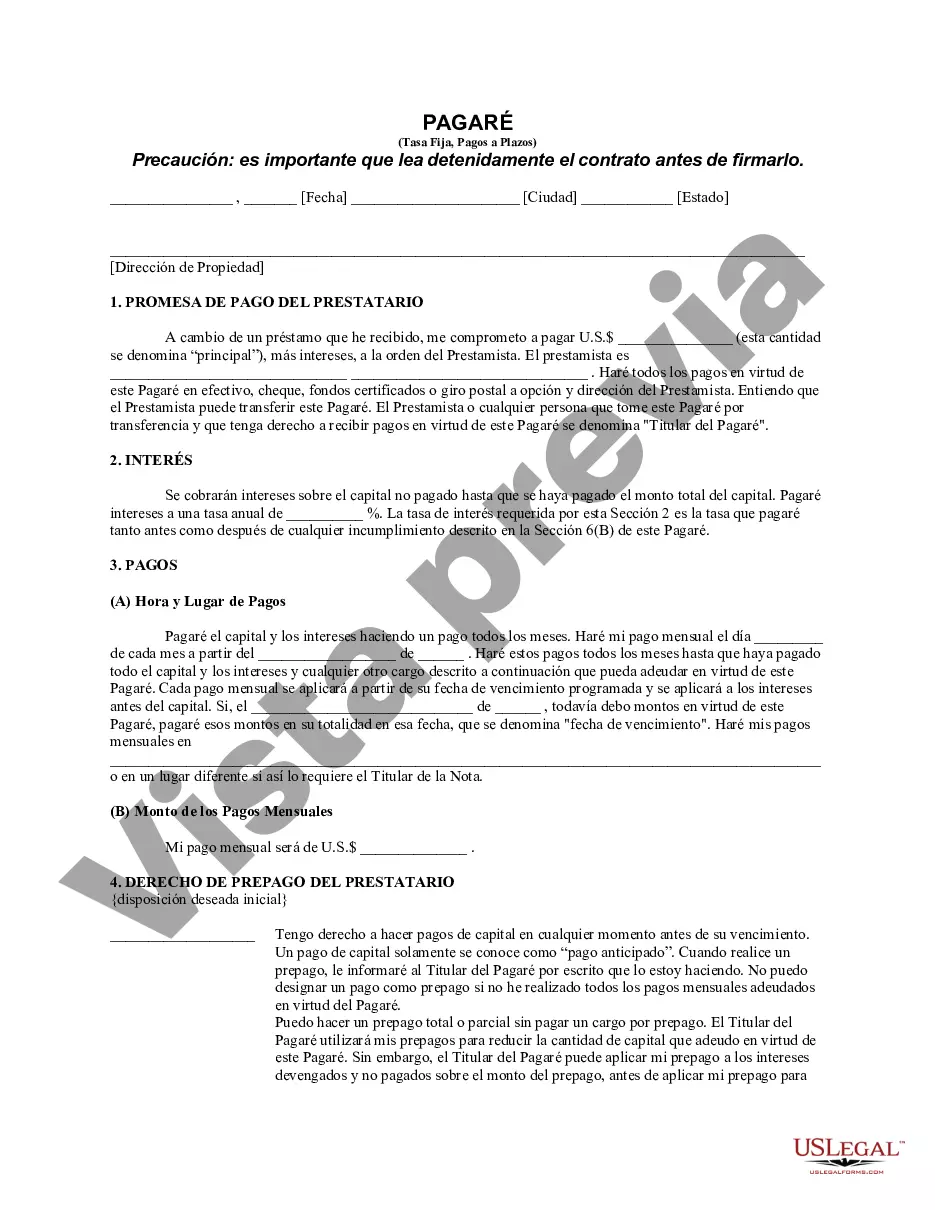

This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

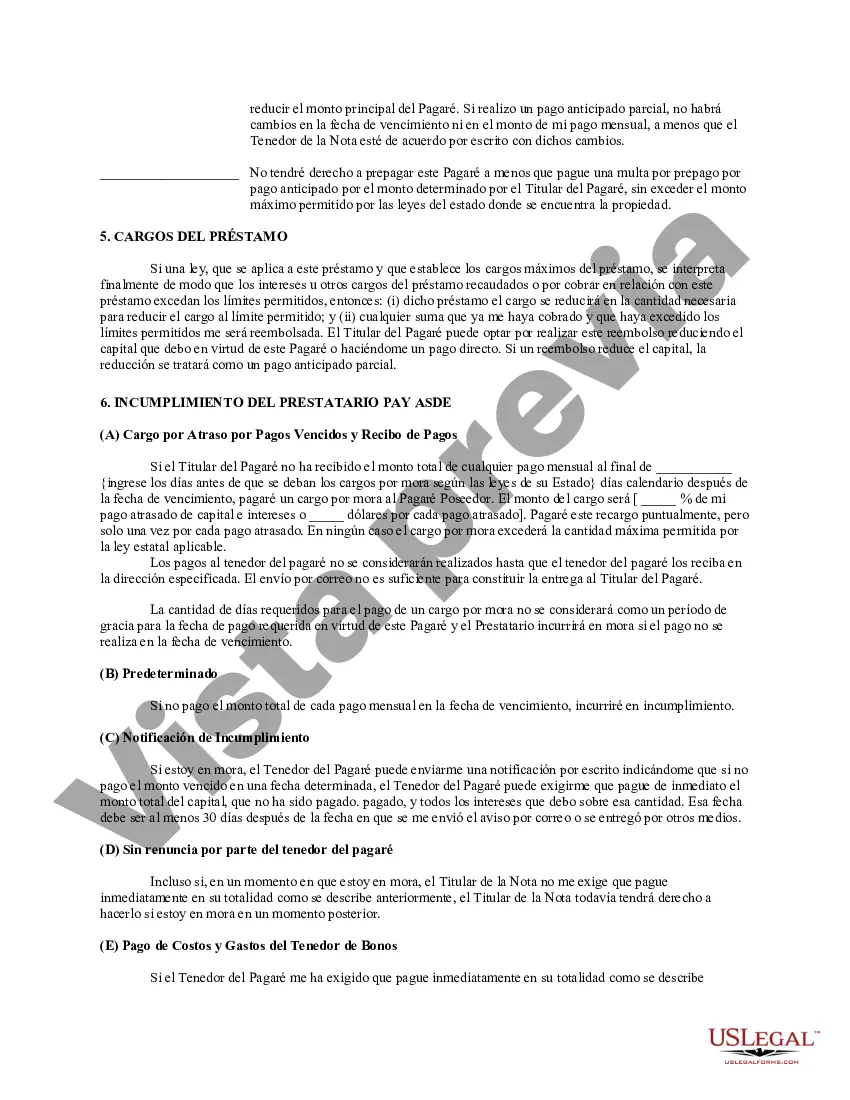

Contra Costa California Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Contra Costa County, California. This promissory note is specifically designed for unsecured loans, meaning that the loan is not backed by any collateral. The Contra Costa California Unsecured Installment Payment Promissory Note for Fixed Rate provides specific details of the loan, including the principal amount, interest rate, repayment schedule, and late payment penalties. The principal amount refers to the total sum borrowed, while the interest rate indicates the fixed rate at which the borrower will be charged for borrowing the money. It is essential to note that there might be different types or variations available for the Contra Costa California Unsecured Installment Payment Promissory Note for Fixed Rate based on specific circumstances: 1. Standard Unsecured Installment Payment Promissory Note: This type of promissory note is the most common and straightforward form. It outlines the basic terms and conditions of the loan, including the repayment schedule and interest rate. 2. Graduate Contra Costa California Unsecured Installment Payment Promissory Note: This loan specifically caters to students pursuing higher education or professional courses. It may offer more lenient repayment terms, such as deferment options until completion of the education or a grace period post-graduation. 3. Business Contra Costa California Unsecured Installment Payment Promissory Note: This type of promissory note is tailored for small businesses or entrepreneurs seeking financial assistance. It may include additional clauses related to the use of funds, business projections, and early repayment penalties, aligned with the borrower's specific business needs. 4. Medical Contra Costa California Unsecured Installment Payment Promissory Note: This promissory note is commonly used within the medical field, where it facilitates loans between medical professionals or institutions and patients who require financial support for medical procedures. It may include provisions to address medical contingencies, payment terms, and interest rates specific to medical expenses. Overall, the Contra Costa California Unsecured Installment Payment Promissory Note for Fixed Rate is a crucial legal instrument that clearly establishes the rights and obligations of both the borrower and lender in Contra Costa County. By carefully drafting and executing this document, parties can ensure transparency and mitigate any potential disputes that might arise during the loan repayment period.

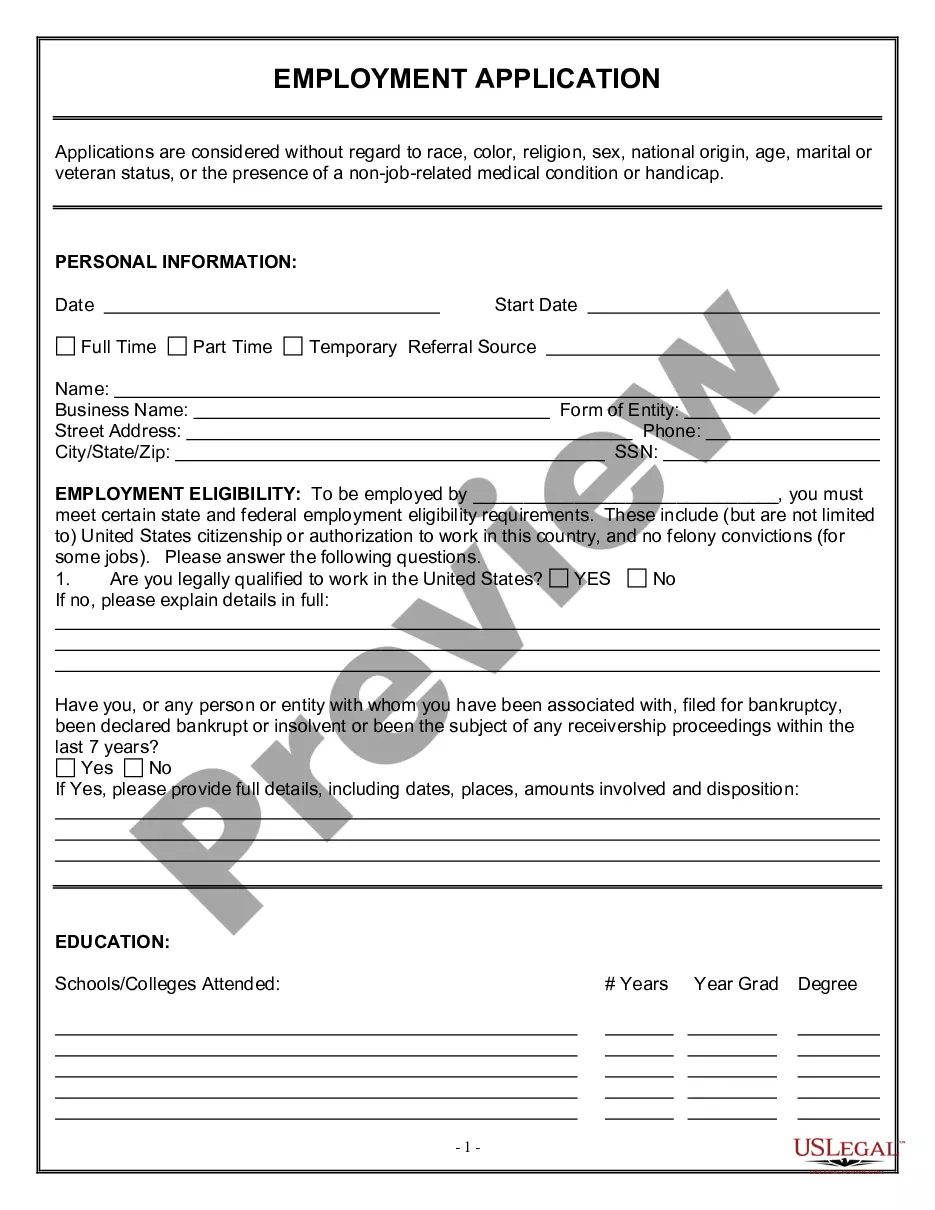

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.