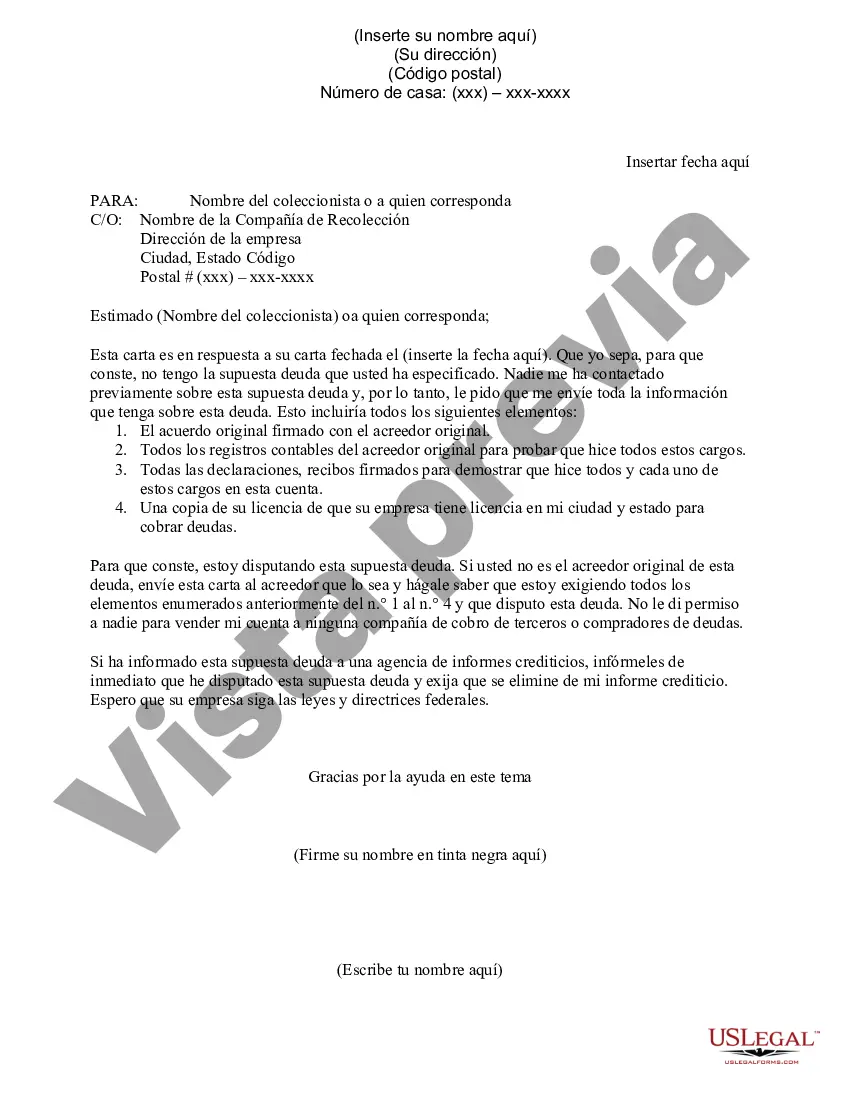

Broward County, Florida is a vibrant and populous county located in the southeastern part of the state. With its bustling cities, rich cultural diversity, and beautiful coastal areas, Broward County offers a wide range of opportunities for both residents and visitors. One important aspect of financial management in Broward County is the Request for Proof of Debt. This legal process allows individuals or businesses to ask debt collectors to provide evidence verifying the legitimacy and accuracy of a debt. With numerous debt collection agencies operating in the county, it is essential for consumers to be aware of their rights and take necessary steps to protect themselves from potential scams or false claims. A Broward Florida Request for Proof of Debt may need to be submitted when a debtor receives a letter or call from a debt collector requesting payment. This request seeks to obtain valid documentation that outlines the origin, amount, and legitimacy of the alleged debt. By doing so, debtors can ensure that they are not being targeted unfairly, facing incorrect debt amounts, or being pursued for debts that have already been paid or expired. The Broward Florida Request for Proof of Debt is governed by state and federal laws, including the Fair Debt Collection Practices Act (FD CPA) and the Florida Consumer Collection Practices Act (FC CPA). These laws regulate how debt collectors can behave, the type of information they must disclose, and what can be considered valid proof of debt. It is important to understand that there are different types of Broward Florida Request for Proof of Debt, depending on the specific situation. Some common types of requests may include: 1. Request for Validation of Debt: This is a general request asking the debt collector to provide evidence that the debt is valid, such as a copy of the original agreement, itemized billing statements, or proof of assignment from the original creditor. 2. Request for Verification of Debt: This type of request seeks to confirm the accuracy of the debt by requesting the debt collector to provide details like the debtor's name, the amount owed, the original creditor's name, and contact information. 3. Request for Cease and Desist: In certain cases, debtors may choose to request an end to all communication from the debt collector. This request aims to halt further contact until valid proof of debt is provided. 4. Request for Confirmation of Statute of Limitations: Debtors may request the debt collector to confirm if the debt falls within the legal timeframe for collection. If the debt is beyond the statute of limitations, it cannot be legally pursued. When submitting a Broward Florida Request for Proof of Debt, it is crucial to keep a record of all correspondence, including copies of letters, email communications, and phone call logs. It is also recommended sending the request via certified mail with return receipt requested, ensuring proof of delivery. By being well-informed about the Broward Florida Request for Proof of Debt process and understanding different forms of requests, debtors can protect themselves from unfair practices and ensure they are treated justly throughout the debt collection process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Solicitud de Prueba de Deuda - Request for Proof of Debt

Description

How to fill out Broward Florida Solicitud De Prueba De Deuda?

Are you looking to quickly create a legally-binding Broward Request for Proof of Debt or probably any other form to manage your personal or business matters? You can go with two options: hire a professional to draft a valid document for you or create it entirely on your own. Thankfully, there's another option - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant form templates, including Broward Request for Proof of Debt and form packages. We provide documents for an array of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, double-check if the Broward Request for Proof of Debt is adapted to your state's or county's regulations.

- In case the document has a desciption, make sure to check what it's suitable for.

- Start the search again if the form isn’t what you were looking for by utilizing the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Broward Request for Proof of Debt template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our services. Moreover, the paperwork we offer are reviewed by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!