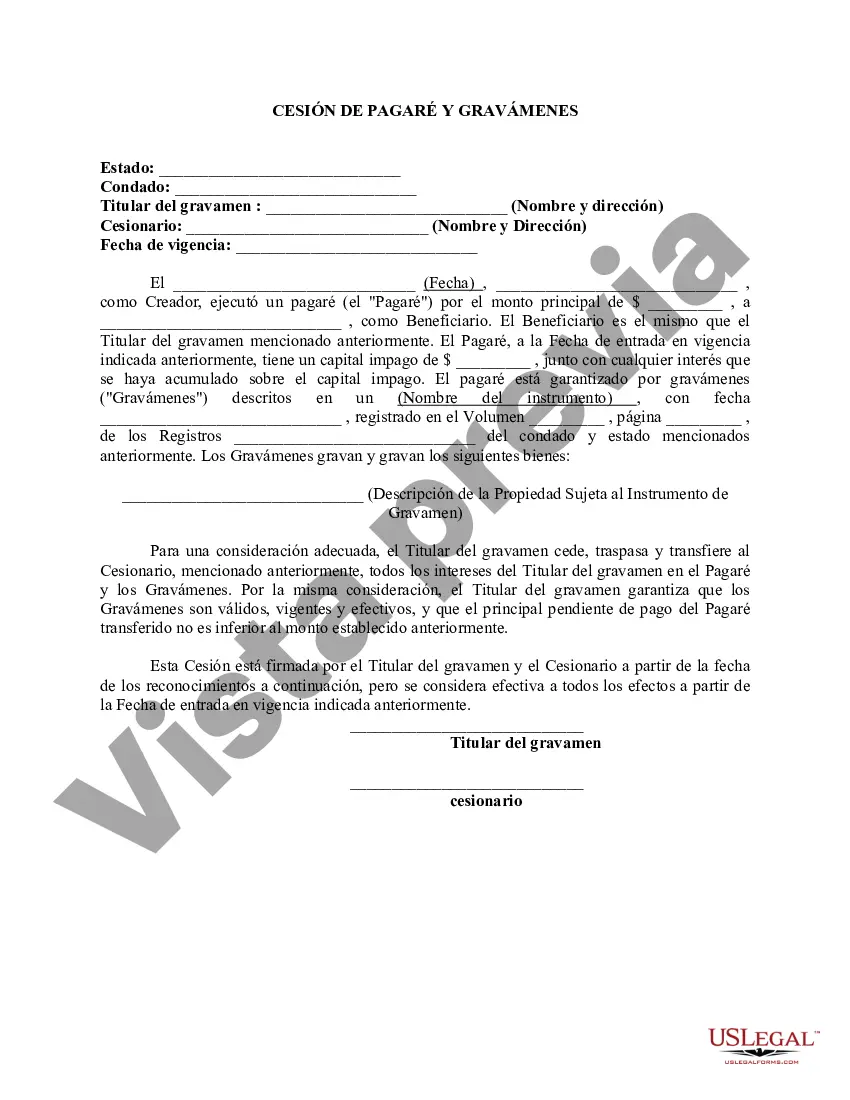

This form is used when Lienholder assigns, conveys, and transfers to Transferee, all of Lienholder's interest in the Note and Liens. Lienholder warrants that the Liens are valid, in force and effect, and the unpaid principal on the Note transferred is no less than the amount stated.

Wake North Carolina Assignment of Promissory Note and Liens is a legal document that allows the transfer of ownership of a promissory note and associated liens from one party to another in Wake County, North Carolina. In the real estate business, promissory notes are commonly used to document loans between a borrower and a lender. When a promissory note is assigned, the ownership rights are transferred, meaning that the assignee becomes the new holder of the debt instrument. In conjunction with the promissory note, liens associated with the property securing the loan are also assigned. The Wake North Carolina Assignment of Promissory Note and Liens is essential to protect the interests of both the assignor (original lender) and the assignee (new lender). This document clearly outlines the terms of the assignment, including the rights and obligations of both parties involved. It establishes the legal framework for the assignee to enforce the debt obligations and exercise any associated rights, such as foreclosure in case of default. Types of Wake North Carolina Assignment of Promissory Note and Liens: 1. Full Assignment: This type of assignment involves the transfer of the entire promissory note and associated liens from the assignor to the assignee. The assignee assumes full responsibility for the debt and all the rights and remedies that come with it. 2. Partial Assignment: In some cases, the assignor may choose to assign only a portion of the promissory note and related liens. This partial assignment allows for a transfer of the debt while the original lender still retains some claim or interest in the remaining balance. 3. Assignment with Recourse: This assignment type provides some guarantee against potential losses for the assignee. If the borrower defaults, the assignor may be held responsible for repurchasing the promissory note from the assignee or compensating for any financial loss. 4. Assignment without Recourse: In this type, the assignee assumes all risks related to the promissory note and liens. The assignor is absolved of any liability, and the assignee cannot seek recourse against the assignor in the event of a borrower default. When executing a Wake North Carolina Assignment of Promissory Note and Liens, it is crucial to consult with a qualified attorney experienced in real estate law to ensure compliance with all applicable state laws and regulations. This document protects the interests of both parties involved and helps facilitate a smooth transaction of debt ownership.Wake North Carolina Assignment of Promissory Note and Liens is a legal document that allows the transfer of ownership of a promissory note and associated liens from one party to another in Wake County, North Carolina. In the real estate business, promissory notes are commonly used to document loans between a borrower and a lender. When a promissory note is assigned, the ownership rights are transferred, meaning that the assignee becomes the new holder of the debt instrument. In conjunction with the promissory note, liens associated with the property securing the loan are also assigned. The Wake North Carolina Assignment of Promissory Note and Liens is essential to protect the interests of both the assignor (original lender) and the assignee (new lender). This document clearly outlines the terms of the assignment, including the rights and obligations of both parties involved. It establishes the legal framework for the assignee to enforce the debt obligations and exercise any associated rights, such as foreclosure in case of default. Types of Wake North Carolina Assignment of Promissory Note and Liens: 1. Full Assignment: This type of assignment involves the transfer of the entire promissory note and associated liens from the assignor to the assignee. The assignee assumes full responsibility for the debt and all the rights and remedies that come with it. 2. Partial Assignment: In some cases, the assignor may choose to assign only a portion of the promissory note and related liens. This partial assignment allows for a transfer of the debt while the original lender still retains some claim or interest in the remaining balance. 3. Assignment with Recourse: This assignment type provides some guarantee against potential losses for the assignee. If the borrower defaults, the assignor may be held responsible for repurchasing the promissory note from the assignee or compensating for any financial loss. 4. Assignment without Recourse: In this type, the assignee assumes all risks related to the promissory note and liens. The assignor is absolved of any liability, and the assignee cannot seek recourse against the assignor in the event of a borrower default. When executing a Wake North Carolina Assignment of Promissory Note and Liens, it is crucial to consult with a qualified attorney experienced in real estate law to ensure compliance with all applicable state laws and regulations. This document protects the interests of both parties involved and helps facilitate a smooth transaction of debt ownership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.