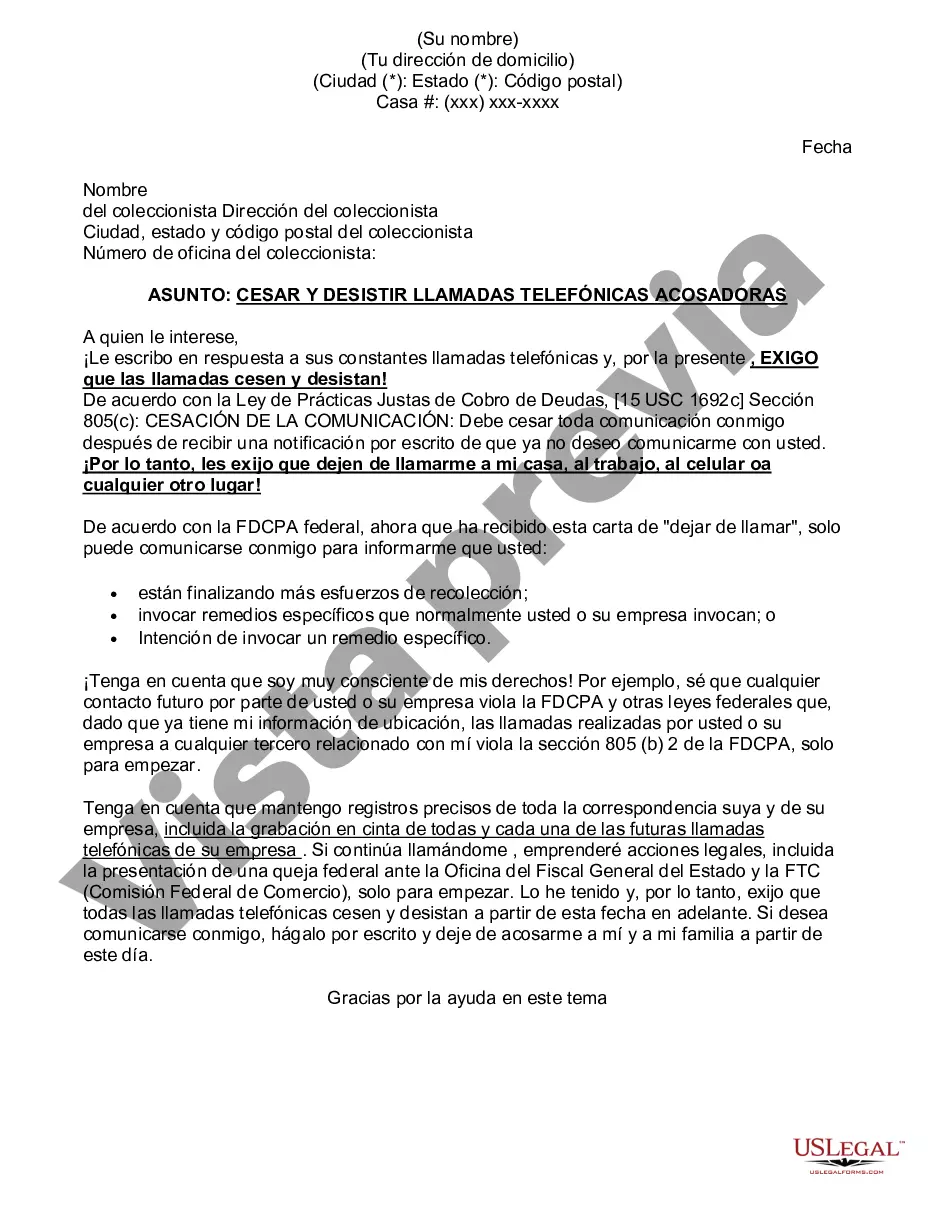

San Jose, California Cease and Desist for Debt Collectors: A Comprehensive Overview In San Jose, California, individuals who are dealing with harassing debt collection practices have the right to send a Cease and Desist letter to put an end to such actions. A Cease and Desist letter serves as a formal notice to debt collectors, demanding that they halt contact and cease any further collection efforts. This legal tool aims to protect individuals from abusive and intrusive debt collection practices and provide relief for those who are struggling to pay off their debts. The San Jose, California Cease and Desist for Debt Collectors is a powerful means for individuals to assert their rights and stop aggressive debt collection tactics. Debt collectors are legally required to abide by the Fair Debt Collection Practices Act (FD CPA) and the California Rosenthal Fair Debt Collection Practices Act (RFD CPA), which set guidelines ensuring fair treatment and prohibiting any abusive, deceptive, or unfair practices. By sending a Cease and Desist letter, individuals assert that their rights have been violated, demanding that the debt collectors stop all communication, including phone calls, letters, texts, or any other form of contact. There are several types of Cease and Desist letters that individuals in San Jose, California can use when dealing with debt collectors: 1. Cease and Desist for Harassment: If debt collectors are repeatedly contacting an individual at inconvenient times, using abusive language, or annoying them with constant calls and messages, a Cease and Desist for Harassment letter can be sent to demand the immediate cessation of such behavior. 2. Cease and Desist for False Representations: Debt collectors are prohibited from using misleading, deceptive, or false tactics in their communication. If an individual believes that a debt collector has misrepresented the nature of the debt, the amount owed, or any other pertinent information, they can send a Cease and Desist for False Representations letter to demand the end of such unethical practices. 3. Cease and Desist for Third-Party Communication: In certain cases, debt collectors may contact third parties, such as family members, friends, or employers, in an attempt to embarrass or intimidate the debtor. A Cease and Desist for Third-Party Communication letter can be sent to demand that the debt collector refrains from discussing the debt with anyone other than the debtor or their legal representative. It is crucial to tailor the content of the Cease and Desist letter to address the specific violations experienced by the debtor. The letter should contain clear and concise language, stating the debtor's intention to halt all communication and urging the debt collector to comply with the FD CPA and RFD CPA regulations. It is advisable to send the letter via certified mail with return receipt requested to have evidence of its delivery. It is important to note that while a Cease and Desist letter can provide temporary relief from debt collection efforts, it does not absolve the debtor of their responsibility to settle outstanding debts or remove any legal consequences associated with the debt. Seeking professional legal advice is recommended to explore further options and determine the best course of action based on individual circumstances. In summary, a San Jose, California Cease and Desist for Debt Collectors is an effective tool for individuals looking to protect themselves from abusive debt collection practices. By sending a well-crafted letter, debtors can demand that debt collectors cease all communication and adhere to legal guidelines, providing them with the necessary relief to address their financial concerns.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Cese y desistimiento para los cobradores de deudas - Cease and Desist for Debt Collectors

Description

How to fill out San Jose California Cese Y Desistimiento Para Los Cobradores De Deudas?

If you need to find a trustworthy legal paperwork provider to get the San Jose Cease and Desist for Debt Collectors, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support make it simple to find and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply type to search or browse San Jose Cease and Desist for Debt Collectors, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the San Jose Cease and Desist for Debt Collectors template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less pricey and more affordable. Create your first business, arrange your advance care planning, create a real estate agreement, or complete the San Jose Cease and Desist for Debt Collectors - all from the convenience of your home.

Sign up for US Legal Forms now!