Montgomery County, Maryland is a vibrant and diverse community located in the Mid-Atlantic region of the United States. With a population of over 1 million people, Montgomery County is the most populous county in Maryland and the second-most populous county in the entire state. Known for its rich history, stunning landscapes, and a thriving economy, Montgomery County offers its residents and visitors a wide array of amenities and opportunities. The county is home to several world-class educational institutions, including the University of Maryland, College Park, and Montgomery College, which both contribute to the region's strong emphasis on education and intellectual pursuit. The county's economy is robust, with a thriving job market that includes various industries such as biotechnology, healthcare, government contracting, and information technology. Many Fortune 500 companies have a presence in Montgomery County, contributing to its status as a major economic hub in the region. In terms of living standards, Montgomery County boasts exceptional public services, top-notch healthcare facilities, and an extensive network of parks and recreational areas. Nature enthusiasts can explore the breathtaking beauty of the Chesapeake and Ohio Canal National Historical Park or enjoy outdoor activities at Rock Creek Park. For those interested in cultural experiences, Montgomery County offers numerous arts and entertainment options, including theaters, galleries, and music venues. The county's proximity to Washington, D.C. also provides easy access to the rich cultural and historical landmarks in the nation's capital. When it comes to credit reports, individuals residing in Montgomery County, Maryland has the option to include a Montgomery Maryland Statement to add relevant information. This statement allows residents to provide additional context or explanations regarding specific aspects of their credit history that may require further clarification. There are different types of Montgomery Maryland Statements that can be added to a credit report, depending on the individual's needs. These statements may highlight factors such as the resolution of a disputed account, the successful completion of a debt repayment plan, or any other significant financial achievements or challenges that may impact their creditworthiness. By including a Montgomery Maryland Statement on their credit report, individuals can ensure that potential lenders or creditors have access to relevant information that may impact their creditworthiness. This statement serves as a valuable tool for residents of Montgomery County to provide a comprehensive view of their financial situation and may increase their chances of obtaining favorable credit terms or opportunities in the future. In conclusion, Montgomery County, Maryland is a vibrant and thriving community that offers its residents a high quality of life. With its rich history, strong economy, excellent public services, and diverse cultural experiences, Montgomery County is truly a place where individuals can thrive. By utilizing a Montgomery Maryland Statement on their credit reports, residents can further enhance their financial profiles and ensure that potential lenders have access to relevant information.

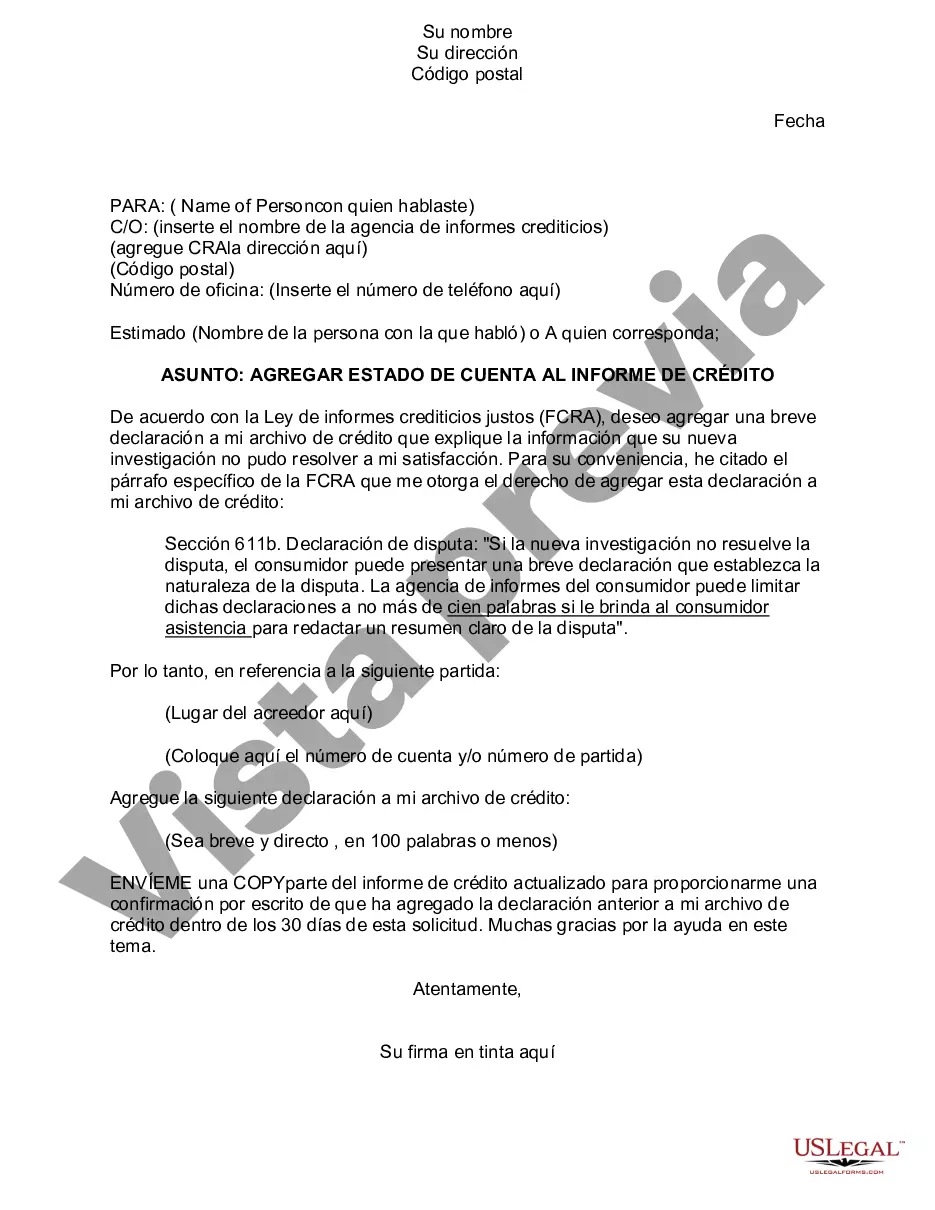

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Estado de cuenta para agregar al informe de crédito - Statement to Add to Credit Report

Description

How to fill out Estado De Cuenta Para Agregar Al Informe De Crédito?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business objective utilized in your county, including the Montgomery Statement to Add to Credit Report.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Montgomery Statement to Add to Credit Report will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Montgomery Statement to Add to Credit Report:

- Make sure you have opened the right page with your regional form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Montgomery Statement to Add to Credit Report on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Un credito es una operacion de financiacion donde una persona llamada 'acreedor' (normalmente una entidad financiera), presta una cierta cifra monetaria a otro, llamado 'deudor', quien a partir de ese momento, garantiza al acreedor que retornara esta cantidad solicitada en el tiempo previamente estipulado mas una

Ocho pasos para eliminar deudas antiguas de tu reporte crediticio Verifica la antiguedad.Confirma la antiguedad de la deuda saldada.Obten los tres reportes de credito.Envia cartas a las agencias de credito.Envia una carta al acreedor informante.Consigue una atencion especial.

La ley estipula que las agencias de reporte de credito no deben reportar los casos de bancarrota despues de (10) anos de la fecha en que el caso de bancarrota fue presentado. Generalmente, la informacion de mal credito es eliminada despues de siete (7) anos.

Informacion personal Su nombre y cualquier nombre que usted pueda haber utilizado en el pasado en relacion con una cuenta de credito, inclusive los apodos. Direcciones actuales y anteriores. Fecha de nacimiento. Su numero de Seguro Social. Numeros de telefono.

¿Esta tratando de aumentar su puntuacion de credito? Lleve un registro de su progreso.Siempre pague sus cuentas puntualmente.Mantenga saldos bajos en sus cuentas de credito.Haga mas pagos en sus tarjetas de credito que el pago mensual.Considere la posibilidad de solicitar un aumento de su limite de credito.

Paga tus deudas a tiempo En tiempos pre-pandemia en Ecuador las deudas pasaban como vencidas a los 15 dias de falta de pago; por temas de pandemia hasta diciembre del 2021, las deudas pasaran como vencidas a los 61 dias de falta de pago. Mientras mas tiempo pagues puntualmente tus deudas, mejor score tendras.

El puntaje crediticio minimo para tener una tarjeta de credito es mayor a 730 puntos en tu score. Si la entidad financiera se encuentra con un score bajo, por ejemplo, en 330, quiere decir que el cliente no paga sus deudas a tiempo, esto es desalentador para el banco y te deja como un mal candidato.

Como conseguir sus informes de credito gratis Una vez al ano usted puede solicitar una copia de cada compania a traves de Annualcreditreport.com (en ingles) o llamando al 1-877-322-8228. La Comision Federal de Comercio ofrece mas informacion sobre estos informes de credito gratis.

¿Esta tratando de aumentar su puntuacion de credito? Lleve un registro de su progreso.Siempre pague sus cuentas puntualmente.Mantenga saldos bajos en sus cuentas de credito.Haga mas pagos en sus tarjetas de credito que el pago mensual.Considere la posibilidad de solicitar un aumento de su limite de credito.