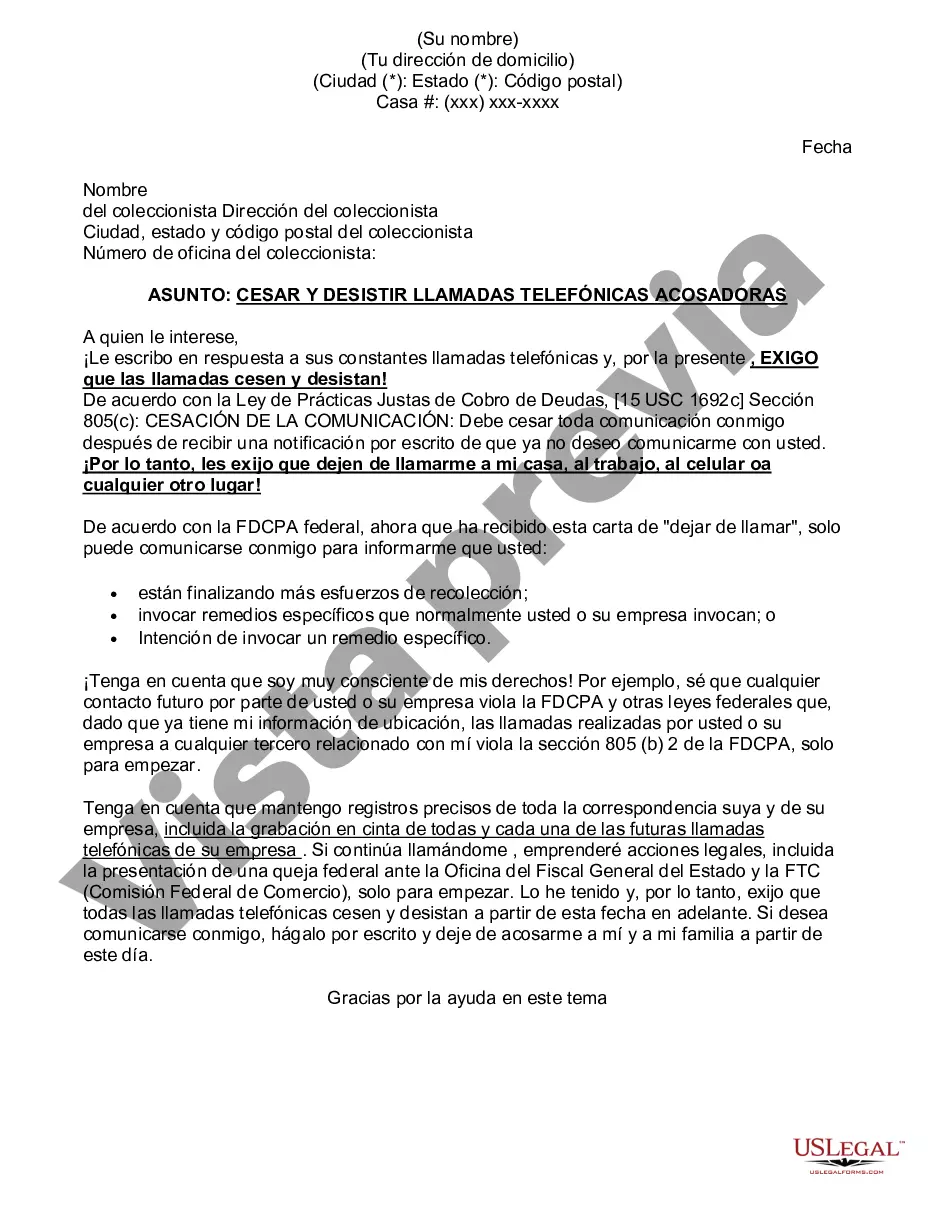

Houston Texas Cease and Desist for Debt Collectors is a legal document that individuals residing in Houston, Texas can use to stop debt collectors from contacting them in relation to a particular debt. Debt collectors are individuals or agencies that collect debts on behalf of creditors. They often engage in practices that may be considered harassing or invasive. This is where the Houston Texas Cease and Desist for Debt Collectors plays a crucial role. By issuing a Cease and Desist letter to a debt collector, Houston residents can effectively communicate their desire for the collector to immediately cease all communication attempts regarding a specific debt. This legal action aims to protect consumers from harassment, unfair practices, or any violation of their rights as debtors under both state and federal laws. Houston Texas Cease and Desist for Debt Collectors may come in different forms. Some variations may include: 1. General Cease and Desist for Debt Collectors: This type of letter is a standard template that individuals can use to stop debt collectors from contacting them regarding any outstanding debt. 2. Specific Debt Cease and Desist: This variation is tailored to address a specific debt that a consumer wishes to dispute or resolve. The letter provides detailed information about the specific debt in question and demands the debt collector's cessation of communication related to that particular debt. 3. Harassment Cease and Desist: This type of letter is issued when debt collectors engage in harassing or unethical practices while attempting to collect a debt. It specifically addresses the unacceptable behavior and demands immediate cessation of such actions. 4. Attorney-Represented Cease and Desist: This type of letter is typically sent by an attorney on behalf of their client. It emphasizes the seriousness of the matter, as legal representation is involved, and demands an immediate stop to all communication attempts from the debt collector. It's important to note that while a Cease and Desist letter can provide temporary relief from debt collector harassment, it does not absolve individuals from their legal obligations. If the debt remains valid, debt collectors may pursue alternative legal avenues to enforce collection. Seeking legal advice or exploring debt resolution options is advisable to effectively manage debts and protect consumer rights. Keywords: Houston Texas, Cease and Desist, Debt Collectors, legal document, debt collector harassment, unfair practices, legal obligations, attorney- represented.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Cese y desistimiento para los cobradores de deudas - Cease and Desist for Debt Collectors

Description

How to fill out Houston Texas Cese Y Desistimiento Para Los Cobradores De Deudas?

Do you need to quickly draft a legally-binding Houston Cease and Desist for Debt Collectors or probably any other form to handle your own or business matters? You can go with two options: hire a professional to draft a valid paper for you or draft it entirely on your own. Luckily, there's another option - US Legal Forms. It will help you receive neatly written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific form templates, including Houston Cease and Desist for Debt Collectors and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- First and foremost, double-check if the Houston Cease and Desist for Debt Collectors is adapted to your state's or county's regulations.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the search over if the template isn’t what you were hoping to find by using the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Houston Cease and Desist for Debt Collectors template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. In addition, the templates we offer are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!