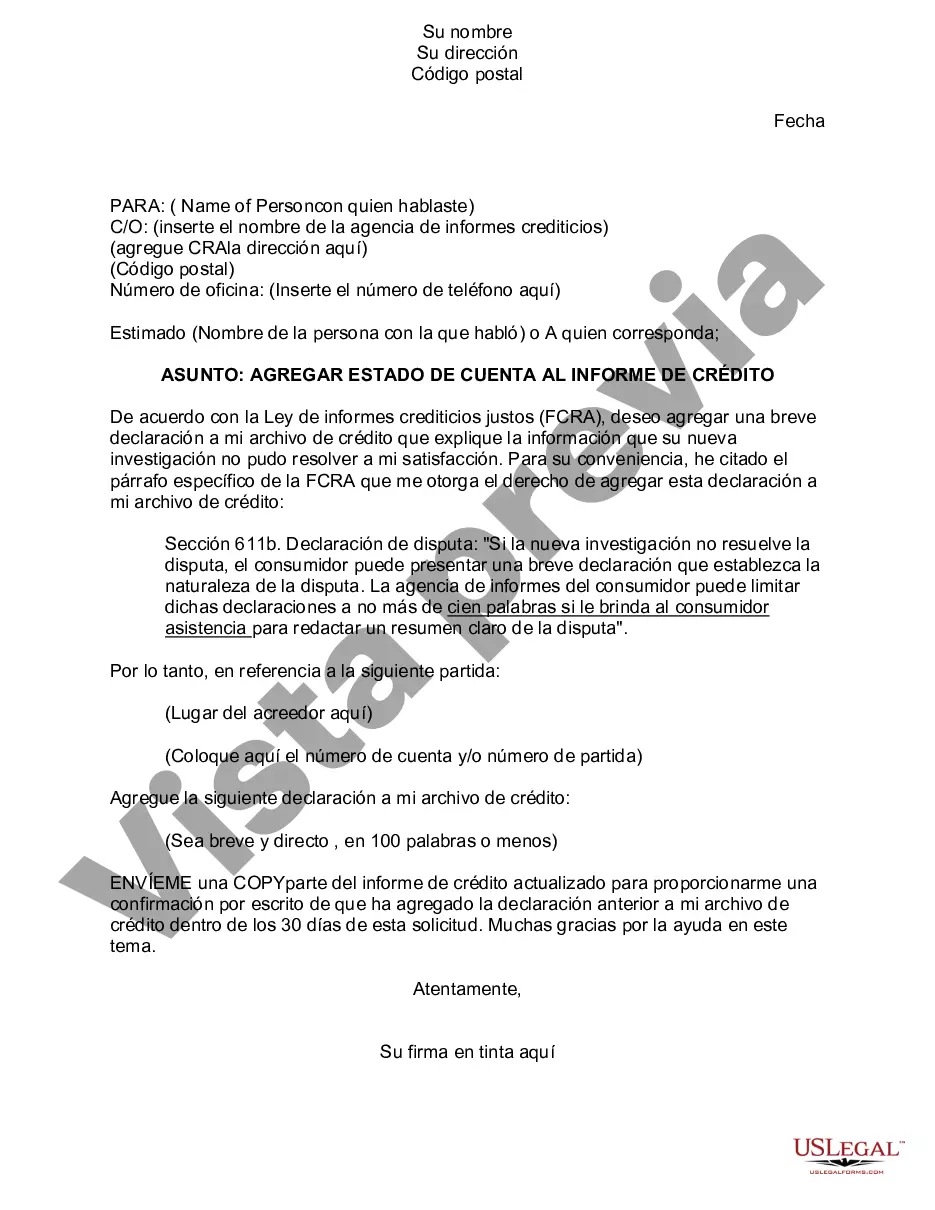

Chicago Statement to Add to Credit Report: A Comprehensive Guide Introduction: In this detailed description, we will explore the concept of a Chicago Statement to Add to Credit Report. We will delve into the importance of this statement for individuals residing in the vibrant city of Chicago, Illinois. Additionally, we will discuss various types of Chicago Statements that can be added to a credit report, highlighting their significance and relevance. By the end, you will have a comprehensive understanding of Chicago Statements and their impact on credit reports. Section 1: Understanding Chicago Statements to Add to Credit Reports 1.1 What is a Chicago Statement, and why is it important? — Definition of a Chicago Statement — Importance of including a Chicago Statement in your credit report 1.2 How does the addition of a Chicago Statement affect your credit report? — Positive impaccreditworthinesses— - Influence on loan applications and interest rates — Helping individuals with credit challenges Section 2: Types of Chicago Statements to Add to Credit Reports 2.1 Chicago Statement for Address Verification: — Purpose anrelevantnc— - Procedure for adding this statement to a credit report — Benefits of this statement for those residing in Chicago 2.2 Chicago Statement for Identity Verification: — Significance of verifying identity in credit reports — Process for adding an identity verification statement — Advantages of this statement in combating identity theft and fraud 2.3 Chicago Statement for Employment Verification: — How this statement validates employment information — Steps to add an employment verification statement to a credit report — Impact of this statement on loan applications 2.4 Chicago Statement for Income Verification: — The role of income verification in credit evaluations — Procedure for adding an income verification statement — Benefits of this statement for individuals in Chicago during loan applications Section 3: How to Request and Add a Chicago Statement to a Credit Report 3.1 Contacting Credit Reporting Agencies: — Explanation of major credit reporting agencies — Process of contacting these agencies for adding a Chicago Statement 3.2 Providing Required Documentation: — Documentation needed to support various types of Chicago Statements — Importance of accurate and up-to-date documentation 3.3 Ensuring Accuracy and Review: — Reviewing the credit report after adding the Chicago Statement — Disputing errors or inconsistencies, if any Conclusion: In conclusion, a Chicago Statement to Add to a Credit Report is a significant tool for individuals residing in Chicago. It can ameliorate creditworthiness, positively impact loan applications, and enhance identity and employment verification. By understanding the different types of Chicago Statements available and following the necessary procedures, individuals can effectively add these statements to their credit reports. Always remember to regularly review your credit report for accuracy and make any necessary corrections promptly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Estado de cuenta para agregar al informe de crédito - Statement to Add to Credit Report

Description

How to fill out Chicago Illinois Estado De Cuenta Para Agregar Al Informe De Crédito?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business objective utilized in your region, including the Chicago Statement to Add to Credit Report.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Chicago Statement to Add to Credit Report will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Chicago Statement to Add to Credit Report:

- Make sure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Chicago Statement to Add to Credit Report on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!