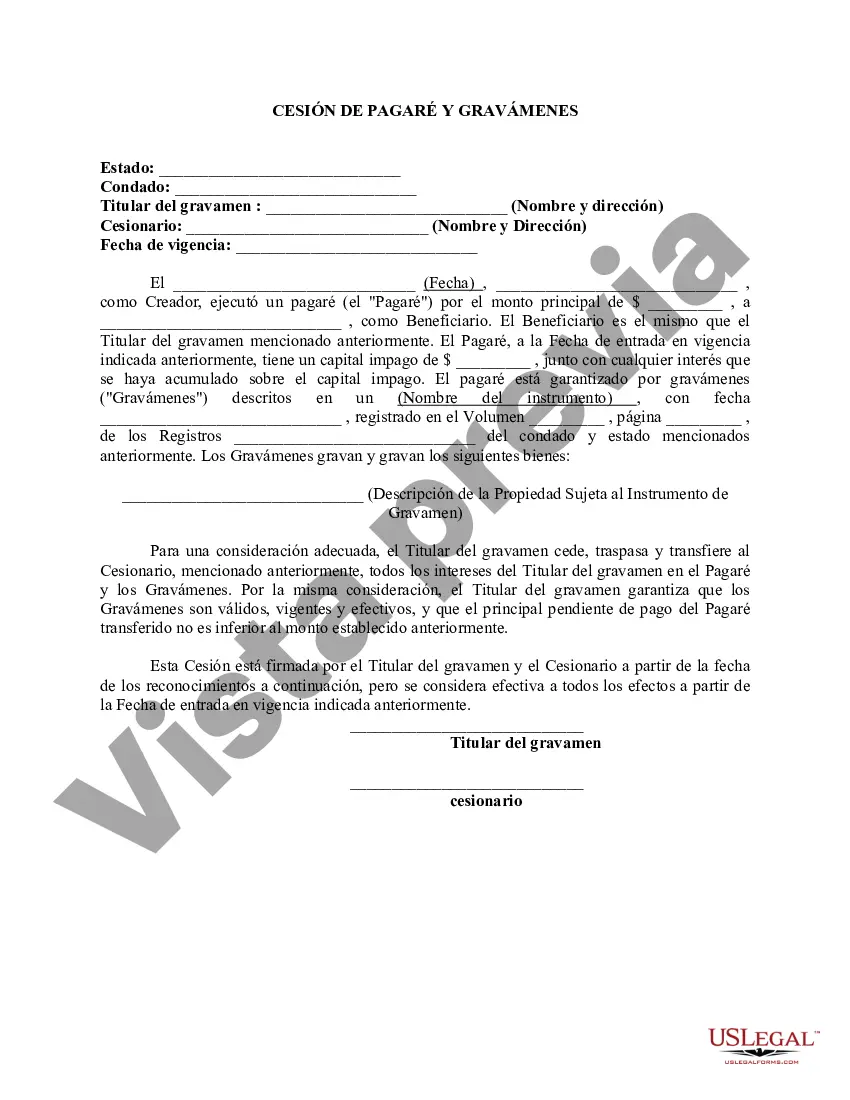

This form is used when Lienholder assigns, conveys, and transfers to Transferee, all of Lienholder's interest in the Note and Liens. Lienholder warrants that the Liens are valid, in force and effect, and the unpaid principal on the Note transferred is no less than the amount stated.

Palm Beach, located in Florida, is a coastal town renowned for its luxurious resorts, upscale shopping, and beautiful beaches. In the real estate industry, when it comes to financial transactions, specifically promissory notes and lien assignments, Palm Beach has its own set of regulations and procedures. An Assignment of Promissory Note refers to the transfer of the right to collect payments from a borrower under a promissory note to another party. In Palm Beach, this process involves a legal documentation called an Assignment Agreement. This agreement outlines the terms of the transfer and assigns the note holder's rights to the assignee, who then becomes entitled to receive the payments. The parties involved must ensure all legal requirements are met to enforce the assignment. Liens in Palm Beach Florida are legal claims placed on a property to secure the payment of a debt. They serve as protection for creditors, ensuring that they can claim repayment if the borrower fails to fulfill their obligations. There are various types of liens that can be placed on a property, including tax liens, mortgage liens, mechanic's liens, and judgment liens. Tax Liens are imposed by the government when property taxes remain unpaid. These liens take priority over other liens and can only be removed once the owed taxes are paid. A Mortgage Lien is created when a property is purchased using borrowed funds. The lender holds a lien on the property until the mortgage is fully paid off. In case of default, the lender may enforce the lien through foreclosure proceedings. Mechanic's Liens are filed by contractors, subcontractors, or suppliers who have provided labor or materials for a project and have not been paid. These liens allow them to claim payment from the property's owner. Judgment Liens are issued when a creditor obtains a judgment in court against a debtor. These liens serve as security for the owed debt and can be collected by seizing the debtor's property or through other legal actions. In Palm Beach, the Assignment of Promissory Note and Liens involves careful documentation and adherence to legal requirements. These processes ensure the smooth transfer of financial rights and safeguard the interests of all parties involved in real estate transactions.Palm Beach, located in Florida, is a coastal town renowned for its luxurious resorts, upscale shopping, and beautiful beaches. In the real estate industry, when it comes to financial transactions, specifically promissory notes and lien assignments, Palm Beach has its own set of regulations and procedures. An Assignment of Promissory Note refers to the transfer of the right to collect payments from a borrower under a promissory note to another party. In Palm Beach, this process involves a legal documentation called an Assignment Agreement. This agreement outlines the terms of the transfer and assigns the note holder's rights to the assignee, who then becomes entitled to receive the payments. The parties involved must ensure all legal requirements are met to enforce the assignment. Liens in Palm Beach Florida are legal claims placed on a property to secure the payment of a debt. They serve as protection for creditors, ensuring that they can claim repayment if the borrower fails to fulfill their obligations. There are various types of liens that can be placed on a property, including tax liens, mortgage liens, mechanic's liens, and judgment liens. Tax Liens are imposed by the government when property taxes remain unpaid. These liens take priority over other liens and can only be removed once the owed taxes are paid. A Mortgage Lien is created when a property is purchased using borrowed funds. The lender holds a lien on the property until the mortgage is fully paid off. In case of default, the lender may enforce the lien through foreclosure proceedings. Mechanic's Liens are filed by contractors, subcontractors, or suppliers who have provided labor or materials for a project and have not been paid. These liens allow them to claim payment from the property's owner. Judgment Liens are issued when a creditor obtains a judgment in court against a debtor. These liens serve as security for the owed debt and can be collected by seizing the debtor's property or through other legal actions. In Palm Beach, the Assignment of Promissory Note and Liens involves careful documentation and adherence to legal requirements. These processes ensure the smooth transfer of financial rights and safeguard the interests of all parties involved in real estate transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.