Orange California Indemnities refers to the various types of insurance policies or agreements offered in Orange County, California that cover indemnification for potential losses or damages incurred by individuals or businesses. These indemnities provide financial protection against specified risks and liabilities, ensuring that parties are compensated or protected in case of unforeseen events. Several types of Orange California Indemnities include: 1. Auto Insurance: This type of indemnity covers damages or injuries resulting from accidents involving automobiles, ensuring that individuals are protected against potential financial losses arising from collisions, theft, or liability claims. 2. Homeowner's Insurance: Homeowner's indemnity protects property owners in Orange County from various risks such as fire, theft, vandalism, natural disasters, and personal liability claims. It provides coverage for damages to the structure, personal belongings, and liability for injuries occurring on the premises. 3. Business Insurance: Orange California offers various indemnity options for businesses, including general liability insurance, professional liability insurance, and workers' compensation insurance. These policies protect businesses against lawsuits, property damage, injuries, and other potential financial liabilities. 4. Renters Insurance: Renters in Orange County can opt for renters insurance, which provides coverage for personal belongings, liability protection, and additional living expenses in case of fire, theft, or other covered hazards. 5. Health Insurance: Health indemnity policies cover medical expenses for individuals and families, ensuring access to healthcare facilities and services in Orange County. This type of indemnity provides coverage for hospital stays, doctor visits, prescription medications, and other healthcare-related expenses. 6. Umbrella Insurance: Umbrella indemnity acts as an additional layer of liability coverage beyond the limits of standard policies like auto, homeowner's, or business insurance. It offers broader protection against major claims, providing extra security for individuals and businesses in Orange County. In summary, Orange California Indemnities comprise a range of insurance policies that protect individuals, homeowners, businesses, and renters against financial losses resulting from accidents, damages, or liabilities. These policies provide peace of mind and ensure financial stability, allowing residents and business owners in Orange County to mitigate potential risks effectively.

Orange California Indemnities

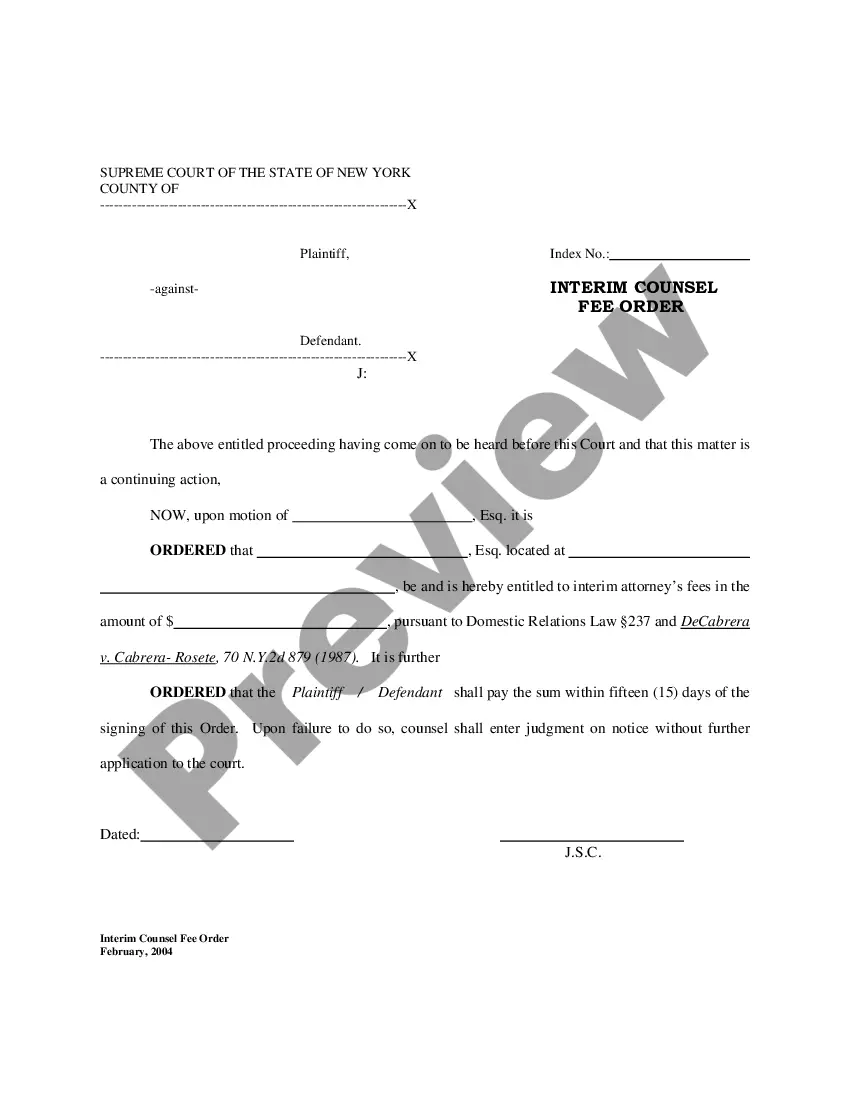

Description

How to fill out Orange California Indemnities?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Orange Indemnities suiting all regional requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Aside from the Orange Indemnities, here you can get any specific form to run your business or individual affairs, complying with your regional requirements. Professionals check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Orange Indemnities:

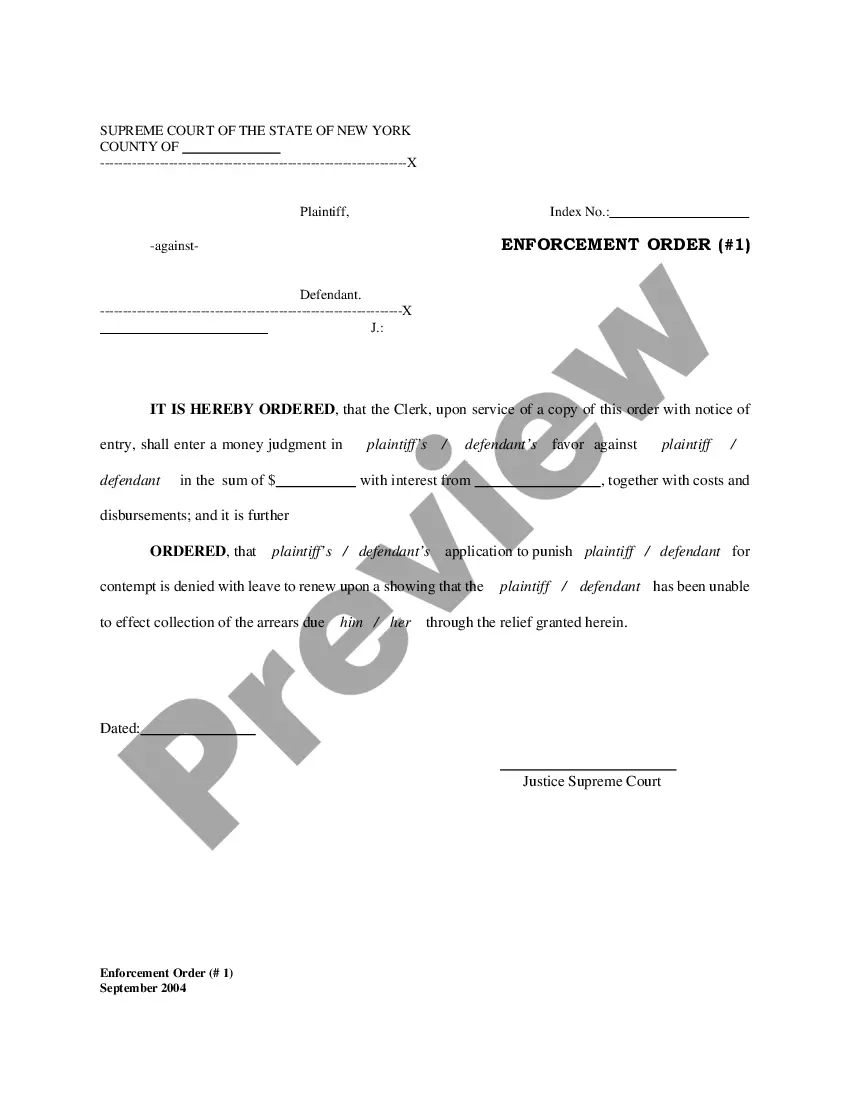

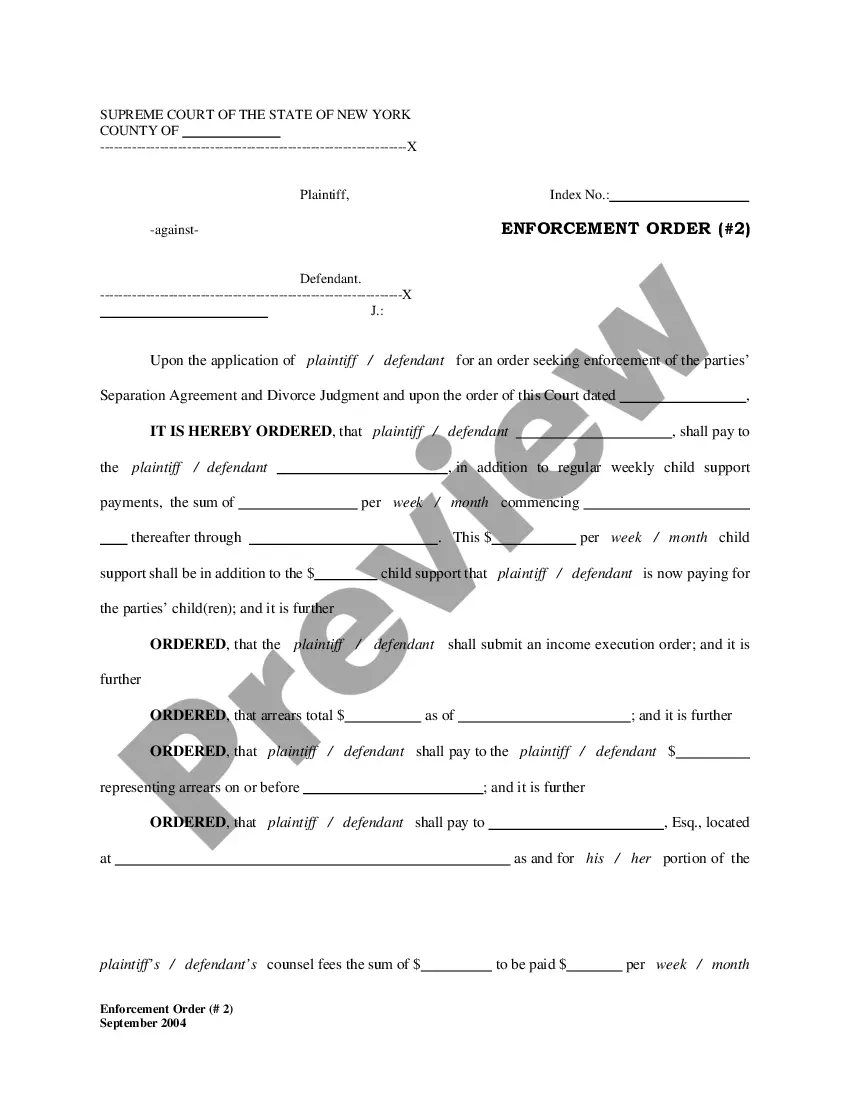

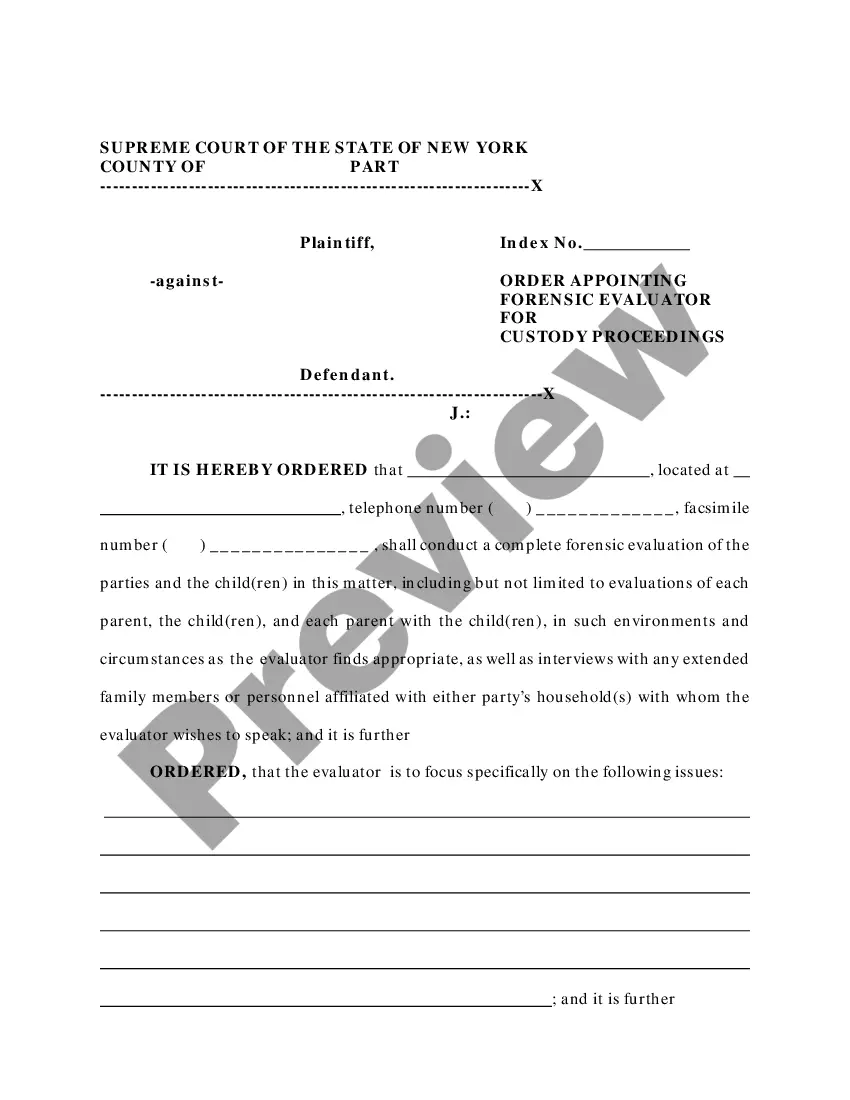

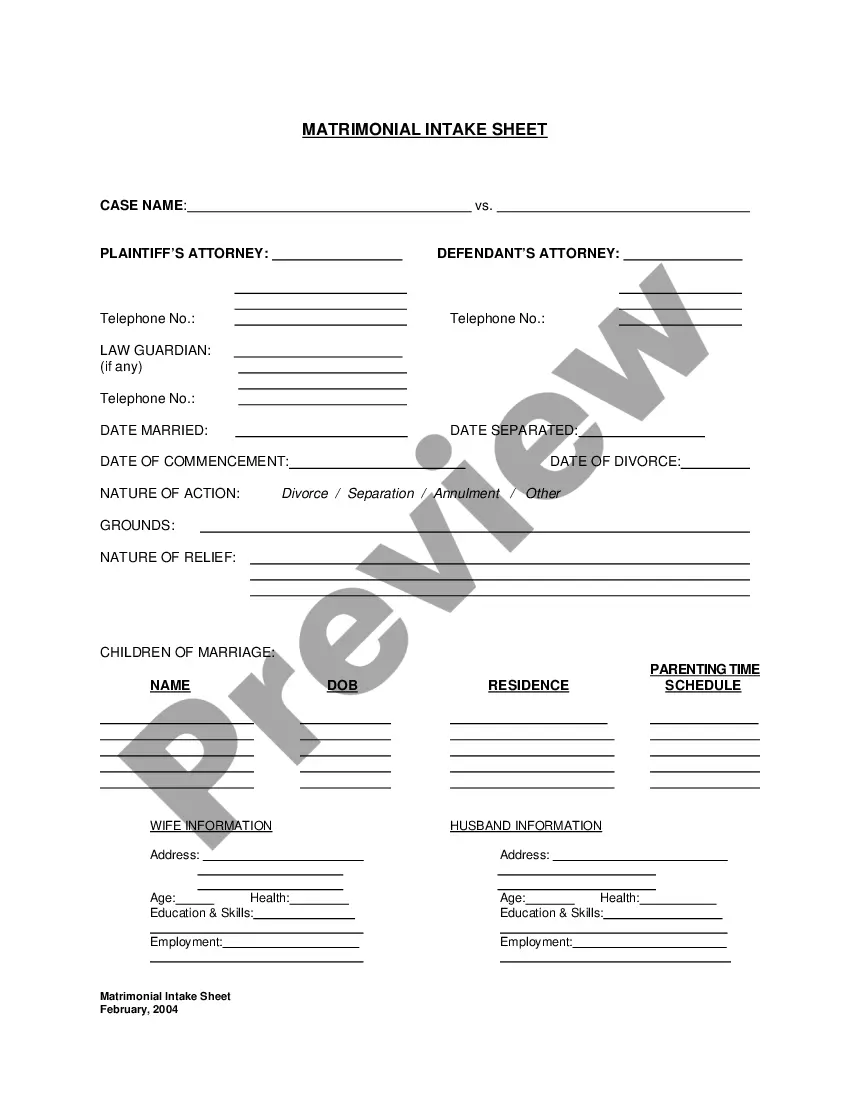

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Orange Indemnities.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!