San Diego, California is a vibrant coastal city located in the southern part of the state. Known for its idyllic climate, stunning beaches, and diverse culture, San Diego is a popular destination for locals and tourists alike. One particular aspect of San Diego that is worth exploring is the legal landscape, specifically the Request for Proof of Debt. In this context, a Request for Proof of Debt refers to a legal process that allows individuals to challenge the validity of a debt claim. This request is typically made when a debtor receives a notice from a creditor or debt collection agency regarding an alleged outstanding debt. Within the sphere of Debt Validation, several types of Requests for Proof of Debt can be identified: 1. Consumer Debt Validation: This type of Request for Proof of Debt is commonly employed by individuals who are being pursued for unpaid debts, such as credit card bills, medical expenses, or personal loans. By submitting a request, the debtor demands that the creditor or collection agency provides evidence that the debt is legitimate and accurate. 2. Business Debt Validation: When businesses face demands for unpaid bills or other financial obligations, they can utilize a Request for Proof of Debt to ensure that the claimed debt is valid. This formal process holds the creditor accountable to present supporting documentation proving the accuracy of the debt. 3. Mortgage Debt Validation: Homeowners who face foreclosure or receive notifications from mortgage lenders asserting unpaid mortgage balances can employ a Request for Proof of Debt to challenge the legitimacy of the claim. This type of validation is used to ensure that the debt is accurate, lawful, and supported with appropriate documentation. 4. Student Loan Debt Validation: As student loan debts significantly impact individuals' financial lives, a Request for Proof of Debt can serve as a tool for borrowers to verify the accuracy and authenticity of their student loan obligations. By demanding proof, borrowers can assess any discrepancies or inconsistencies within the debt claim. By understanding the different types of Requests for Proof of Debt in San Diego, individuals can effectively navigate the legal requirements and safeguards available to them. It is essential to consult with a legal professional, such as a debt attorney, to ensure proper handling of the request and address any specific concerns related to the alleged debt.

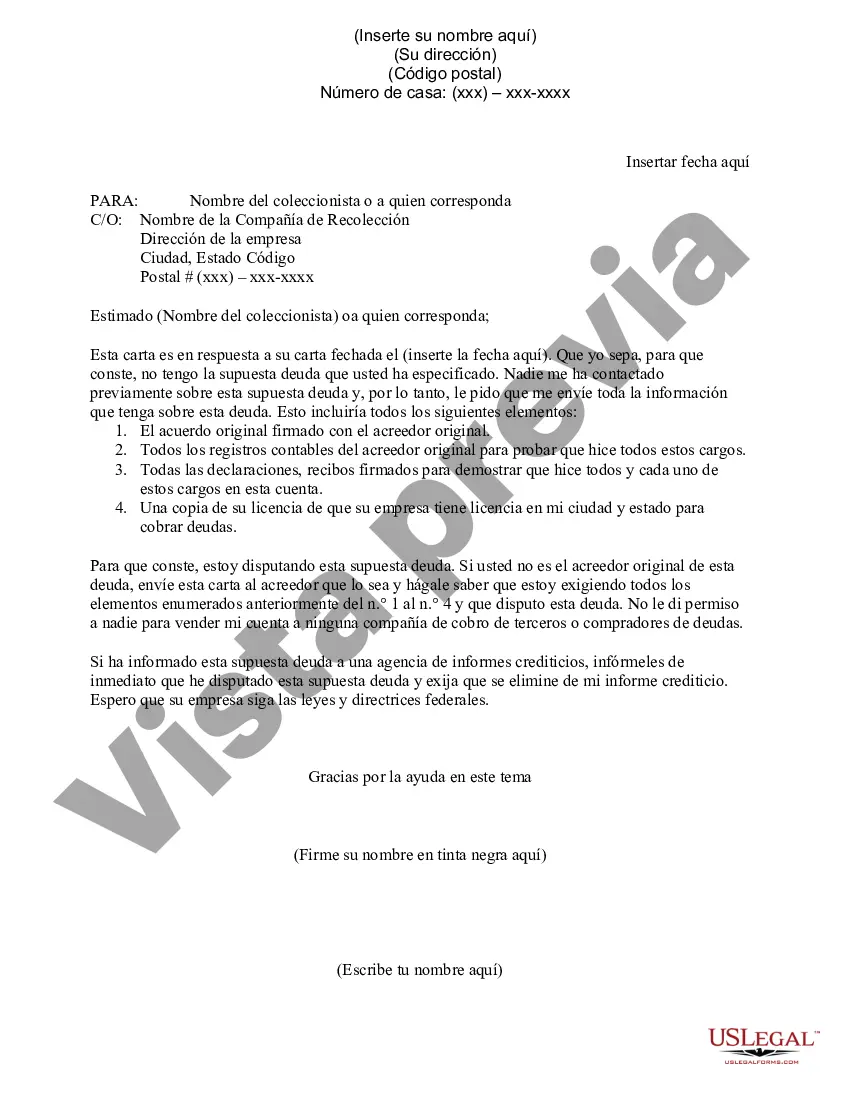

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Solicitud de Prueba de Deuda - Request for Proof of Debt

Description

How to fill out San Diego California Solicitud De Prueba De Deuda?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from scratch, including San Diego Request for Proof of Debt, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different types varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any tasks related to document execution simple.

Here's how to locate and download San Diego Request for Proof of Debt.

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Examine the similar forms or start the search over to locate the appropriate document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy San Diego Request for Proof of Debt.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed San Diego Request for Proof of Debt, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional entirely. If you need to cope with an extremely complicated situation, we recommend getting a lawyer to check your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and get your state-specific documents with ease!