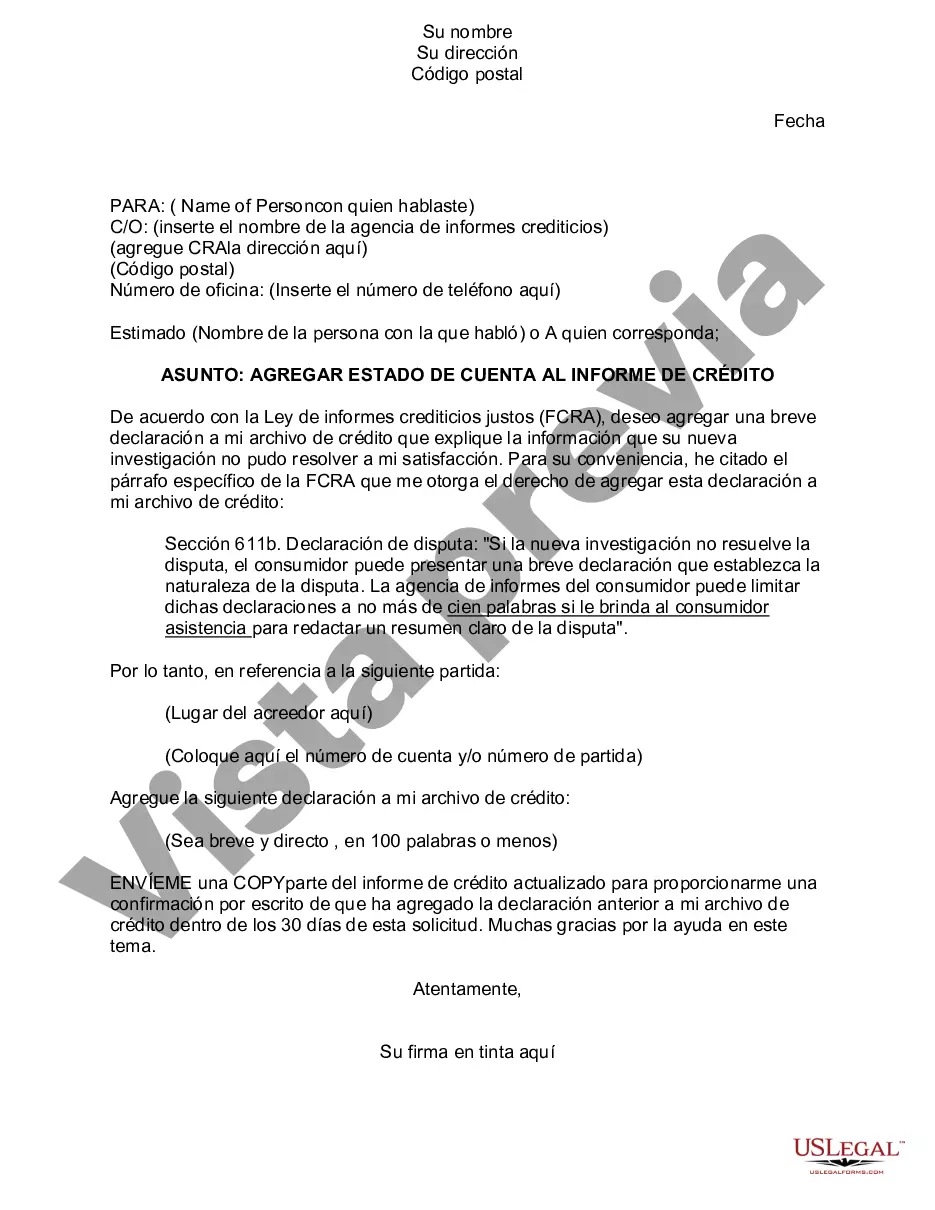

Hennepin Minnesota Statement to Add to Credit Report: A Comprehensive Guide Introduction: When it comes to managing your credit history, it's crucial to ensure accuracy and completeness. One effective way to address any potential errors or provide additional context is by adding a Hennepin Minnesota Statement to your credit report. This detailed description explores the process, importance, and various types of statements available to individuals seeking to clarify their credit information. Understanding Hennepin Minnesota Statement: A Hennepin Minnesota Statement is a written explanation or description of specific information on your credit report. This statement allows individuals to provide context, explanations, or dispute any inaccurate or misleading details listed on their credit history. By adding this statement, consumers can ensure that the credit report accurately reflects their financial situation and take steps towards maintaining a healthy credit profile. Importance of a Hennepin Minnesota Statement: 1. Clarification and Explanation: Sometimes, certain negative marks or discrepancies on a credit report may not necessarily reflect an individual's true creditworthiness. A Hennepin Minnesota Statement can provide details about extenuating circumstances, identity theft, or fraudulent activities that affected the creditworthiness. 2. Disputing Errors: In cases where errors appear on the credit report, a Hennepin Minnesota Statement can act as a dispute mechanism, allowing consumers to alert credit bureaus and potential lenders about the inaccuracies and seek their rectification. 3. Enhancing Creditworthiness: Individuals with a less-than-perfect credit history can add a Hennepin Minnesota Statement to highlight positive changes, financial rehabilitation efforts, or additional information that showcases their creditworthiness. Types of Hennepin Minnesota Statements: 1. General Statement: A general Hennepin Minnesota Statement provides an overall explanation or clarification regarding the entire credit report. It may include information on financial hardships faced in the past, extenuating circumstances, or identity theft issues, aiming to provide a comprehensive understanding of an individual's credit history. 2. Specific Account Statement: This type of Hennepin Minnesota Statement focuses on a specific account held by the individual. It offers a detailed explanation of any negative information related to that specific account, such as late payments, collections, or charge-offs, providing context or clarifying issues that might otherwise impact creditworthiness. 3. Identity Theft Statement: In cases of identity theft, an Identity Theft Hennepin Minnesota Statement helps victims provide information to credit bureaus and potential lenders, explaining the situation and providing evidence of fraudulent activity. This statement helps mitigate the negative impact on credit history caused by unauthorized accounts or transactions. Conclusion: Adding a Hennepin Minnesota Statement to your credit report is an effective way to ensure accuracy, transparency, and context when it comes to your creditworthiness. Whether you are addressing errors, providing explanations for negative information, or dealing with identity theft, these statements are essential tools to maintain a reliable credit history. Choose the appropriate type of Hennepin Minnesota Statement that best suits your needs and take control of your credit report today.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Estado de cuenta para agregar al informe de crédito - Statement to Add to Credit Report

Description

How to fill out Hennepin Minnesota Estado De Cuenta Para Agregar Al Informe De Crédito?

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Hennepin Statement to Add to Credit Report is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to get the Hennepin Statement to Add to Credit Report. Follow the instructions below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the right one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Hennepin Statement to Add to Credit Report in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!