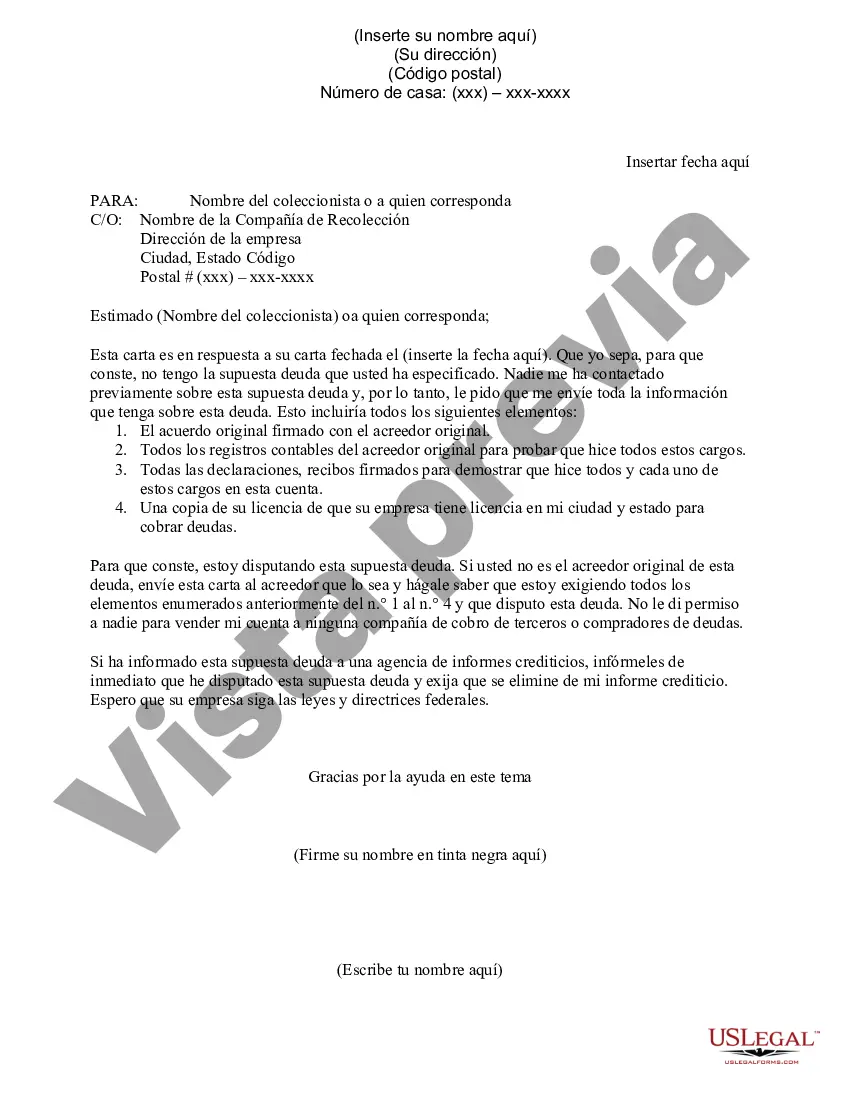

Miami-Dade County, located in the southeastern part of the state of Florida, is a major metropolitan area known for its vibrant culture, stunning beaches, and bustling city life. With a population of over 2.7 million people, it is the most populous county in Florida and the eighth-most populous county in the United States. A Miami-Dade Florida Request for Proof of Debt is a legal document often used by individuals or businesses seeking verification or validation of a debt. This request is typically made when a debtor believes that they may not owe the disputed debt or when they need more information regarding the validity and accuracy of the debt claimed. As Miami-Dade is a diverse and populous county, it encompasses various types of debt-related situations that may warrant the use of a proof of debt request. Some different types of Miami-Dade Florida Request for Proof of Debt include: 1. Consumer Debt: This type of request arises when a consumer disputes a debt claimed by a creditor or collection agency, such as credit card debts, personal loans, medical bills, or auto loans. 2. Business Debt: Businesses in Miami-Dade County may utilize this request to challenge or gather evidence regarding debts owed to or by their organization. Examples include outstanding invoices, commercial loans, or unpaid services. 3. Mortgage Debt: Homeowners who question the validity or terms of their mortgage may submit a request for proof of debt to their mortgage lender. It allows them to seek clarification or verify information related to their mortgage payments, interest rates, or terms of the loan. 4. Student Loan Debt: Miami-Dade residents burdened by student loan debt can submit a request for proof of debt to loan services or collection agencies to ascertain the accuracy of the outstanding balance and payment terms. 5. Tax Debt: Individuals or businesses facing tax-related debts in Miami-Dade County can utilize a request for proof of debt to ensure that the claimed amount is correct and to gather relevant documentation concerning their tax obligations. When preparing a Miami-Dade Florida Request for Proof of Debt, it is crucial to provide specific details including the creditor's name, the debt's value, the date of the debt, any account numbers associated with the debt, and any supporting evidence demonstrating discrepancies or factors that question its validity. By utilizing this request effectively, individuals or businesses can ensure the accuracy and legitimacy of the debt claimed and protect their rights as debtors within the legal framework of Miami-Dade County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Solicitud de Prueba de Deuda - Request for Proof of Debt

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-MC-0007

Format:

Word

Instant download

Description

Request for Proof of Debt

Miami-Dade County, located in the southeastern part of the state of Florida, is a major metropolitan area known for its vibrant culture, stunning beaches, and bustling city life. With a population of over 2.7 million people, it is the most populous county in Florida and the eighth-most populous county in the United States. A Miami-Dade Florida Request for Proof of Debt is a legal document often used by individuals or businesses seeking verification or validation of a debt. This request is typically made when a debtor believes that they may not owe the disputed debt or when they need more information regarding the validity and accuracy of the debt claimed. As Miami-Dade is a diverse and populous county, it encompasses various types of debt-related situations that may warrant the use of a proof of debt request. Some different types of Miami-Dade Florida Request for Proof of Debt include: 1. Consumer Debt: This type of request arises when a consumer disputes a debt claimed by a creditor or collection agency, such as credit card debts, personal loans, medical bills, or auto loans. 2. Business Debt: Businesses in Miami-Dade County may utilize this request to challenge or gather evidence regarding debts owed to or by their organization. Examples include outstanding invoices, commercial loans, or unpaid services. 3. Mortgage Debt: Homeowners who question the validity or terms of their mortgage may submit a request for proof of debt to their mortgage lender. It allows them to seek clarification or verify information related to their mortgage payments, interest rates, or terms of the loan. 4. Student Loan Debt: Miami-Dade residents burdened by student loan debt can submit a request for proof of debt to loan services or collection agencies to ascertain the accuracy of the outstanding balance and payment terms. 5. Tax Debt: Individuals or businesses facing tax-related debts in Miami-Dade County can utilize a request for proof of debt to ensure that the claimed amount is correct and to gather relevant documentation concerning their tax obligations. When preparing a Miami-Dade Florida Request for Proof of Debt, it is crucial to provide specific details including the creditor's name, the debt's value, the date of the debt, any account numbers associated with the debt, and any supporting evidence demonstrating discrepancies or factors that question its validity. By utilizing this request effectively, individuals or businesses can ensure the accuracy and legitimacy of the debt claimed and protect their rights as debtors within the legal framework of Miami-Dade County.