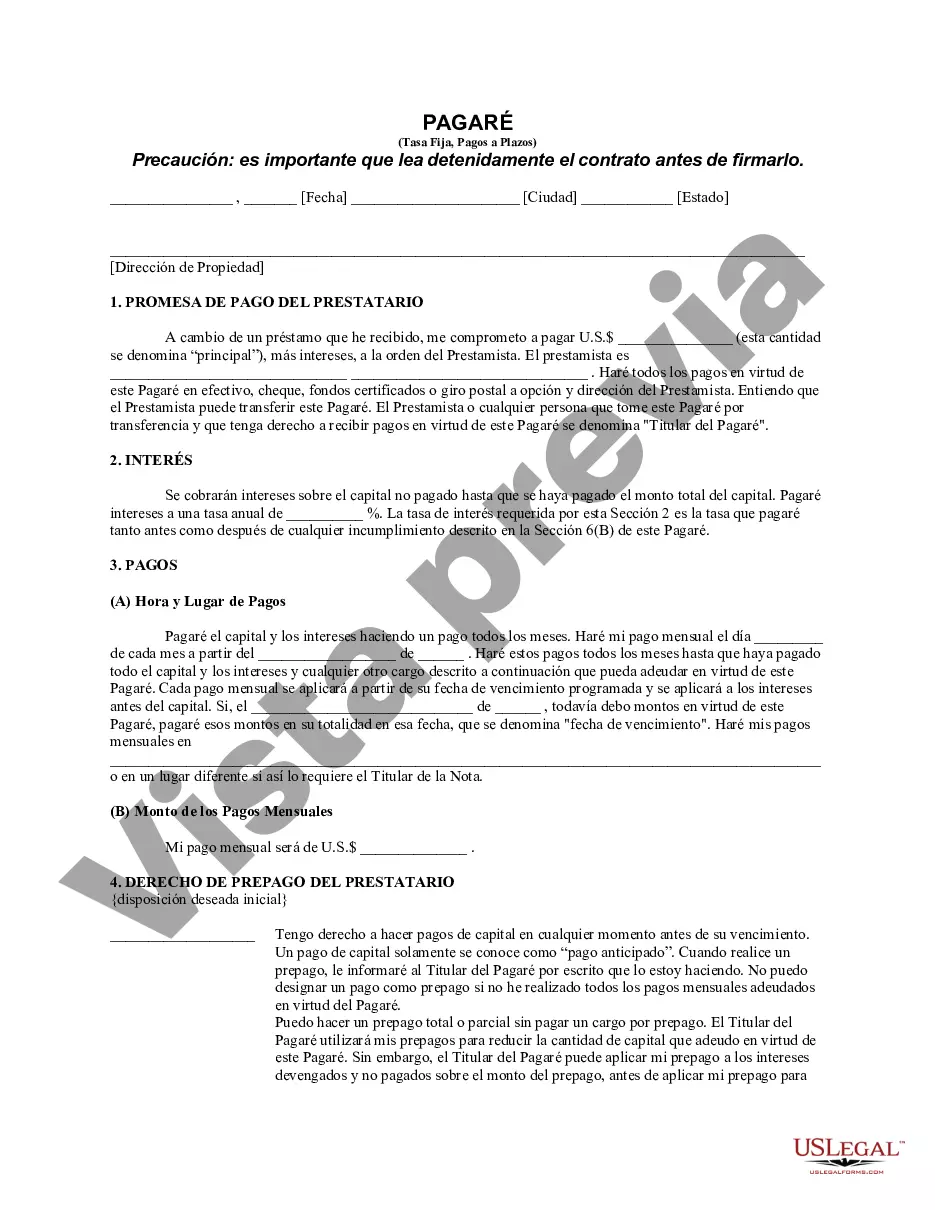

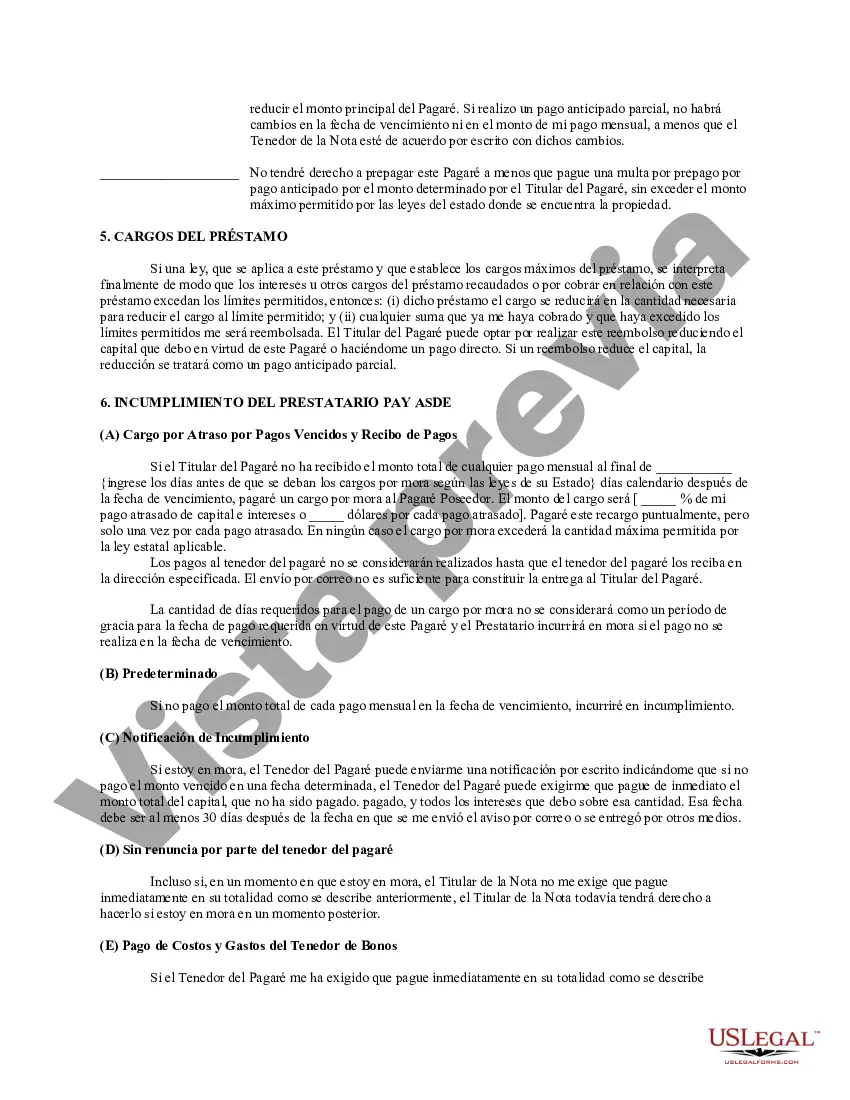

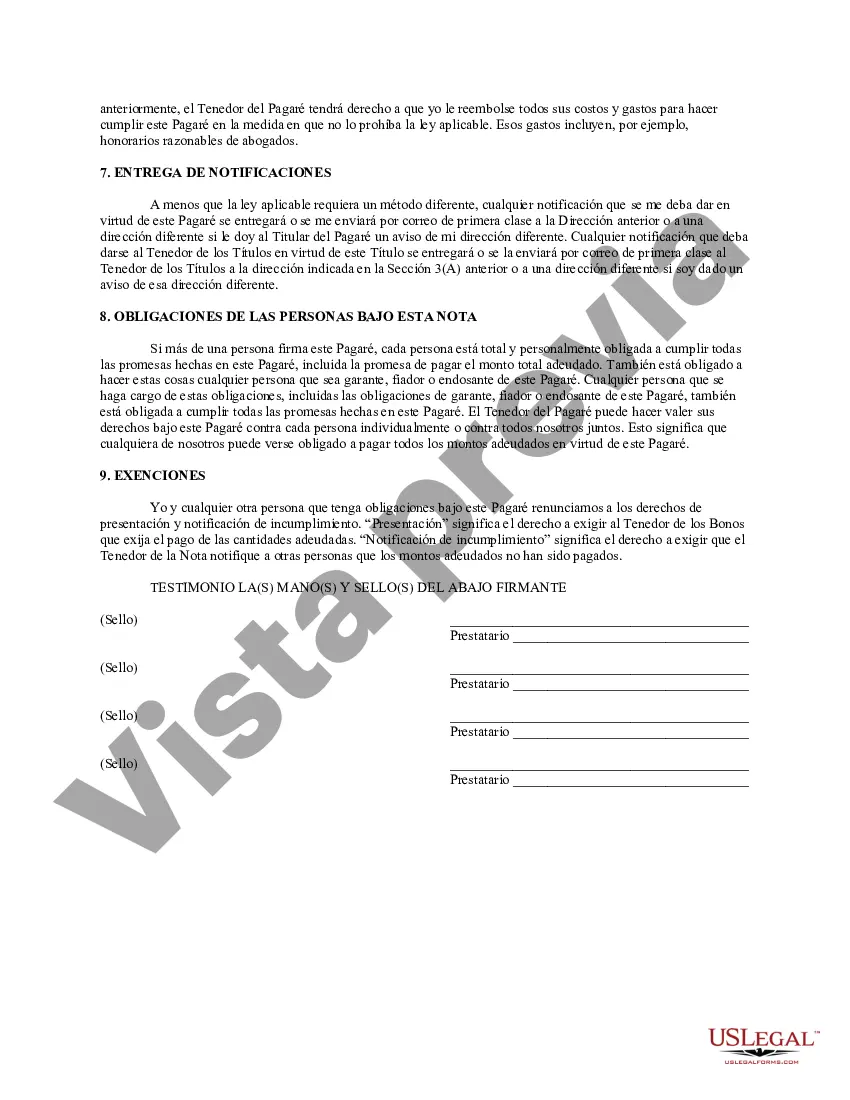

This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Mecklenburg North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note is specifically designed for residents of Mecklenburg County, North Carolina, and it is an effective tool for securing a loan without the need for collateral. Keywords: Mecklenburg North Carolina, Unsecured, Installment Payment, Promissory Note, Fixed Rate, loan agreement, lender, borrower, collateral, residents, terms and conditions. The Mecklenburg North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate enables residents of Mecklenburg County to borrow money from a lender and repay in fixed installments over a specified period. This type of promissory note does not require the borrower to provide any collateral, making it an attractive option for individuals who may not have assets to offer as security but still need financial assistance. There are various types of Mecklenburg North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate, each catering to specific needs and circumstances: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for personal loans, such as financing a vehicle purchase, funding a wedding, or covering unexpected medical expenses. Borrowers can secure a fixed interest rate throughout the loan term and make regular installment payments until the loan is fully repaid. 2. Student Loan Promissory Note: Students residing in Mecklenburg County can utilize this type of promissory note to secure educational loans for tuition fees, books, or other educational expenses. With a fixed interest rate and predetermined payment schedule, students can easily plan their finances and manage repayment. 3. Business Loan Promissory Note: Entrepreneurs and small business owners in Mecklenburg County can benefit from this type of promissory note to obtain funds for business needs, such as equipment purchase, expansion, or working capital. The fixed rate and installment terms allow borrowers to budget their finances accordingly. It is crucial for both lenders and borrowers to carefully review and understand the terms stated in the Mecklenburg North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate before entering into an agreement. This document serves as proof of the loan and ensures that both parties are aware of their rights and obligations during the loan term. In conclusion, the Mecklenburg North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate is a flexible and secure method for obtaining a loan without the need for collateral. By clearly defining the terms and conditions, this legal document protects the interests of both lenders and borrowers, making it an essential tool for financial transactions within Mecklenburg County.Mecklenburg North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note is specifically designed for residents of Mecklenburg County, North Carolina, and it is an effective tool for securing a loan without the need for collateral. Keywords: Mecklenburg North Carolina, Unsecured, Installment Payment, Promissory Note, Fixed Rate, loan agreement, lender, borrower, collateral, residents, terms and conditions. The Mecklenburg North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate enables residents of Mecklenburg County to borrow money from a lender and repay in fixed installments over a specified period. This type of promissory note does not require the borrower to provide any collateral, making it an attractive option for individuals who may not have assets to offer as security but still need financial assistance. There are various types of Mecklenburg North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate, each catering to specific needs and circumstances: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for personal loans, such as financing a vehicle purchase, funding a wedding, or covering unexpected medical expenses. Borrowers can secure a fixed interest rate throughout the loan term and make regular installment payments until the loan is fully repaid. 2. Student Loan Promissory Note: Students residing in Mecklenburg County can utilize this type of promissory note to secure educational loans for tuition fees, books, or other educational expenses. With a fixed interest rate and predetermined payment schedule, students can easily plan their finances and manage repayment. 3. Business Loan Promissory Note: Entrepreneurs and small business owners in Mecklenburg County can benefit from this type of promissory note to obtain funds for business needs, such as equipment purchase, expansion, or working capital. The fixed rate and installment terms allow borrowers to budget their finances accordingly. It is crucial for both lenders and borrowers to carefully review and understand the terms stated in the Mecklenburg North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate before entering into an agreement. This document serves as proof of the loan and ensures that both parties are aware of their rights and obligations during the loan term. In conclusion, the Mecklenburg North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate is a flexible and secure method for obtaining a loan without the need for collateral. By clearly defining the terms and conditions, this legal document protects the interests of both lenders and borrowers, making it an essential tool for financial transactions within Mecklenburg County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.