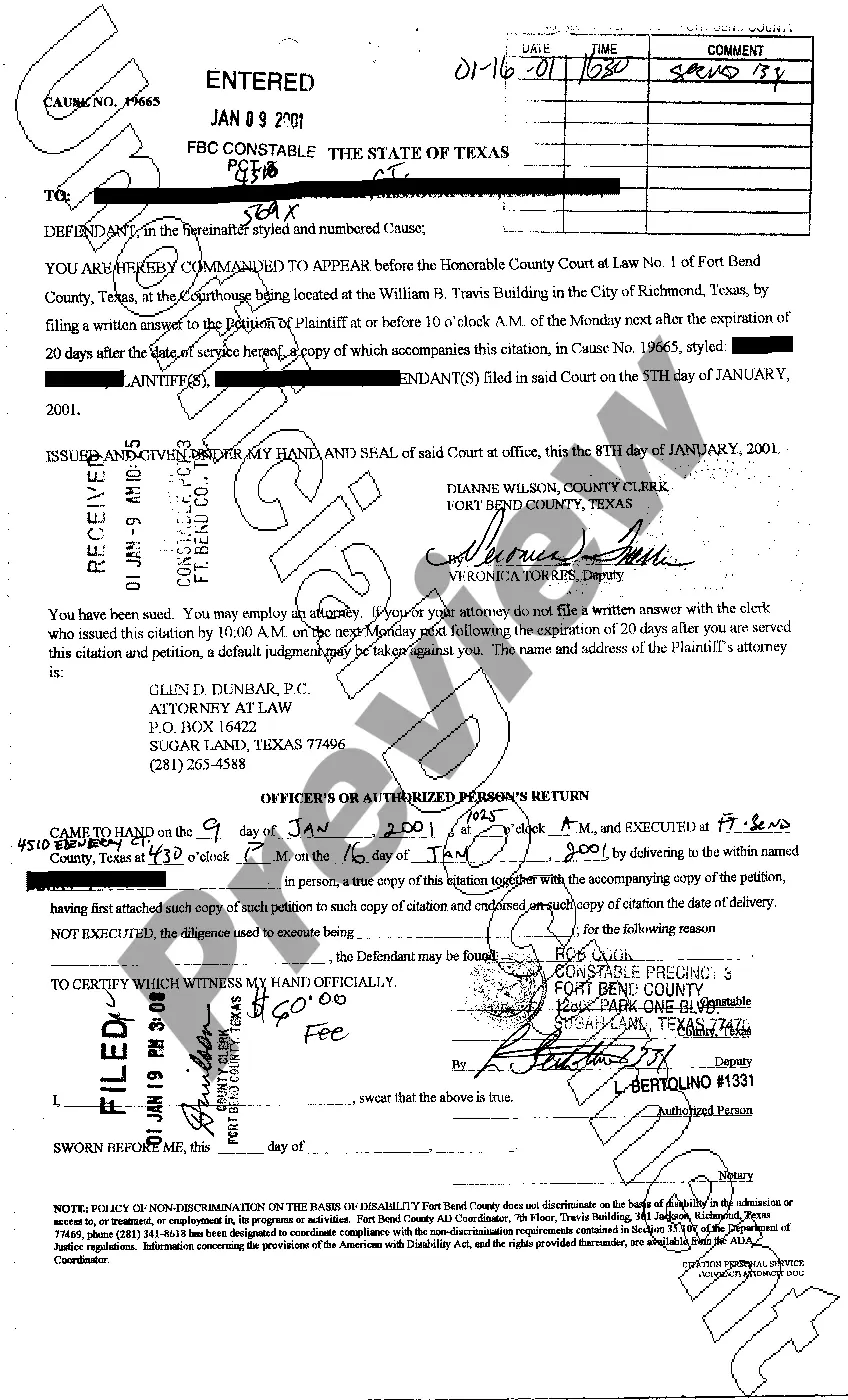

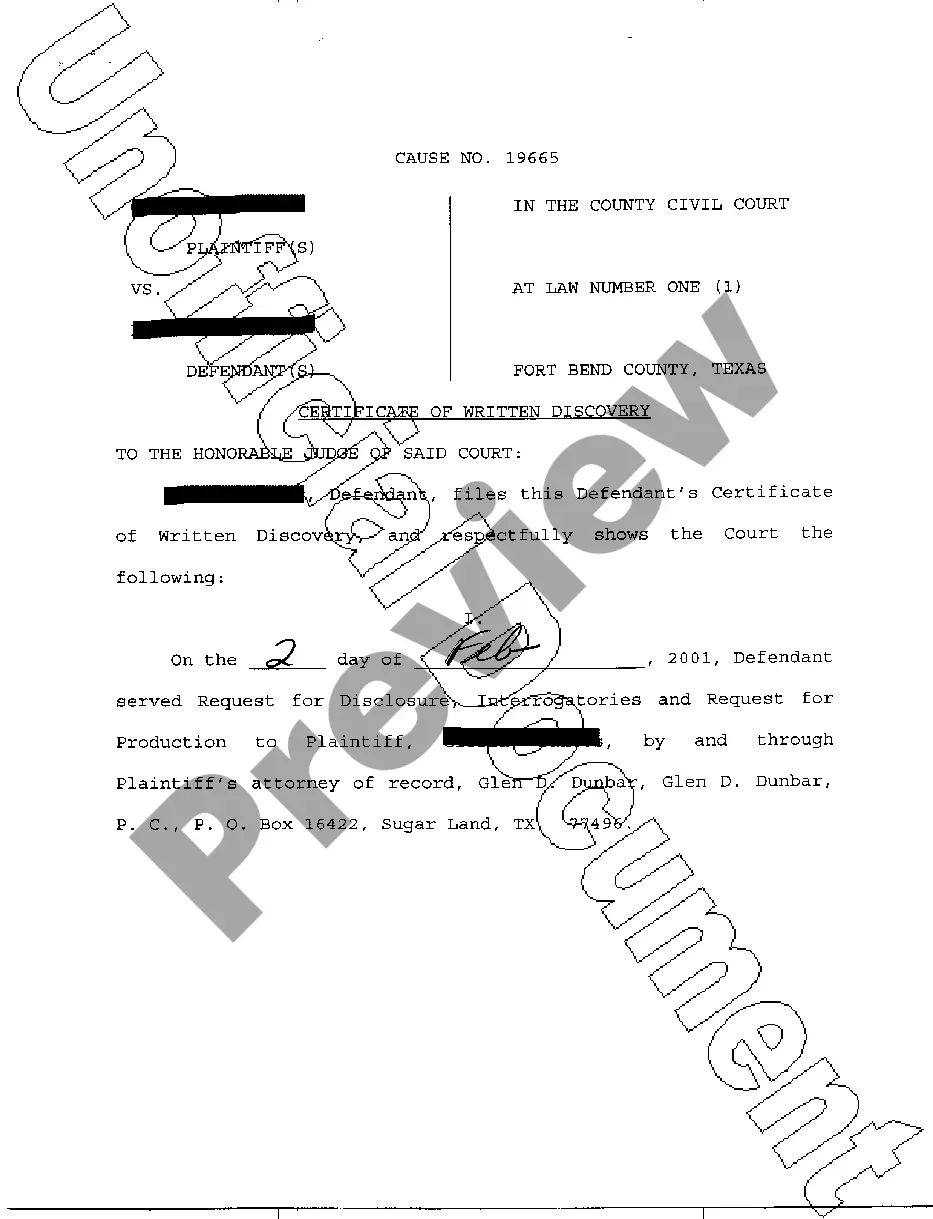

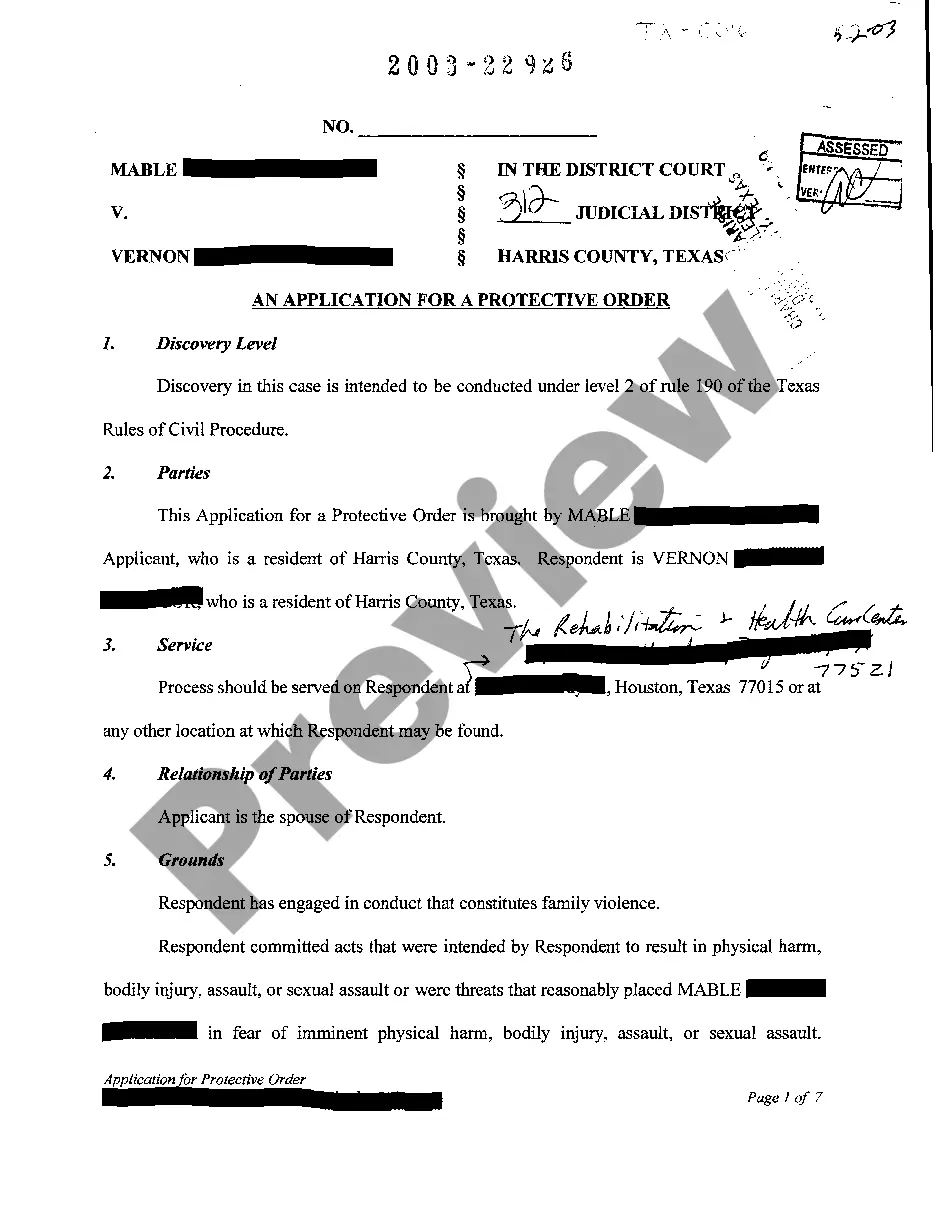

Dallas Texas Statements to Add to Credit Report — A Comprehensive Guide If you are residing in Dallas, Texas and looking to add a statement to your credit report, it's important to understand the options available to you. Dallas, being a vibrant city known for its business and financial activity, holds various types of statements that you can consider adding to your credit report to reflect accurate information and improve your creditworthiness. Here's a detailed description of the commonly used Dallas Texas Statements to Add to Credit Report: 1. Dallas Texas Residential Statement: This statement can be used to indicate your residential history within Dallas, Texas. By adding this statement to your credit report, you provide additional information to potential creditors about your stability and length of residency in the area, which can positively affect their decision-making process. Example: "Resident of Dallas, Texas since [year]." 2. Dallas Texas Employment Statement: This statement highlights your employment status and history in Dallas, Texas. By including this statement on your credit report, you provide potential lenders with valuable insight into your job stability and income, ultimately strengthening your creditworthiness. Example: "Employed with [company name] in Dallas, Texas since [year]." 3. Dallas Texas Business Statement: If you own a business in Dallas, Texas, adding a Business Statement to your credit report can help showcase your entrepreneurial achievements and demonstrate your financial responsibility in managing a successful enterprise. This statement may be helpful for securing business-related loans or securing favorable credit terms. Example: "Owner of [business name] in Dallas, Texas since [year]." 4. Dallas Texas Legal Statement: In some cases, you may require a Legal Statement to address specific legal matters related to your credit report. This statement can be used to convey important details regarding any legalities, such as bankruptcy proceedings, financial dispute resolutions, or court-ordered credit adjustments, which might be relevant for potential creditors. Example: "Legal resolution completed on [date] regarding [nature of legal matter] in Dallas, Texas." 5. Dallas Texas Financial Hardship Statement: During times of financial hardship, such as unexpected medical expenses or temporary unemployment, adding a Financial Hardship Statement to your credit report can provide context for late or missed payments. This statement allows you to explain the circumstances that led to the temporary setback, providing potential creditors with a clearer understanding of your credit history. Example: "Experienced financial hardship due to [reason] in Dallas, Texas from [start date] to [end date]." Remember, when adding any statement to your credit report, it's crucial to ensure accuracy and clarity while avoiding any fraudulent or misleading information. Statements should only be added when they genuinely reflect your situation and provide factual details that can enhance your creditworthiness. Ultimately, the purpose of adding a Dallas Texas Statement to your credit report is to offer a comprehensive picture of your financial history and stability directly to potential lenders. By leveraging these statements effectively, you can increase your chances of obtaining credit, securing favorable terms, and achieving your financial goals in Dallas, Texas.

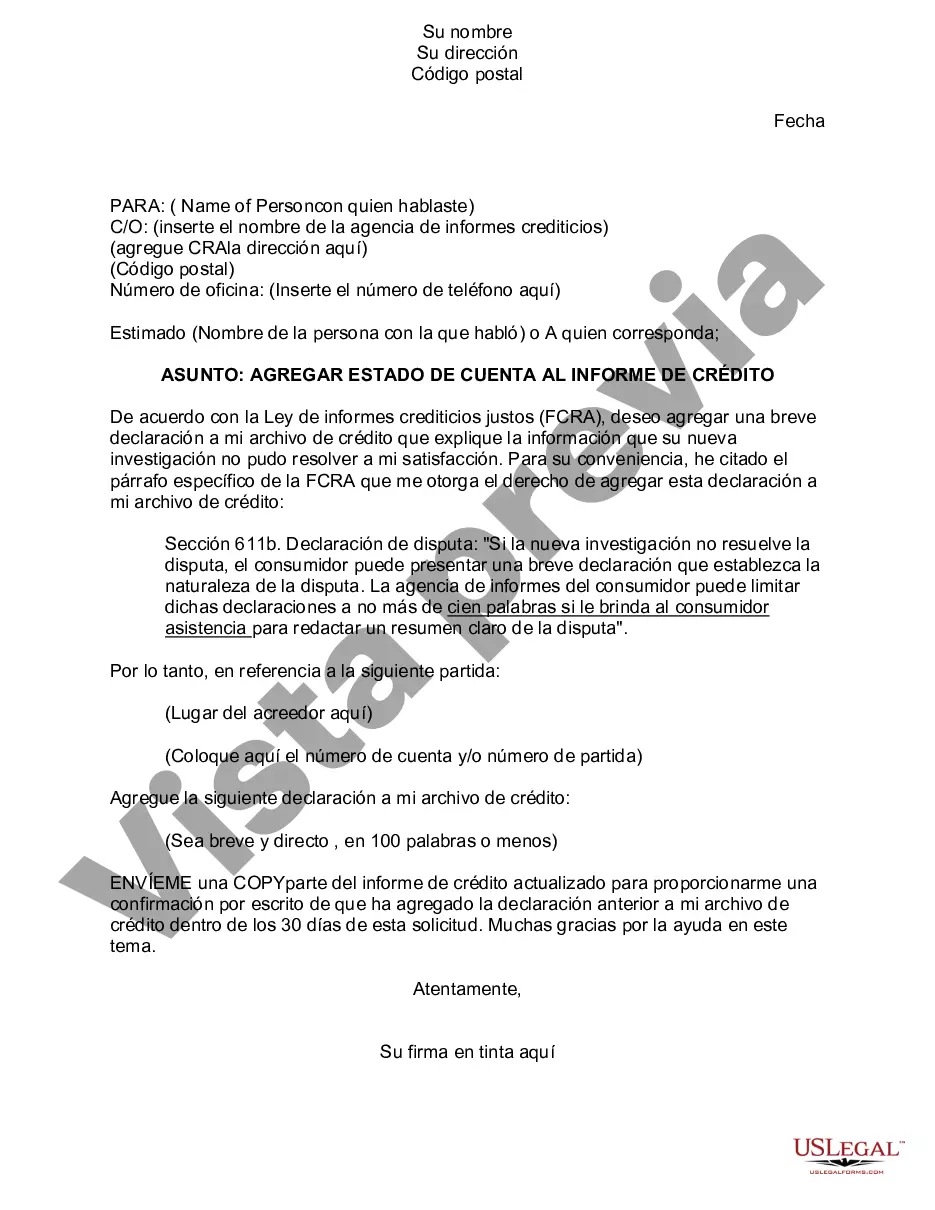

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Estado de cuenta para agregar al informe de crédito - Statement to Add to Credit Report

Description

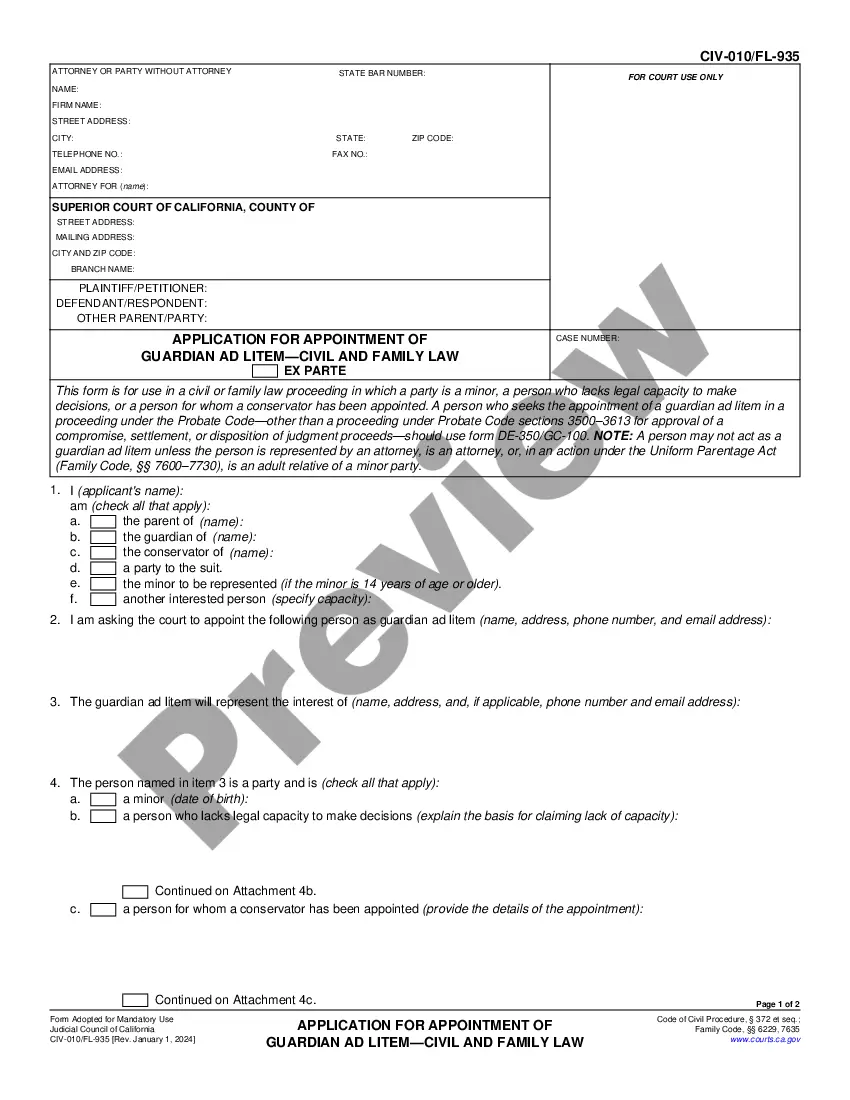

How to fill out Dallas Texas Estado De Cuenta Para Agregar Al Informe De Crédito?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life scenario, locating a Dallas Statement to Add to Credit Report meeting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Apart from the Dallas Statement to Add to Credit Report, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can pick the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Dallas Statement to Add to Credit Report:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Dallas Statement to Add to Credit Report.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Paga tus deudas a tiempo En tiempos pre-pandemia en Ecuador las deudas pasaban como vencidas a los 15 dias de falta de pago; por temas de pandemia hasta diciembre del 2021, las deudas pasaran como vencidas a los 61 dias de falta de pago. Mientras mas tiempo pagues puntualmente tus deudas, mejor score tendras.

Ocho pasos para eliminar deudas antiguas de tu reporte crediticio Verifica la antiguedad.Confirma la antiguedad de la deuda saldada.Obten los tres reportes de credito.Envia cartas a las agencias de credito.Envia una carta al acreedor informante.Consigue una atencion especial.

¿Esta tratando de aumentar su puntuacion de credito? Lleve un registro de su progreso.Siempre pague sus cuentas puntualmente.Mantenga saldos bajos en sus cuentas de credito.Haga mas pagos en sus tarjetas de credito que el pago mensual.Considere la posibilidad de solicitar un aumento de su limite de credito.

¿Esta tratando de aumentar su puntuacion de credito? Lleve un registro de su progreso.Siempre pague sus cuentas puntualmente.Mantenga saldos bajos en sus cuentas de credito.Haga mas pagos en sus tarjetas de credito que el pago mensual.Considere la posibilidad de solicitar un aumento de su limite de credito.

Como conseguir sus informes de credito gratis Una vez al ano usted puede solicitar una copia de cada compania a traves de Annualcreditreport.com (en ingles) o llamando al 1-877-322-8228. La Comision Federal de Comercio ofrece mas informacion sobre estos informes de credito gratis.

7 Formas de Construir tu Historial Crediticio como Extranjero en los EE. UU Obten una Tarjeta de Credito de EE.Solicita una tarjeta de EE.Obten una Tarjeta Asegurada.Conviertete en un Usuario Autorizado.Consejo para Prestamos #1: El Prestamo para Generar Credito.Consejo para Prestamos #2: Obten un Consignatario.

El puntaje crediticio minimo para tener una tarjeta de credito es mayor a 730 puntos en tu score. Si la entidad financiera se encuentra con un score bajo, por ejemplo, en 330, quiere decir que el cliente no paga sus deudas a tiempo, esto es desalentador para el banco y te deja como un mal candidato.

Un credito es una operacion de financiacion donde una persona llamada 'acreedor' (normalmente una entidad financiera), presta una cierta cifra monetaria a otro, llamado 'deudor', quien a partir de ese momento, garantiza al acreedor que retornara esta cantidad solicitada en el tiempo previamente estipulado mas una