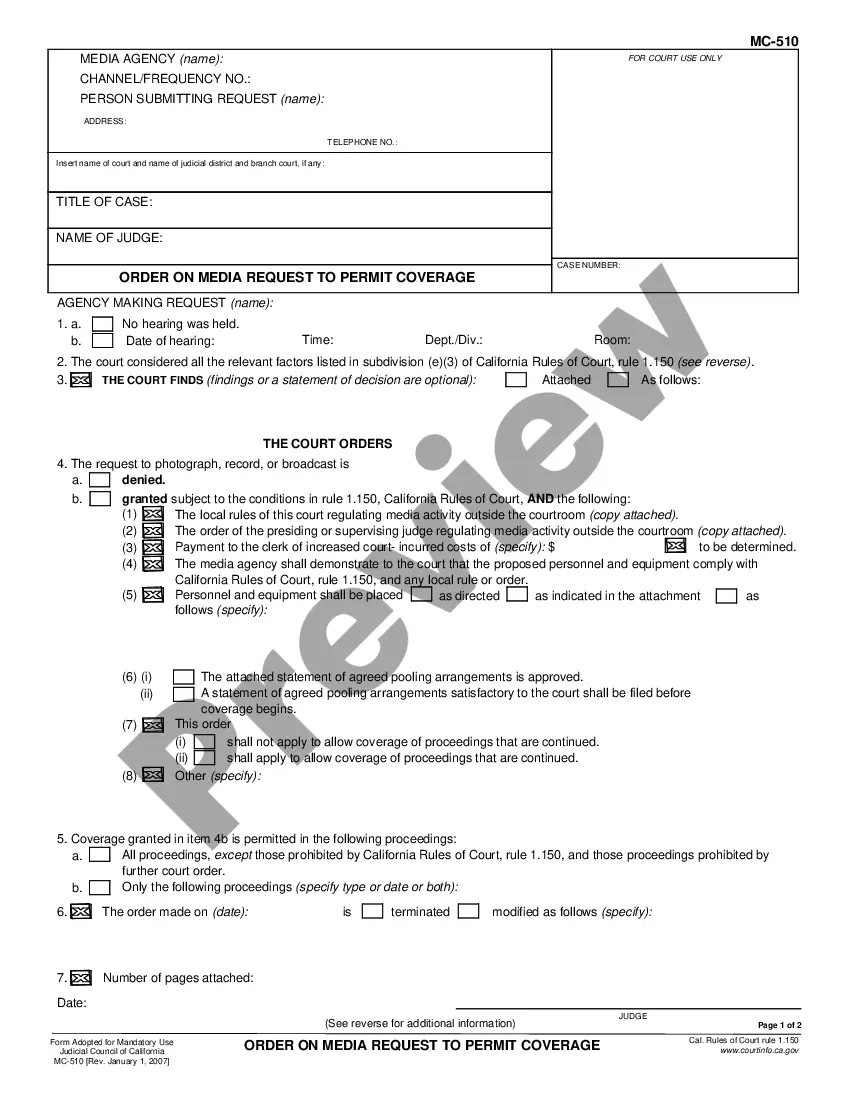

This a shareholders' agreement for a professional service corporation which has been managed over time by the two founding shareholders and is about to admit another shareholder. It addresses governance, income-sharing, indemnities, repayment of loans, disability, termination of the relationship, retirement, and all other issues commonly found in shareholders' agreements.

Maricopa Arizona Shareholders Agreement is a legal document that outlines the rights, obligations, and responsibilities of shareholders in a company registered in Maricopa, Arizona. It serves as a crucial tool for establishing rules and regulations to protect the interests of shareholders and maintain a harmonious relationship among them. The Maricopa Arizona Shareholders Agreement typically covers various key aspects including ownership percentages, voting rights, share transfer restrictions, decision-making procedures, shareholder meetings, dividend distribution policies, and dispute resolution mechanisms. By addressing these important areas, the agreement helps foster transparency, clarity, and accountability within the company's shareholder structure. Moreover, the Maricopa Arizona Shareholders Agreement also provides a framework for managing conflicts among shareholders, protecting minority shareholders' rights, defining the process of selling or transferring shares, and preventing unauthorized disclosure of sensitive company information. It plays a vital role in safeguarding the company's long-term stability, financial interests, and reputation. In Maricopa, Arizona, there can be several types of Shareholders Agreements depending on the specific needs of the shareholders and the company. Some commonly seen types include: 1. Standard Shareholders Agreement: This type of agreement primarily focuses on the fundamental rights and obligations of shareholders, such as share ownership, voting rights, and dividend distribution. 2. Minority Shareholder Protection Agreement: This type of agreement offers additional safeguards and protections for minority shareholders, ensuring their rights are not marginalized by majority shareholders. 3. Voting Agreement: A voting agreement is specifically designed to regulate the voting procedures and decision-making process among the shareholders, providing guidelines for unanimous or majority decision requirements. 4. Transfer Restriction Agreement: This type of agreement imposes restrictions on the transfer or sale of shares, allowing the existing shareholders to have a say in new ownership and maintain consistency in the shareholder structure. 5. Buy-Sell Agreement: A buy-sell agreement outlines the procedures for the sale or transfer of shares upon predefined triggering events such as death, disability, retirement, or voluntary exit of a shareholder. It helps to ensure a smooth transition of ownership in such events. 6. Confidentiality Agreement: In some cases, shareholders may enter into a confidentiality agreement to safeguard sensitive company information and trade secrets from unauthorized disclosure or use. These different types of Maricopa Arizona Shareholders Agreements cater to the varying needs and objectives of shareholders, providing a legally binding framework to govern their relationship and protect their rights. It is advisable to consult with a qualified attorney to draft or review the specific agreement that suits the unique requirements and circumstances of the company and its shareholders.Maricopa Arizona Shareholders Agreement is a legal document that outlines the rights, obligations, and responsibilities of shareholders in a company registered in Maricopa, Arizona. It serves as a crucial tool for establishing rules and regulations to protect the interests of shareholders and maintain a harmonious relationship among them. The Maricopa Arizona Shareholders Agreement typically covers various key aspects including ownership percentages, voting rights, share transfer restrictions, decision-making procedures, shareholder meetings, dividend distribution policies, and dispute resolution mechanisms. By addressing these important areas, the agreement helps foster transparency, clarity, and accountability within the company's shareholder structure. Moreover, the Maricopa Arizona Shareholders Agreement also provides a framework for managing conflicts among shareholders, protecting minority shareholders' rights, defining the process of selling or transferring shares, and preventing unauthorized disclosure of sensitive company information. It plays a vital role in safeguarding the company's long-term stability, financial interests, and reputation. In Maricopa, Arizona, there can be several types of Shareholders Agreements depending on the specific needs of the shareholders and the company. Some commonly seen types include: 1. Standard Shareholders Agreement: This type of agreement primarily focuses on the fundamental rights and obligations of shareholders, such as share ownership, voting rights, and dividend distribution. 2. Minority Shareholder Protection Agreement: This type of agreement offers additional safeguards and protections for minority shareholders, ensuring their rights are not marginalized by majority shareholders. 3. Voting Agreement: A voting agreement is specifically designed to regulate the voting procedures and decision-making process among the shareholders, providing guidelines for unanimous or majority decision requirements. 4. Transfer Restriction Agreement: This type of agreement imposes restrictions on the transfer or sale of shares, allowing the existing shareholders to have a say in new ownership and maintain consistency in the shareholder structure. 5. Buy-Sell Agreement: A buy-sell agreement outlines the procedures for the sale or transfer of shares upon predefined triggering events such as death, disability, retirement, or voluntary exit of a shareholder. It helps to ensure a smooth transition of ownership in such events. 6. Confidentiality Agreement: In some cases, shareholders may enter into a confidentiality agreement to safeguard sensitive company information and trade secrets from unauthorized disclosure or use. These different types of Maricopa Arizona Shareholders Agreements cater to the varying needs and objectives of shareholders, providing a legally binding framework to govern their relationship and protect their rights. It is advisable to consult with a qualified attorney to draft or review the specific agreement that suits the unique requirements and circumstances of the company and its shareholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.