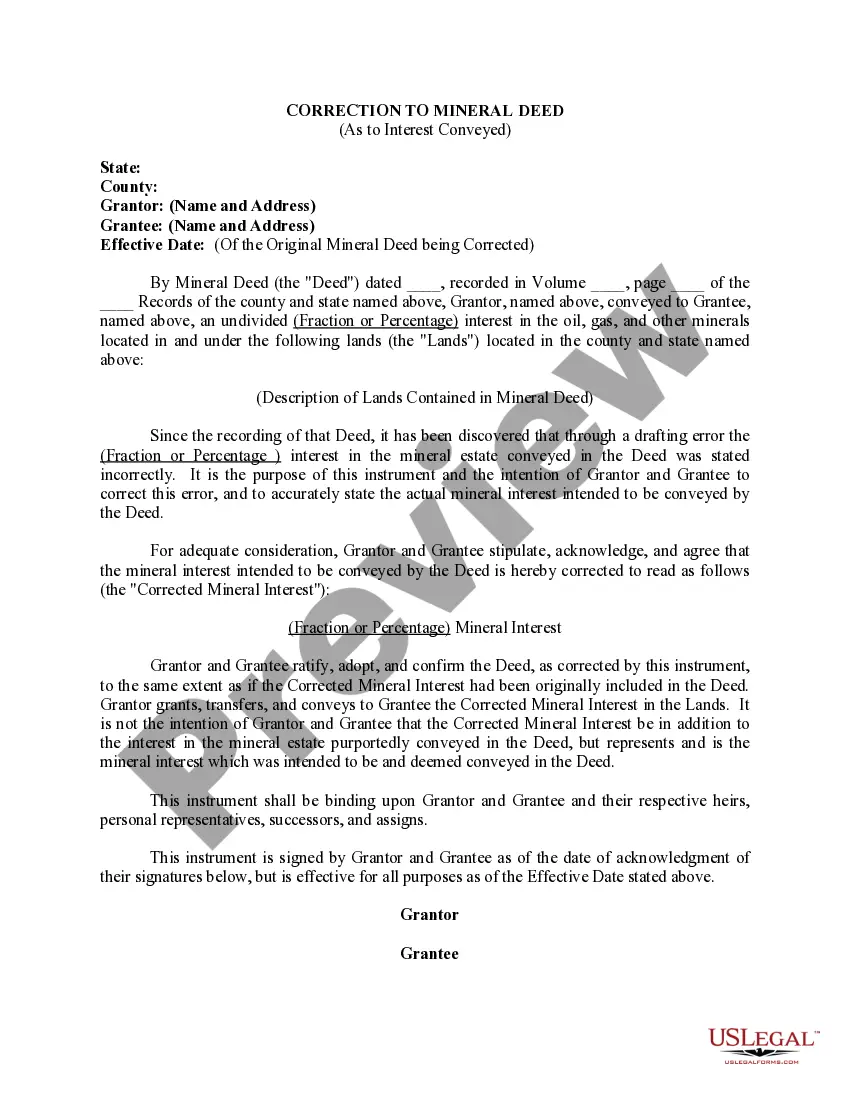

This form is used to when it has been discovered that through a drafting error the (Fraction or Percentage ) interest in the mineral estate conveyed in a Deed was stated incorrectly. It is the purpose of this instrument and the intention of Grantor and Grantee to correct this error, and to accurately state the actual mineral interest intended to be conveyed by the Deed.

Harris County, located in Texas, has a specific form known as the "Harris Texas Correction to Mineral Deed As to Interest Conveyed." This document is used to rectify any errors or inaccuracies related to the conveyance of interests in mineral rights through a previously recorded mineral deed in Harris County. The Correction to Mineral Deed serves as an amendment to the original document and aims to ensure that the conveyed interests accurately reflect the intent of the parties involved. By using this corrective instrument, any mistakes, omissions, or ambiguities in the previously recorded mineral deed can be clarified and rectified. This correction is essential because inaccuracies in mineral deeds can have significant legal implications and may affect the ownership or transfer of these valuable assets. It is crucial to promptly address any errors or discrepancies to avoid potential disputes or title issues in the future. Common types of Harris Texas Correction to Mineral Deed As to Interest Conveyed may include: 1. Correction of Mineral Interest Percentage: In cases where the percentage of ownership or interest in the mineral rights has been incorrectly stated in the original mineral deed, a correction can be made to accurately reflect the intended distribution of interests among the parties involved. 2. Correction of Description: If the legal description of the mineral property, such as the metes and bounds description or the survey details, was inaccurately portrayed in the initial deed, a correction can be made to provide an accurate and complete representation of the property's location and boundaries. 3. Correction of Names or Entities: In situations where the names of individuals or entities involved in the mineral rights' conveyance were misspelled, incomplete, or misrepresented in the original deed, the correction document can be used to rectify these errors and ensure that the correct parties are identified. 4. Correction of Recording Information: Occasionally, clerical mistakes may occur during the recording process, resulting in incorrect page numbers, book numbers, or filing dates. A correction to the mineral deed can be filed to rectify such errors and provide accurate recording information. It is crucial to consult with a qualified attorney or real estate professional familiar with Harris County's specific requirements and procedures when preparing and filing a Harris Texas Correction to Mineral Deed As to Interest Conveyed. Adhering to the proper legal process will help ensure the correction is valid, effective, and enforceable.Harris County, located in Texas, has a specific form known as the "Harris Texas Correction to Mineral Deed As to Interest Conveyed." This document is used to rectify any errors or inaccuracies related to the conveyance of interests in mineral rights through a previously recorded mineral deed in Harris County. The Correction to Mineral Deed serves as an amendment to the original document and aims to ensure that the conveyed interests accurately reflect the intent of the parties involved. By using this corrective instrument, any mistakes, omissions, or ambiguities in the previously recorded mineral deed can be clarified and rectified. This correction is essential because inaccuracies in mineral deeds can have significant legal implications and may affect the ownership or transfer of these valuable assets. It is crucial to promptly address any errors or discrepancies to avoid potential disputes or title issues in the future. Common types of Harris Texas Correction to Mineral Deed As to Interest Conveyed may include: 1. Correction of Mineral Interest Percentage: In cases where the percentage of ownership or interest in the mineral rights has been incorrectly stated in the original mineral deed, a correction can be made to accurately reflect the intended distribution of interests among the parties involved. 2. Correction of Description: If the legal description of the mineral property, such as the metes and bounds description or the survey details, was inaccurately portrayed in the initial deed, a correction can be made to provide an accurate and complete representation of the property's location and boundaries. 3. Correction of Names or Entities: In situations where the names of individuals or entities involved in the mineral rights' conveyance were misspelled, incomplete, or misrepresented in the original deed, the correction document can be used to rectify these errors and ensure that the correct parties are identified. 4. Correction of Recording Information: Occasionally, clerical mistakes may occur during the recording process, resulting in incorrect page numbers, book numbers, or filing dates. A correction to the mineral deed can be filed to rectify such errors and provide accurate recording information. It is crucial to consult with a qualified attorney or real estate professional familiar with Harris County's specific requirements and procedures when preparing and filing a Harris Texas Correction to Mineral Deed As to Interest Conveyed. Adhering to the proper legal process will help ensure the correction is valid, effective, and enforceable.