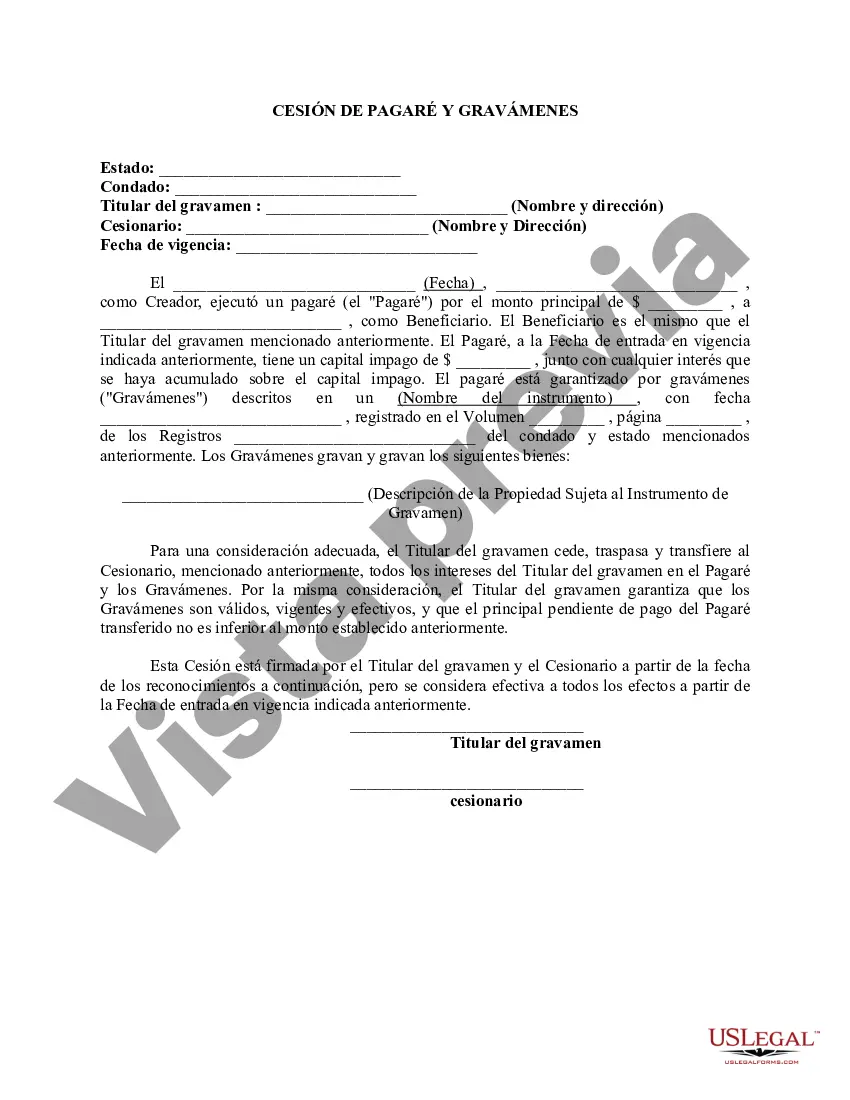

This form is used when Lienholder assigns, conveys, and transfers to Transferee, all of Lienholder's interest in the Note and Liens. Lienholder warrants that the Liens are valid, in force and effect, and the unpaid principal on the Note transferred is no less than the amount stated.

Houston, Texas is a vibrant city known for its thriving economy and diverse culture. It is the most populous city in the state of Texas and the fourth-largest city in the United States. With a rich history and a wide range of industries, Houston offers numerous opportunities for businesses and individuals alike. When it comes to financial matters, including loans and debt obligations, Houston, Texas utilizes specific legal mechanisms to ensure the smooth transfer of promissory notes and the enforcement of liens. One of such mechanisms is the Houston Texas Assignment of Promissory Note and Liens. An Assignment of Promissory Note is a legal document that allows the transfer of rights, duties, and benefits associated with a promissory note from one party, known as the assignor, to another party known as the assignee. In Houston, Texas, this assignment must comply with specific legal requirements to be valid and enforceable. This document is crucial in situations where a lender wants to transfer or sell their interest in a promissory note to another party. The assignment will include details such as the original parties to the promissory note, the loan amount, the repayment terms, and any other relevant provisions. By executing an assignment, the assignor relinquishes their rights and obligations under the promissory note, while the assignee becomes the new holder of the note. In addition to the Assignment of Promissory Note, the concept of liens plays a significant role in Houston, Texas. A lien serves as a security interest held by a creditor, typically a lender, over a specific piece of property. It provides the creditor with the right to take possession of the property if the debtor defaults on their obligations. Different types of liens exist in Houston, Texas, that may be associated with the Assignment of Promissory Note. These include: 1. Mechanic's lien: This type of lien is often filed by contractors, subcontractors, or suppliers who haven't received full payment for work performed or materials supplied on a construction project. It allows them to claim an interest in the property until their debts are satisfied. 2. Judgment lien: A judgment lien arises when a court grants a judgment against a debtor, usually to satisfy an unpaid debt. This lien attaches to the debtor's property, preventing them from selling or refinancing the property without first satisfying the judgment. 3. Tax lien: A tax lien is imposed by the government when an individual or business fails to pay their taxes. It enables the government to claim ownership over the taxpayer's property until the tax debt is paid. 4. Trust deed lien: A trust deed lien is typically associated with real estate transactions. It occurs when a borrower grants a lender a security interest in a property through a trust deed, which serves as collateral for a mortgage loan. In conclusion, Houston, Texas utilizes the Assignment of Promissory Note and various types of liens to facilitate the transfer of debt obligations and ensure the security interests of creditors. Properly understanding and executing these legal mechanisms is essential for businesses and individuals navigating the financial landscape in Houston, Texas.Houston, Texas is a vibrant city known for its thriving economy and diverse culture. It is the most populous city in the state of Texas and the fourth-largest city in the United States. With a rich history and a wide range of industries, Houston offers numerous opportunities for businesses and individuals alike. When it comes to financial matters, including loans and debt obligations, Houston, Texas utilizes specific legal mechanisms to ensure the smooth transfer of promissory notes and the enforcement of liens. One of such mechanisms is the Houston Texas Assignment of Promissory Note and Liens. An Assignment of Promissory Note is a legal document that allows the transfer of rights, duties, and benefits associated with a promissory note from one party, known as the assignor, to another party known as the assignee. In Houston, Texas, this assignment must comply with specific legal requirements to be valid and enforceable. This document is crucial in situations where a lender wants to transfer or sell their interest in a promissory note to another party. The assignment will include details such as the original parties to the promissory note, the loan amount, the repayment terms, and any other relevant provisions. By executing an assignment, the assignor relinquishes their rights and obligations under the promissory note, while the assignee becomes the new holder of the note. In addition to the Assignment of Promissory Note, the concept of liens plays a significant role in Houston, Texas. A lien serves as a security interest held by a creditor, typically a lender, over a specific piece of property. It provides the creditor with the right to take possession of the property if the debtor defaults on their obligations. Different types of liens exist in Houston, Texas, that may be associated with the Assignment of Promissory Note. These include: 1. Mechanic's lien: This type of lien is often filed by contractors, subcontractors, or suppliers who haven't received full payment for work performed or materials supplied on a construction project. It allows them to claim an interest in the property until their debts are satisfied. 2. Judgment lien: A judgment lien arises when a court grants a judgment against a debtor, usually to satisfy an unpaid debt. This lien attaches to the debtor's property, preventing them from selling or refinancing the property without first satisfying the judgment. 3. Tax lien: A tax lien is imposed by the government when an individual or business fails to pay their taxes. It enables the government to claim ownership over the taxpayer's property until the tax debt is paid. 4. Trust deed lien: A trust deed lien is typically associated with real estate transactions. It occurs when a borrower grants a lender a security interest in a property through a trust deed, which serves as collateral for a mortgage loan. In conclusion, Houston, Texas utilizes the Assignment of Promissory Note and various types of liens to facilitate the transfer of debt obligations and ensure the security interests of creditors. Properly understanding and executing these legal mechanisms is essential for businesses and individuals navigating the financial landscape in Houston, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.