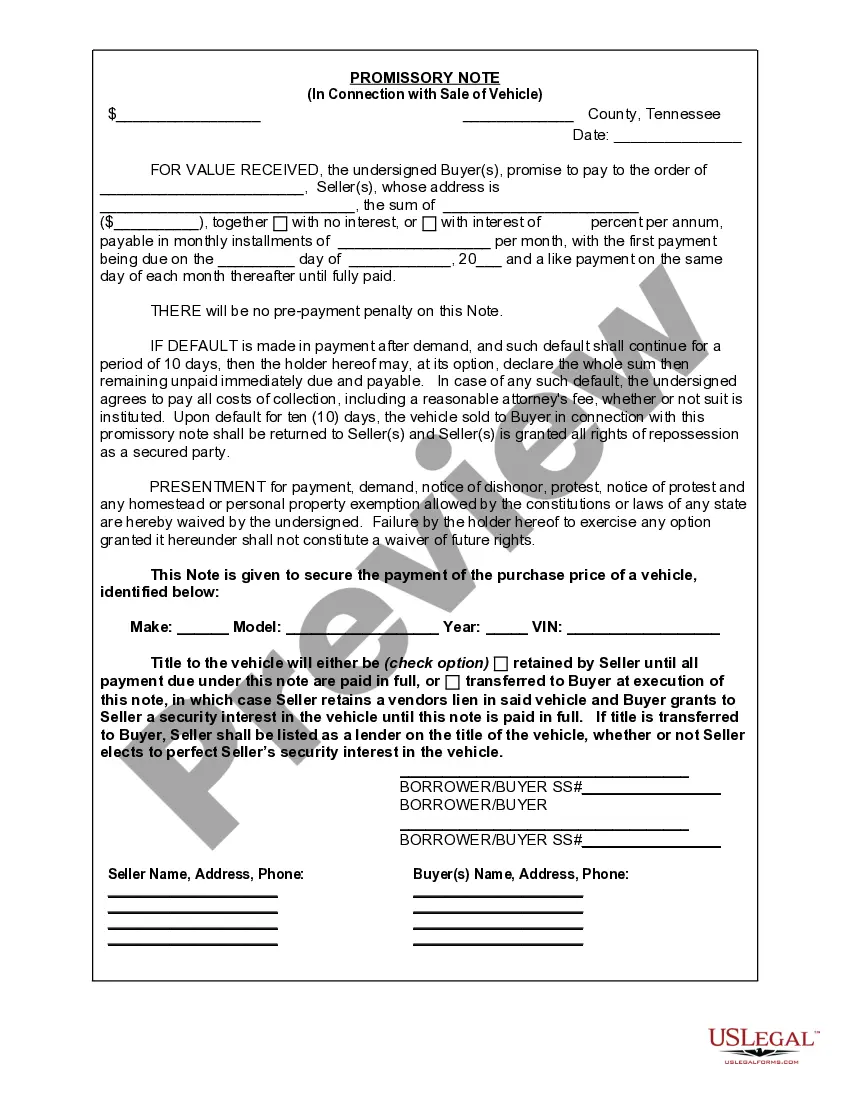

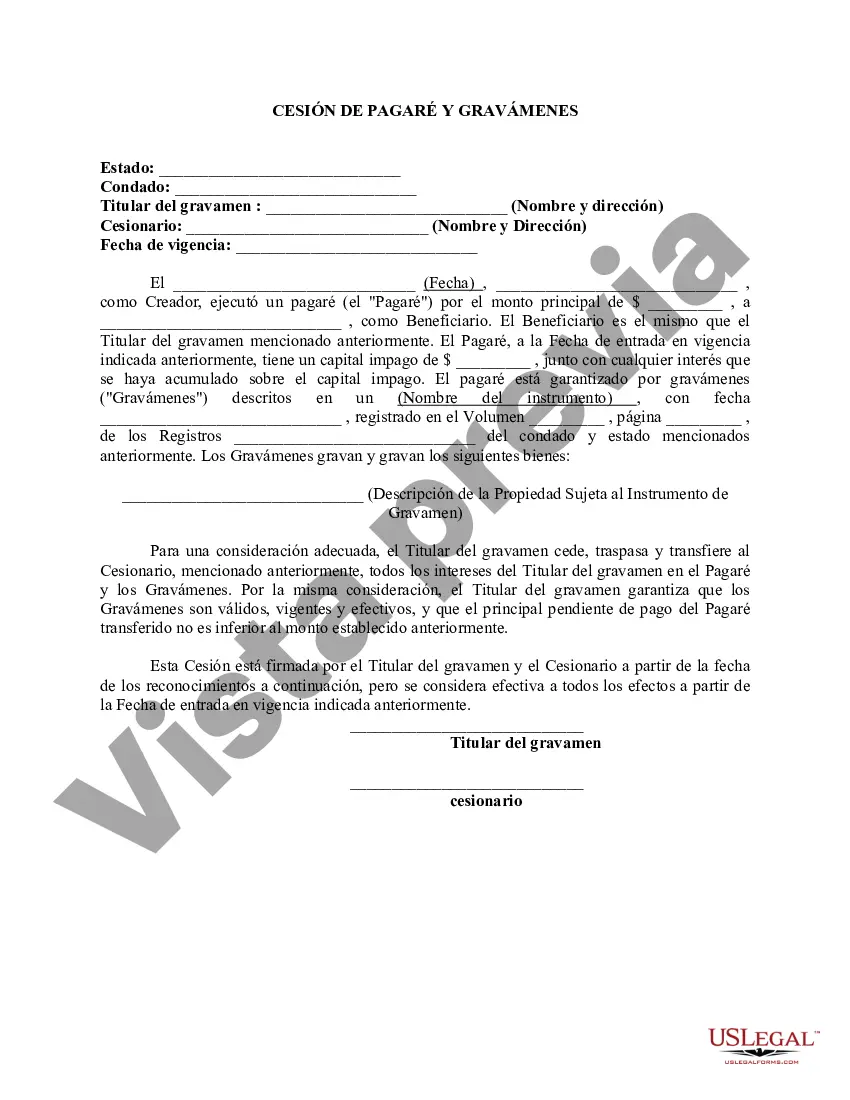

This form is used when Lienholder assigns, conveys, and transfers to Transferee, all of Lienholder's interest in the Note and Liens. Lienholder warrants that the Liens are valid, in force and effect, and the unpaid principal on the Note transferred is no less than the amount stated.

San Diego, California is a vibrant city known for its beautiful coastline, mild climate, and diverse culture. Being one of the largest cities in California, San Diego offers a plethora of opportunities for both residents and visitors. In the realm of real estate, the city has specific processes and guidelines governing the assignment of promissory notes and liens. An assignment of promissory note refers to the transfer of the right to receive payment from a promissory note from one party to another. This legal document ensures that the new party assumes all the rights, responsibilities, and benefits associated with the promissory note. In San Diego, California, there are different types of assignment of promissory notes and liens, namely: 1. Commercial Real Estate Assignment: This type of assignment involves the transfer of promissory notes and liens related to commercial properties such as office buildings, retail spaces, and warehouses. It is common in San Diego due to the city's thriving business and tourism sectors. 2. Residential Real Estate Assignment: This type of assignment focuses on promissory notes and liens associated with residential properties, including single-family homes, condominiums, and townhouses. San Diego's thriving real estate market often sees individuals or companies assigning their promissory notes and liens related to residential properties for various reasons. 3. Construction Loan Assignment: Construction loans play a significant role in the development of real estate projects. In San Diego, the assignment of promissory notes and liens related to construction loans is prevalent, enabling developers to transfer their rights and obligations to another party during the construction phase. 4. Mortgage Assignment: A mortgage assignment involves the transfer of the promissory note and lien associated with a mortgage loan from one lender to another. This type of assignment is crucial for maintaining a streamlined loan repayment process and is quite common in San Diego's dynamic real estate market. When pursuing an assignment of promissory note and liens in San Diego, California, certain considerations should be taken into account. These include complying with state and federal regulations, engaging legal professionals specializing in real estate transactions, and conducting thorough due diligence to ensure the validity and enforceability of the promissory note and lien being assigned. In conclusion, San Diego, California, presents various types of assignment of promissory notes and liens, such as commercial real estate assignment, residential real estate assignment, construction loan assignment, and mortgage assignment. Proper understanding and adherence to the legal procedures in San Diego are crucial when engaging in such transactions, ensuring a smooth and secure transfer of rights and obligations related to promissory notes and liens.San Diego, California is a vibrant city known for its beautiful coastline, mild climate, and diverse culture. Being one of the largest cities in California, San Diego offers a plethora of opportunities for both residents and visitors. In the realm of real estate, the city has specific processes and guidelines governing the assignment of promissory notes and liens. An assignment of promissory note refers to the transfer of the right to receive payment from a promissory note from one party to another. This legal document ensures that the new party assumes all the rights, responsibilities, and benefits associated with the promissory note. In San Diego, California, there are different types of assignment of promissory notes and liens, namely: 1. Commercial Real Estate Assignment: This type of assignment involves the transfer of promissory notes and liens related to commercial properties such as office buildings, retail spaces, and warehouses. It is common in San Diego due to the city's thriving business and tourism sectors. 2. Residential Real Estate Assignment: This type of assignment focuses on promissory notes and liens associated with residential properties, including single-family homes, condominiums, and townhouses. San Diego's thriving real estate market often sees individuals or companies assigning their promissory notes and liens related to residential properties for various reasons. 3. Construction Loan Assignment: Construction loans play a significant role in the development of real estate projects. In San Diego, the assignment of promissory notes and liens related to construction loans is prevalent, enabling developers to transfer their rights and obligations to another party during the construction phase. 4. Mortgage Assignment: A mortgage assignment involves the transfer of the promissory note and lien associated with a mortgage loan from one lender to another. This type of assignment is crucial for maintaining a streamlined loan repayment process and is quite common in San Diego's dynamic real estate market. When pursuing an assignment of promissory note and liens in San Diego, California, certain considerations should be taken into account. These include complying with state and federal regulations, engaging legal professionals specializing in real estate transactions, and conducting thorough due diligence to ensure the validity and enforceability of the promissory note and lien being assigned. In conclusion, San Diego, California, presents various types of assignment of promissory notes and liens, such as commercial real estate assignment, residential real estate assignment, construction loan assignment, and mortgage assignment. Proper understanding and adherence to the legal procedures in San Diego are crucial when engaging in such transactions, ensuring a smooth and secure transfer of rights and obligations related to promissory notes and liens.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.