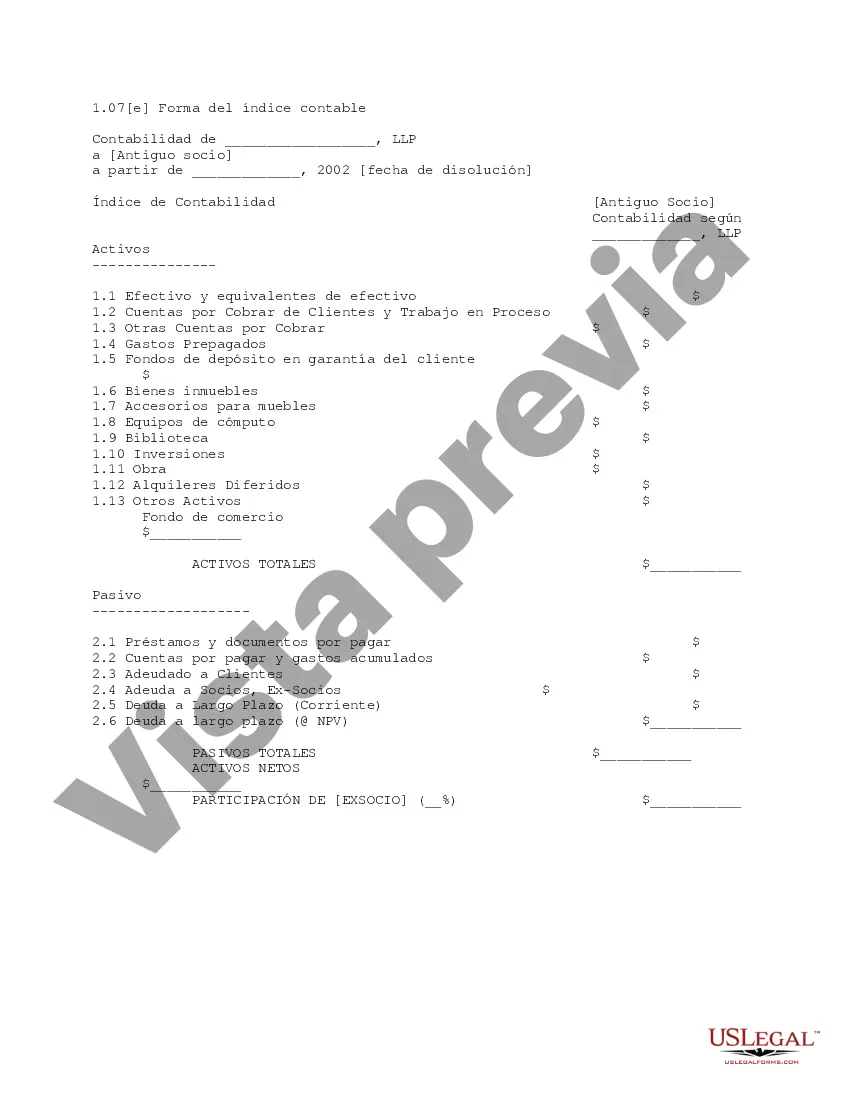

The Santa Clara California Form of Accounting Index is a vital tool used by businesses and individuals in Santa Clara, California, to maintain accurate financial records and comply with accounting regulations. This index encompasses various types of accounting indexes, each serving a specific purpose, including: 1. General Ledger Index: The General Ledger Index is the foundation of accounting records in Santa Clara, California. It categorizes all financial transactions systematically, such as income, expenses, assets, liabilities, and equity. This index provides a detailed overview of a company's financial health and facilitates the preparation of financial statements. 2. Accounts Payable Index: The Accounts Payable Index tracks and organizes all outstanding debts owed by a company to its suppliers or vendors. This index enables businesses in Santa Clara to efficiently manage and maintain accurate records of their financial obligations, ensuring timely payments while building strong relationships with creditors. 3. Accounts Receivable Index: The Accounts Receivable Index focuses on tracking and managing the money owed to a company by its customers or clients. This index helps Santa Clara businesses maintain consistent cash flow, monitor outstanding invoices, and take necessary actions to collect payment on time. 4. Payroll Index: The Payroll Index is specifically designed to manage employee-related financial information. It includes data on wages, salaries, tax withholding, benefits, and other payroll-related expenses. This index plays a crucial role in calculating accurate salaries, ensuring compliance with tax laws, and maintaining records for human resources purposes. 5. Inventory Index: The Inventory Index is used to track and manage the quantity, cost, and value of a company's goods or products. It helps businesses in Santa Clara monitor inventory levels, streamline purchasing decisions, and maintain accurate cost of goods sold (COGS) records. 6. Fixed Assets Index: The Fixed Assets Index records all tangible assets owned by a business, such as land, buildings, vehicles, machinery, and equipment. This index ensures proper depreciation, maintenance, and disposal of fixed assets, enabling Santa Clara businesses to measure their asset value accurately and make informed decisions. In conclusion, the Santa Clara California Form of Accounting Index encompasses various types of accounting indexes essential for effectively managing financial records and complying with accounting regulations. The General Ledger, Accounts Payable, Accounts Receivable, Payroll, Inventory, and Fixed Assets Indexes are some examples of the diverse types of indexes used in Santa Clara to ensure accurate and transparent financial reporting.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Forma de Índice Contable - Form of Accounting Index

Description

How to fill out Santa Clara California Forma De Índice Contable?

Drafting papers for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate Santa Clara Form of Accounting Index without expert assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Santa Clara Form of Accounting Index by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Santa Clara Form of Accounting Index:

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a few clicks!