Suffolk County, located in the state of New York, is one of the most populous counties in the United States. As part of the collection process for outstanding debts, individuals and businesses may send a Suffolk New York Request for Proof of Debt to debtors. This legal document serves as a means to verify and validate the existence and ownership of a debt. By requesting proof of the debt, the sender seeks to ensure the accuracy and legitimacy of the claim, protecting both parties involved. There are different types of Suffolk New York Request for Proof of Debt that can be sent depending on the nature of the owed balance. Some common examples include: 1. Suffolk New York Request for Proof of Credit Card Debt: This type of request is used when a credit card company or a debt collection agency needs to validate an outstanding credit card balance. It typically includes information such as the account number, amount owed, and any relevant documentation supporting the claim. 2. Suffolk New York Request for Proof of Medical Debt: When medical services or treatments are provided, healthcare providers or medical billing companies may send this request to patients who owe outstanding medical bills. It may include medical invoices, receipts, or any other relevant documentation proving the incurred debt. 3. Suffolk New York Request for Proof of Mortgage Debt: If a debtor has an outstanding mortgage balance, banks or mortgage lenders may send this request to validate the debt's existence. It commonly includes loan agreements, payment history, and other documents supporting the claim. 4. Suffolk New York Request for Proof of Student Loan Debt: When individuals owe student loan debt, loan services or collection agencies may request proof of the debt. This type of request often requires verifying loan statements, promissory notes, or any other relevant documentation related to the student loan. Regardless of the type of debt, a Suffolk New York Request for Proof of Debt must comply with applicable laws and regulations, providing debtors an opportunity to review and verify the claimed debt. It is crucial for debtors and creditors to communicate effectively and transparently through this process to resolve any potential misunderstandings or discrepancies.

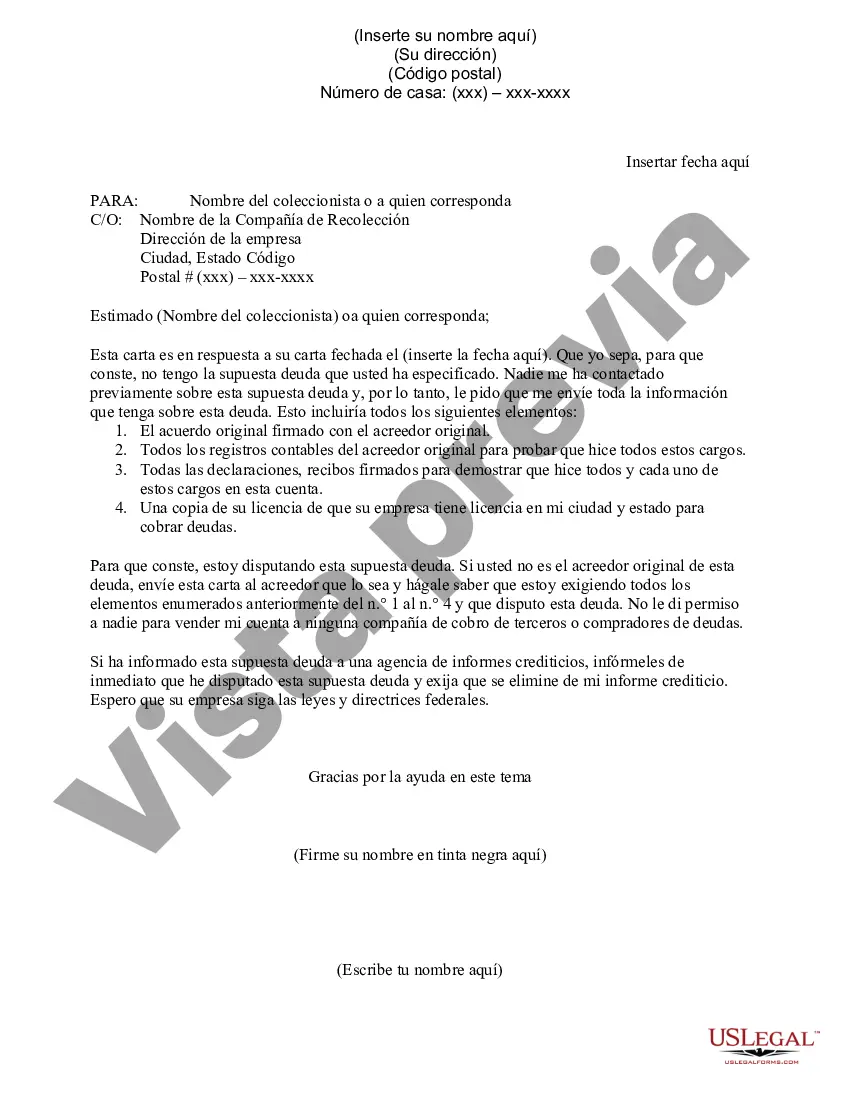

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Solicitud de Prueba de Deuda - Request for Proof of Debt

Description

How to fill out Suffolk New York Solicitud De Prueba De Deuda?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Suffolk Request for Proof of Debt, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any activities related to paperwork completion straightforward.

Here's how to locate and download Suffolk Request for Proof of Debt.

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the legality of some records.

- Examine the related forms or start the search over to locate the correct file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Suffolk Request for Proof of Debt.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Suffolk Request for Proof of Debt, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you have to cope with an extremely difficult case, we advise getting a lawyer to review your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!