Allegheny Pennsylvania Statement to Add to Credit Report: A Comprehensive Overview If you are an individual residing in Allegheny, Pennsylvania and need to add a statement to your credit report, it's crucial to understand the process and options available. This statement can help clarify any lingering concerns about specific credit entries, discrepancies, or inaccuracies, providing potential lenders with a clearer picture of your financial history. By adding an Allegheny Pennsylvania Statement to your credit report, you aim to ensure fair assessment and strengthen your creditworthiness. Types of Allegheny Pennsylvania Statements: 1. Allegheny Pennsylvania Identity Statement: This statement highlights an individual's identity theft concerns or victims of fraudulent activities related to their credit history residing in Allegheny, Pennsylvania. It serves to notify potential lenders about the situation, protecting their creditworthiness and reputation. 2. Allegheny Pennsylvania Discrepancy Statement: This type of statement addresses any disputed information or discrepancies in an individual's credit file. By adding this statement, residents of Allegheny, Pennsylvania can report errors, provide context, or request investigations into specific entries, ensuring the accuracy of their credit report. 3. Allegheny Pennsylvania Victim Statement: Victims of financial fraud or identity theft in Allegheny, Pennsylvania can use this type of statement to inform potential lenders of their unfortunate situation. By including this statement, individuals can explain the circumstances of the fraudulent activity and emphasize the impact on their credit history, encouraging lenders to consider their situation compassionately. 4. Allegheny Pennsylvania Financial Hardship Statement: In case of significant financial hardships faced by Allegheny, Pennsylvania residents, this statement can provide context and explanations to potential lenders. By including details about job losses, medical emergencies, or other financial challenges, individuals can present a more thorough understanding of their credit history amidst difficult circumstances, aiming to improve their chances of obtaining credit. 5. Allegheny Pennsylvania Corrected Entry Statement: If mistakes are discovered in an individual's credit report, this statement can clearly and concisely address the errors and provide corrected information. By incorporating this statement, individuals residing in Allegheny, Pennsylvania can ensure that future lenders receive accurate data, preventing potential credit obstacles. When adding an Allegheny Pennsylvania Statement to your credit report, it is vital to use relevant keywords such as "Allegheny Pennsylvania," "credit report statement," and variations of the specific statement type you are requesting. Remember to adhere to the credit bureau's guidelines and requirements for adding statements, providing concise, accurate, and factual information. In conclusion, Allegheny Pennsylvania Statements added to credit reports serve as powerful tools for individuals seeking to improve their creditworthiness while demonstrating transparency and addressing any concerns. Whether it's to address identity theft, discrepancies, financial hardships, or incorrect entries, these statements can help individuals residing in Allegheny, Pennsylvania present a comprehensive and accurate picture of their credit history to potential lenders.

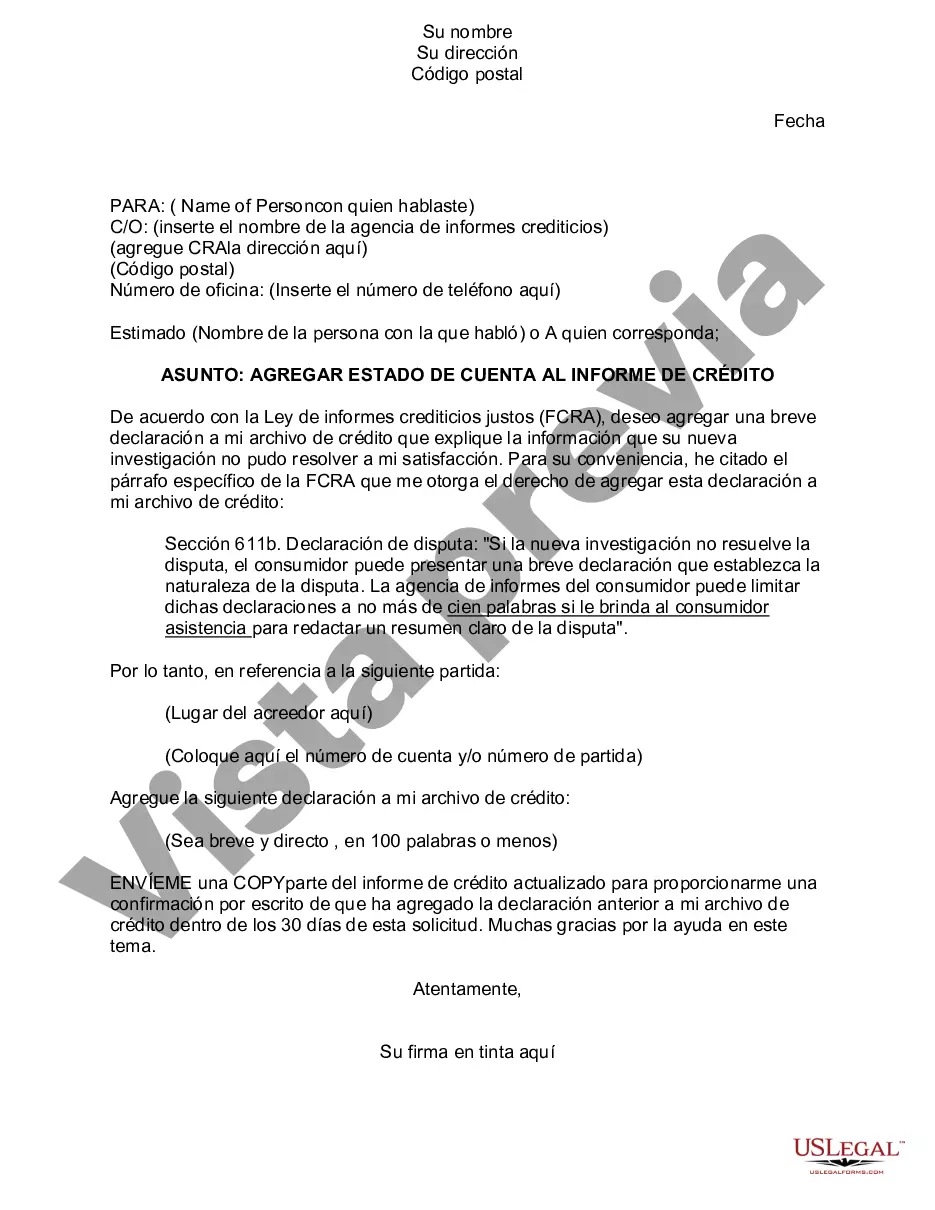

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Estado de cuenta para agregar al informe de crédito - Statement to Add to Credit Report

Description

How to fill out Allegheny Pennsylvania Estado De Cuenta Para Agregar Al Informe De Crédito?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Allegheny Statement to Add to Credit Report, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various categories ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find information materials and tutorials on the website to make any tasks associated with paperwork completion simple.

Here's how you can locate and download Allegheny Statement to Add to Credit Report.

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the legality of some documents.

- Examine the similar forms or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and buy Allegheny Statement to Add to Credit Report.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Allegheny Statement to Add to Credit Report, log in to your account, and download it. Needless to say, our website can’t replace an attorney completely. If you have to cope with an extremely difficult situation, we advise using the services of an attorney to check your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork with ease!