Title: Mecklenburg North Carolina Statement to Add to Credit Report — Detailed Description and Types Introduction: Mecklenburg County, located in the state of North Carolina, is a vibrant region renowned for its economic growth, cultural diversity, and rich heritage. This detailed description delves into the purpose, significance, and various types of Mecklenburg North Carolina Statements that can be added to credit reports. These statements serve to provide additional context and local information for lenders and creditors assessing an individual's creditworthiness. 1. Mecklenburg North Carolina Statement: Overview and Importance: A Mecklenburg North Carolina Statement added to a credit report allows residents of this county to highlight any unique circumstances or events specific to their locality that may have influenced their financial history. Lenders and creditors can consider this statement while assessing credit risk, potentially offering a deeper understanding of the individual's financial situation and the local context in which it arose. 2. Types of Mecklenburg North Carolina Statements to Add to Credit Reports: a. Economic Downturn Impact Statement: This statement may be appropriate for individuals who suffered financial setbacks due to an economic downturn that significantly affected Mecklenburg County. It provides an opportunity to explain any related credit issues and emphasizes the temporary nature of the negative financial history, which may have occurred due to external factors. b. Natural Disaster Impact Statement: Residents who faced credit challenges due to a natural disaster, such as a hurricane or flood, can utilize this statement to indicate the extraordinary circumstances they encountered. It may include information regarding property damage, relocation, or temporary financial difficulties that occurred as a direct consequence of the natural disaster. c. Limited Access to Financial Services Statement: Individuals residing in areas of Mecklenburg County with limited access to traditional banking and financial services can use this statement to highlight the related challenges they faced. It may encompass distance from banks, inadequate financial literacy resources, or reliance on alternative financial arrangements, which can provide a comprehensive understanding of the applicant's financial situation. d. Community Support and Involvement Statement: This type of statement is designed for individuals involved in community activities, non-profit organizations, or actively supporting local causes within Mecklenburg County. By highlighting their community engagement, individuals can present a positive image that demonstrates their dedication to improving the local environment and building strong interpersonal ties. Conclusion: Mecklenburg North Carolina Statements added to credit reports offer a platform for individuals to outline unique circumstances that may have affected their credit history within the county. These statements enable lenders and creditors to gain a more comprehensive understanding of an individual’s creditworthiness by considering pertinent local challenges, context, and events. By utilizing relevant Mecklenburg North Carolina Statements, individuals can potentially enhance their credit application and present a clearer picture of their financial standing to lenders.

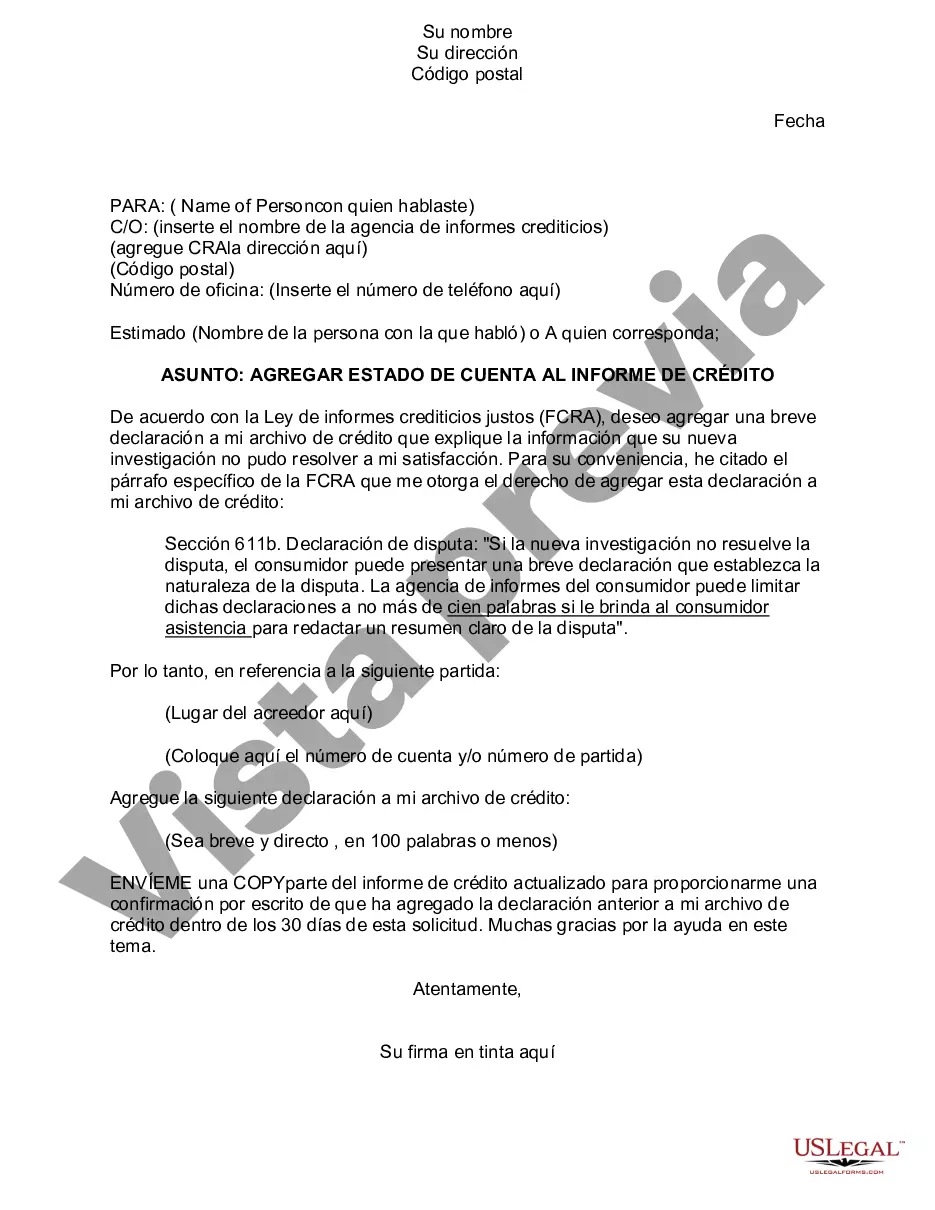

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Estado de cuenta para agregar al informe de crédito - Statement to Add to Credit Report

Description

How to fill out Mecklenburg North Carolina Estado De Cuenta Para Agregar Al Informe De Crédito?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Mecklenburg Statement to Add to Credit Report is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Mecklenburg Statement to Add to Credit Report. Adhere to the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Mecklenburg Statement to Add to Credit Report in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!