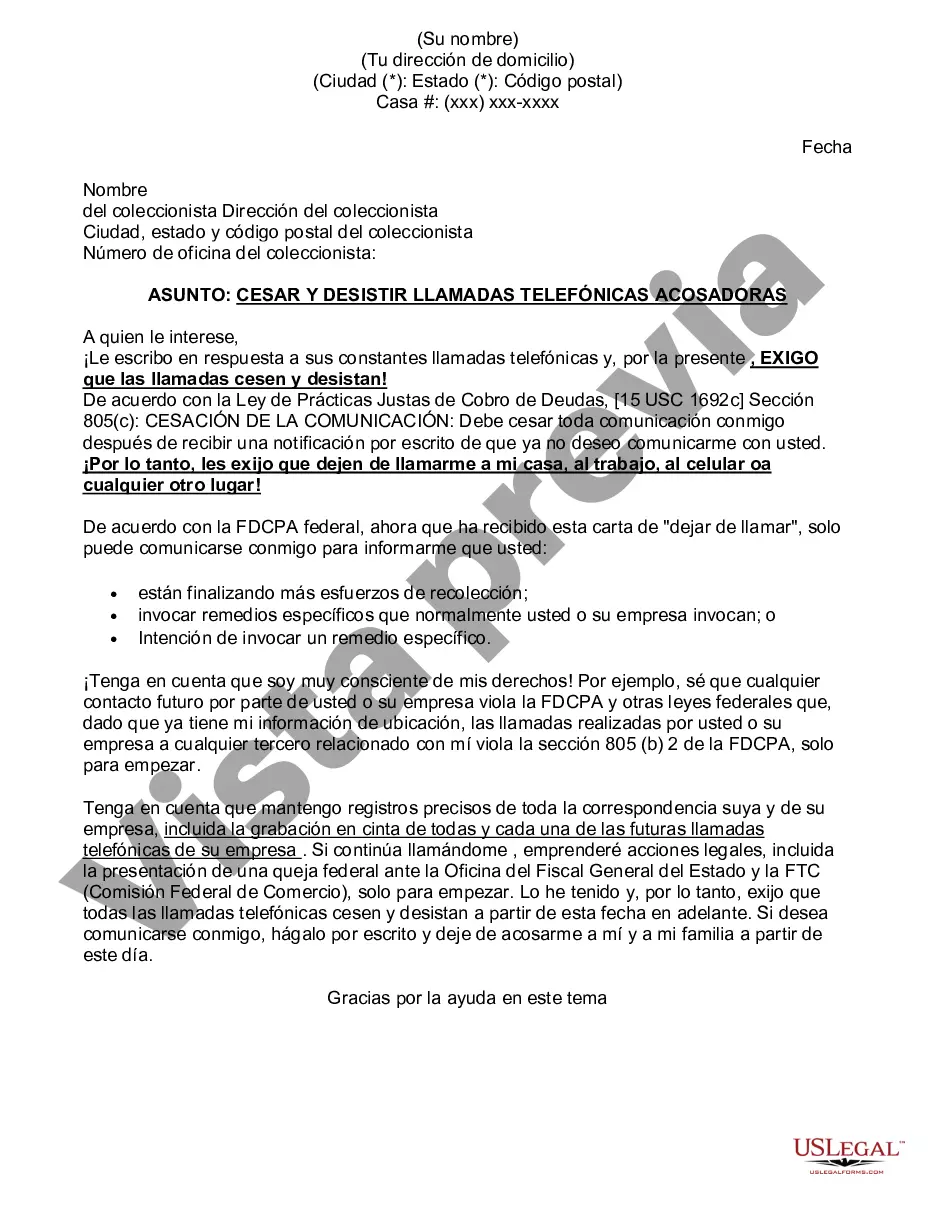

Contra Costa California Cease and Desist for Debt Collectors: Understanding Your Rights and Taking Action In Contra Costa County, California, individuals have legal protection against harassing debt collection practices. When faced with aggressive debt collectors, residents can assert their rights by issuing a Cease and Desist letter. This letter acts as a powerful tool to stop excessive collection efforts and demand fair treatment in debt collection matters. A Cease and Desist letter is a formal communication sent to creditors or debt collectors, instructing them to halt all communication attempts. It serves as a warning that their actions may be in violation of the Fair Debt Collection Practices Act (FD CPA), a federal law regulating how debt collectors interact with consumers. When crafting a Contra Costa California Cease and Desist for Debt Collectors, be sure to include the following essential elements: 1. Identifying Information: Begin the letter with your full name, address, and contact information. Include the creditor's name, address, and any relevant account numbers or reference information. 2. State Relevant Laws: Mention that debt collectors are subject to federal and state laws, including the Fair Debt Collection Practices Act (FD CPA) and the California Rosenthal Fair Debt Collection Practices Act (RFD CPA). 3. Prohibit Communication: Clearly express your desire to cease all communication from the debt collector. Specify that this includes phone calls, emails, letters, text messages, and any other forms of communication. It is crucial to outline your preferred mode of communication, such as written correspondence only. 4. Validation Request: Assert your right to request validation of the debt within the initial thirty-day period provided by the FD CPA. Emphasize that until the requested verification is provided, all collection activities should cease immediately. 5. Warning of Legal Action: Cite potential violations of federal and state laws and mention that any continued collection efforts will result in a formal complaint filed with the Federal Trade Commission (FTC), the Consumer Financial Protection Bureau (CFPB), and the California Attorney General's Office. In certain situations, there may be different types of Contra Costa California Cease and Desist for Debt Collectors. These variations can stem from specific circumstances or the need to address multiple creditors simultaneously. Here are a few examples: 1. Individual Cease and Desist: Typically used when dealing with a single debt collector or creditor who is engaging in unlawful or abusive behavior. 2. Multiple Creditor Cease and Desist: Suitable when asserting your rights against multiple creditors or debt collection agencies to cease communication and collection efforts simultaneously. 3. Inclusion of Legal Representation: If you have legal representation, your Cease and Desist letter can also include a section notifying the debt collector of your legal counsel's involvement. This further emphasizes your commitment to protecting your rights and may induce the creditor to reconsider their actions. It is important to remember that a Cease and Desist letter does not erase the existence of the debt, but it can put an end to the harassing tactics employed by debt collectors. Seeking legal advice from an attorney specializing in debt collection issues can provide valuable guidance and support throughout the process. Exercise your rights in Contra Costa, California, by sending a clearly articulated Cease and Desist letter to debt collectors who are violating the law. Taking this proactive step can help restore peace of mind and put an end to unwarranted harassment in debt collection processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Cese y desistimiento para los cobradores de deudas - Cease and Desist for Debt Collectors

Description

How to fill out Contra Costa California Cese Y Desistimiento Para Los Cobradores De Deudas?

If you need to get a trustworthy legal document supplier to get the Contra Costa Cease and Desist for Debt Collectors, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support make it simple to find and execute different papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to look for or browse Contra Costa Cease and Desist for Debt Collectors, either by a keyword or by the state/county the form is created for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Contra Costa Cease and Desist for Debt Collectors template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less pricey and more affordable. Set up your first company, organize your advance care planning, create a real estate contract, or complete the Contra Costa Cease and Desist for Debt Collectors - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

Cuando un cobrador de deudas le contacte, averigue lo siguiente: La identidad del cobrador de deudas, incluyendo: nombre, direccion y telefono. El monto de la deuda, incluyendo cualquier tarifa como intereses, o costos de cobranza. Para que y cuando fue contraida la deuda. Nombre del acreedor original.

Es legitimo iniciar un reclamo de su deuda: Si inicia un proceso de disputa del monto que debe, hagalo por escrito y dentro de 30 dias desde el primer contacto con el cobrador. Una vez que el reclamo se inicia, la agencia recaudadora no debe contactarlo durante el proceso.

Cuando un cobrador de deudas le contacte, averigue lo siguiente: La identidad del cobrador de deudas, incluyendo: nombre, direccion y telefono. El monto de la deuda, incluyendo cualquier tarifa como intereses, o costos de cobranza. Para que y cuando fue contraida la deuda.

El desistimiento de contrato es un derecho o facultad del consumidor o usuario de dejar sin efecto el contrato celebrado, notificandose a la otra parte dentro de los plazos establecidos, sin necesidad de justificar su decision y sin penalizacion de ninguna clase.

Para ejercer el derecho de desistimiento, el consumidor debera notificar su decision de desistir del contrato a traves de una declaracion inequivoca (por ejemplo, una carta enviada por correo postal, fax o correo electronico).

'Accion y efecto de cesar', tanto en el sentido de 'dejar de desempenar un cargo' como en el de 'dejar de producir(se) algo': «Los comentarios se limitaban a pedir el cese del entrenador» (Proceso Mex.

Usted tiene derecho a decirle a un cobrador de deudas que deje de comunicarse con usted. Para detener la comunicacion, envie una carta al cobrador de deudas y guarde una copia. Si no desea que un cobrador de deudas se comunique con usted otra vez, escribale una carta para notificarselo.

El desistimiento de contrato es un derecho o facultad del consumidor o usuario de dejar sin efecto el contrato celebrado, notificandose a la otra parte dentro de los plazos establecidos, sin necesidad de justificar su decision y sin penalizacion de ninguna clase.

Un cese y desista (en ingles, cease and desist) es una orden o solicitud para detener una actividad (cesar) y no retomarla mas tarde (desistir), o si no se acata, enfrentarse a acciones legales. El destinatario de una orden cese y desista puede ser un individuo o una organizacion.

La carta de cese y desistimiento es una comunicacion que se envia al presunto infractor, en la que se le expone la infraccion, con las correspondientes pruebas y explicando las consecuencias legales de sus actos.