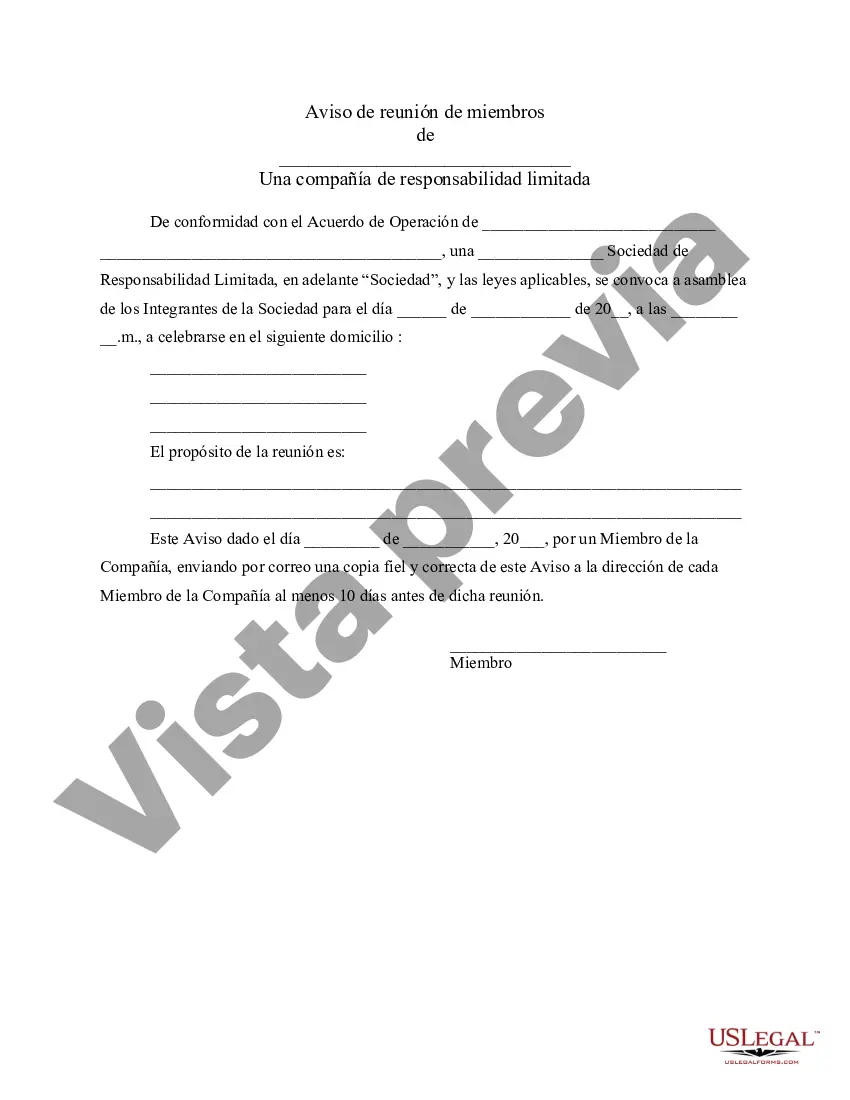

Title: Cuyahoga Ohio Notice of Meeting of Members of LLC Limited Liability Company Introduction: A Notice of Meeting of Members of an LLC Limited Liability Company is a formal document designed to inform the members of the Cuyahoga Ohio LLC about an upcoming meeting, its purpose, date, time, and location. This is a crucial communication tool to ensure all members are well-informed and that the meeting is conducted in accordance with the LLC's governing documents. In this article, we will provide a detailed description of the purpose and different types of Cuyahoga Ohio Notice of Meetings of Members of an LLC Limited Liability Company. Purpose of a Cuyahoga Ohio Notice of Meeting: 1. Annual Meeting Notice: The most common type of Notice of Meeting of Members is for the Annual Meeting. This notice informs members about the yearly gathering to discuss important matters, including the election of new directors, financial reports, operational updates, and other pertinent topics related to the LLC's affairs. The purpose of this notice is to ensure transparency, accountability, and actively involve members in decision-making processes. 2. Special Meeting Notice: A Special Meeting Notice is used when there is a need for an urgent gathering outside the regular annual meeting schedule. This notice explicitly states the reason for the meeting, such as changes in the LLC's operating agreement, major business transactions, potential lawsuits, or any other significant matters requiring immediate attention from the members. The purpose of a Special Meeting Notice is to address time-sensitive issues, gather input, and make informed decisions promptly. 3. Amendment Meeting Notice: When proposing amendments to the LLC's foundational documents, such as the Articles of Organization or Operating Agreement, an Amendment Meeting Notice is issued. This notice outlines the proposed changes, reasoning behind them, and the meeting details where members can discuss and vote on the amendments. The purpose of this notice is to give members an opportunity to participate in the decision-making process that could impact the LLC's structure, governance, or operations. 4. Dissolution Meeting Notice: In case the LLC is contemplating dissolution or termination, a Dissolution Meeting Notice is circulated among the members. This notice informs members about the intention to dissolve the LLC, the reasons behind it, and provides an opportunity to discuss potential alternatives or finalize the dissolution process. The aim of this notice is to engage members in discussing the LLC's future and making informed choices regarding its dissolution. Conclusion: A Cuyahoga Ohio Notice of Meeting of Members of an LLC Limited Liability Company is an essential tool for communicating with members about scheduled gatherings, purpose, and relevant topics to be covered during the meeting. The different types of notices, such as Annual Meeting, Special Meeting, Amendment Meeting, and Dissolution Meeting Notices, serve distinct purposes and ensure that members are involved in the decision-making processes of the LLC. These notices enhance transparency, promote active participation, and foster a cohesive environment among members.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Notificación de la reunión de miembros de LLC propósito de la compañía de responsabilidad limitada para ser completado - Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed

Description

How to fill out Cuyahoga Ohio Notificación De La Reunión De Miembros De LLC Propósito De La Compañía De Responsabilidad Limitada Para Ser Completado?

Draftwing paperwork, like Cuyahoga Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed, to manage your legal matters is a tough and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can get your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms created for various cases and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Cuyahoga Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before downloading Cuyahoga Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed:

- Ensure that your form is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a quick description. If the Cuyahoga Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start using our website and download the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is good to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Una compania de responsabilidad limitada (LLC) no paga impuestos a nivel empresarial.

¿Y cuanto voy a tener que pagar? ImpuestoRangoA pagar10%$0 a $9,95010% de la base imponible12%$9,951 a $40,525$995 mas el 12% del excedente por encima de $9,95022%$40,526 a $86,375$4,664 mas el 22% del excedente por encima de $40,52524%$86,376 a $164,925$14,751 mas el 24% del excedente por encima de $86,3754 more rows

Dependiendo de la estructura de tu LLC, hay varias formas de gravar una LLC a nivel federal....Formulario 1065 Nombre Comercial y Direccion. Actividad Comercial Principal: Aqui es donde describes lo que hace tu negocio.Numero de Identificacion del Empleador (EIN): Esto es obligatorio para las LLC de varios miembros.

Esto significa que la LLC en si no paga impuestos y no tiene que presentar una declaracion ante el IRS. Es el propietario de la LLC quien debe reportar todas las ganancias o perdidas de su negocio en el Anexo C y presentarlo con la declaracion de impuestos individual (Formulario 1040).

Una compania de responsabilidad limitada (LLC) no paga impuestos a nivel empresarial.

Para las LLC de un solo miembro que actuan como entidades excluidas, los propietarios deben presentar el formulario 1040 si ganan mas de $400 (USD) del trabajo por cuenta propia. Como propietario, completaras tu declaracion de impuestos personal normalmente, pero con el Anexo C adjunto.

Impuesto empresarial estatal El impuesto sobre la renta de corporaciones en Florida es generalmente a una tasa de 5.5% de ingresos imponibles federales.

El mayor beneficio de una LLC es la proteccion de responsabilidad personal que brinda. Esto significa que el propietario de una LLC no corre el riesgo de perder sus posesiones personales si la empresa quiebra o es demandada. Las empresas unipersonales y las sociedades generales no brindan esta proteccion.

Interesting Questions

More info

The company is organized with two officers, Mr. and Mrs. John Devine of Lorain, Ohio. They have owned and occupied the building at 1211 West 6th Street for approximately 4yrs. The purpose for the business was to create and promote a college education for the parents of those who are unable to afford higher educational expenses. The business is now on the verge of failure. Since starting the business the Devices have acquired approximately 100 acres in Cuyahoga County. They are attempting to obtain state and federal money. Cuyahoga County Probate Court, Cuyahoga County. The Cuyahoga Valley Community College Board, The Ohio State University Board of Trustees, the City of Columbus. August 2018 Board Meeting. Develop: Ohio. The Ohio Department of Education. July 2018 Board Meeting. Cuyahoga County Board of Probate. Board of Education, the City of Columbus. August 2018 Board Meeting. The Ohio State University. Board of Trustees, the city of Columbus. August 2018 Board Meeting.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.