets or fund balances. The Miami-Dade Florida Form of Accounting Index ensures accurate financial reporting, facilitates budget planning and monitoring, aids in decision-making processes, and enables compliance with audit requirements. It allows policymakers, stakeholders, and the public to understand the financial health, performance, and accountability of Miami-Dade County. In conclusion, the Miami-Dade Florida Form of Accounting Index is a vital tool that ensures efficient financial management and transparency within the Miami-Dade County government. It encompasses various forms designed to capture, classify, and report financial information accurately, following GAAP and GAS guidelines. By utilizing this index, the county can maintain sound financial practices and provide stakeholders with a comprehensive understanding of its financial operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Forma de Índice Contable - Form of Accounting Index

State:

Multi-State

County:

Miami-Dade

Control #:

US-L0107E

Format:

Word

Instant download

Description

Acuerdos de Asociación de Bufetes de Abogados