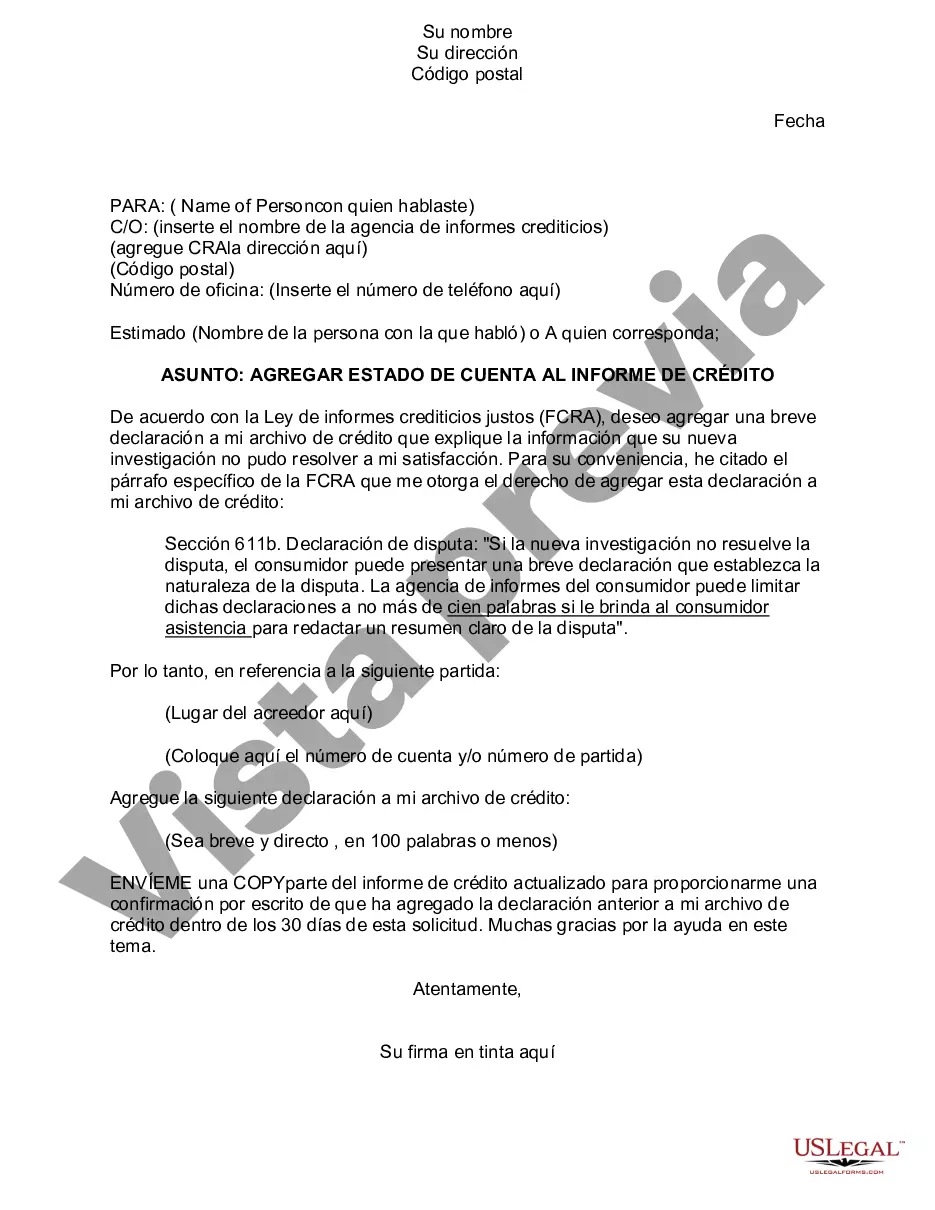

Cuyahoga Ohio Statement to Add to Credit Report is a detailed description that individuals in Cuyahoga County, Ohio can incorporate into their credit reports to provide additional context or explanations regarding specific financial circumstances or events. This statement serves as a means to inform potential lenders or creditors about relevant information that may impact creditworthiness or credit history. By adding a Cuyahoga Ohio Statement to Add to Credit Report, residents can share crucial details that may assist lenders in making more informed decisions when assessing credit applications. These statements can vary in nature and cover a range of topics. Here are a few examples of different types of Cuyahoga Ohio Statements that individuals may consider including in their credit reports: 1. Financial Hardship Explanation: This statement could outline any severe financial hardship that occurred in the past, such as job loss or a significant medical expense. It allows individuals to explain the factors that contributed to temporary setbacks and how they have since been resolved or managed. 2. Identity Theft or Fraudulent Activity: If an individual has experienced identity theft or any fraudulent activity on their accounts, they can include a statement to alert creditors to the situation. This serves as a precautionary measure to ensure that the credit applications in question are scrutinized more thoroughly to prevent potential misuse. 3. Disputes or Errors on Credit Reports: In cases where individuals have identified errors or inaccuracies on their credit reports, including a statement can help provide background information about ongoing disputes or investigations. This informs potential lenders that the credit report is subject to ongoing updates or revisions. 4. Special Circumstances: Individuals may have unique circumstances that require additional explanation, such as a temporary relocation, extended travel, or major life events impacting credit. Adding a statement can help creditors understand the context surrounding the individual's credit history. 5. Improvement and Credit-Building Efforts: If individuals have taken significant steps to improve their credit profiles, they can include a statement to highlight these efforts. This may involve demonstrating responsible financial behavior, successfully paying off debts, or participating in credit counseling programs. When crafting a Cuyahoga Ohio Statement to Add to Credit Report, it's essential to be concise, informative, and specific to provide an accurate representation of the circumstances. These statements should adhere to federal regulations, such as the Fair Credit Reporting Act, which outlines the rights and responsibilities of consumers and credit reporting agencies. Including a Cuyahoga Ohio Statement in the credit report can potentially offer lenders a more comprehensive understanding of an individual's creditworthiness, enabling fairer evaluation of credit applications and increasing the chances of obtaining favorable terms and conditions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Estado de cuenta para agregar al informe de crédito - Statement to Add to Credit Report

Description

How to fill out Cuyahoga Ohio Estado De Cuenta Para Agregar Al Informe De Crédito?

Drafting documents for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Cuyahoga Statement to Add to Credit Report without expert assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Cuyahoga Statement to Add to Credit Report by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Cuyahoga Statement to Add to Credit Report:

- Examine the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any scenario with just a few clicks!