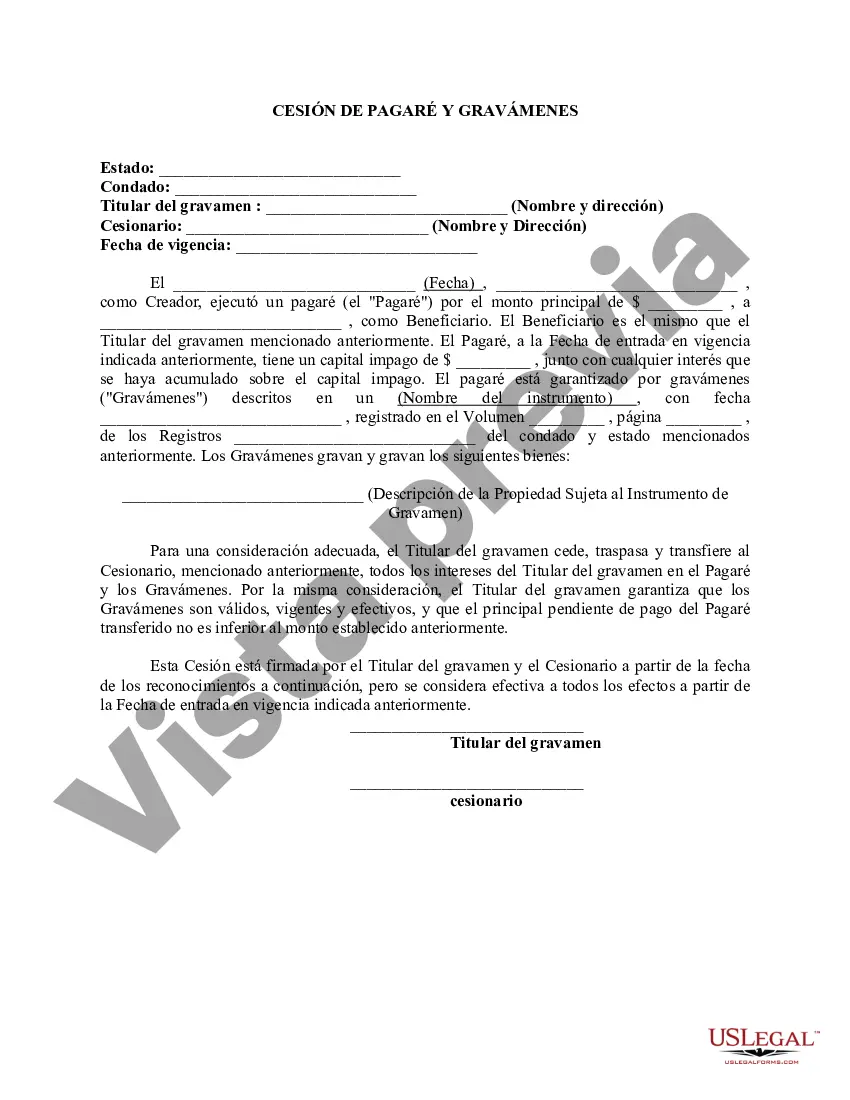

This form is used when Lienholder assigns, conveys, and transfers to Transferee, all of Lienholder's interest in the Note and Liens. Lienholder warrants that the Liens are valid, in force and effect, and the unpaid principal on the Note transferred is no less than the amount stated.

San Jose, California is home to a thriving real estate market and a significant number of financial transactions take place in the region. One such financial instrument commonly used in San Jose is the Assignment of Promissory Note and Liens. This mechanism allows for the transfer of rights and interests in promissory notes and associated liens from one party to another. An Assignment of Promissory Note and Liens serves as a legal document that formalizes the transfer of obligations and rights outlined in a promissory note, usually related to a loan or mortgage. The assignment can occur for various reasons, including the sale or transfer of the underlying property, consolidating debt, or changing the loan service. These assignments are crucial in protecting the interests of parties involved in financial transactions. In San Jose, different types of Assignment of Promissory Note and Liens may include: 1. Mortgage Assignment: This type of assignment involves the transfer of a mortgage and associated promissory note from the original lender to another party, such as a financial institution or an investor. The assignee assumes the rights and obligations of the original lender. 2. Deed of Trust Assignment: Similar to a mortgage assignment, a deed of trust assignment transfers the rights and interests in a trust deed and accompanying promissory note from the original beneficiary to a third party. This allows the new assignee to collect payments and enforce the terms outlined in the promissory note. 3. Collateral Assignment: A collateral assignment involves the transfer of collateral interests, often associated with a promissory note, to secure a debt. This assignment allows the assignee to possess the rights and benefits associated with the collateral if the debtor defaults. 4. Partial Assignment: As the name suggests, a partial assignment refers to the transfer of a portion of the rights and obligations outlined in a promissory note and accompanying liens. This type of assignment is often used when parties wish to divide ownership or rights between multiple individuals or entities. When executing an Assignment of Promissory Note and Liens in San Jose, California, it is crucial to consult with legal professionals experienced in real estate and financial matters. They can provide expert guidance on the specific steps and requirements necessary to execute a valid assignment while ensuring compliance with local laws and regulations.San Jose, California is home to a thriving real estate market and a significant number of financial transactions take place in the region. One such financial instrument commonly used in San Jose is the Assignment of Promissory Note and Liens. This mechanism allows for the transfer of rights and interests in promissory notes and associated liens from one party to another. An Assignment of Promissory Note and Liens serves as a legal document that formalizes the transfer of obligations and rights outlined in a promissory note, usually related to a loan or mortgage. The assignment can occur for various reasons, including the sale or transfer of the underlying property, consolidating debt, or changing the loan service. These assignments are crucial in protecting the interests of parties involved in financial transactions. In San Jose, different types of Assignment of Promissory Note and Liens may include: 1. Mortgage Assignment: This type of assignment involves the transfer of a mortgage and associated promissory note from the original lender to another party, such as a financial institution or an investor. The assignee assumes the rights and obligations of the original lender. 2. Deed of Trust Assignment: Similar to a mortgage assignment, a deed of trust assignment transfers the rights and interests in a trust deed and accompanying promissory note from the original beneficiary to a third party. This allows the new assignee to collect payments and enforce the terms outlined in the promissory note. 3. Collateral Assignment: A collateral assignment involves the transfer of collateral interests, often associated with a promissory note, to secure a debt. This assignment allows the assignee to possess the rights and benefits associated with the collateral if the debtor defaults. 4. Partial Assignment: As the name suggests, a partial assignment refers to the transfer of a portion of the rights and obligations outlined in a promissory note and accompanying liens. This type of assignment is often used when parties wish to divide ownership or rights between multiple individuals or entities. When executing an Assignment of Promissory Note and Liens in San Jose, California, it is crucial to consult with legal professionals experienced in real estate and financial matters. They can provide expert guidance on the specific steps and requirements necessary to execute a valid assignment while ensuring compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.