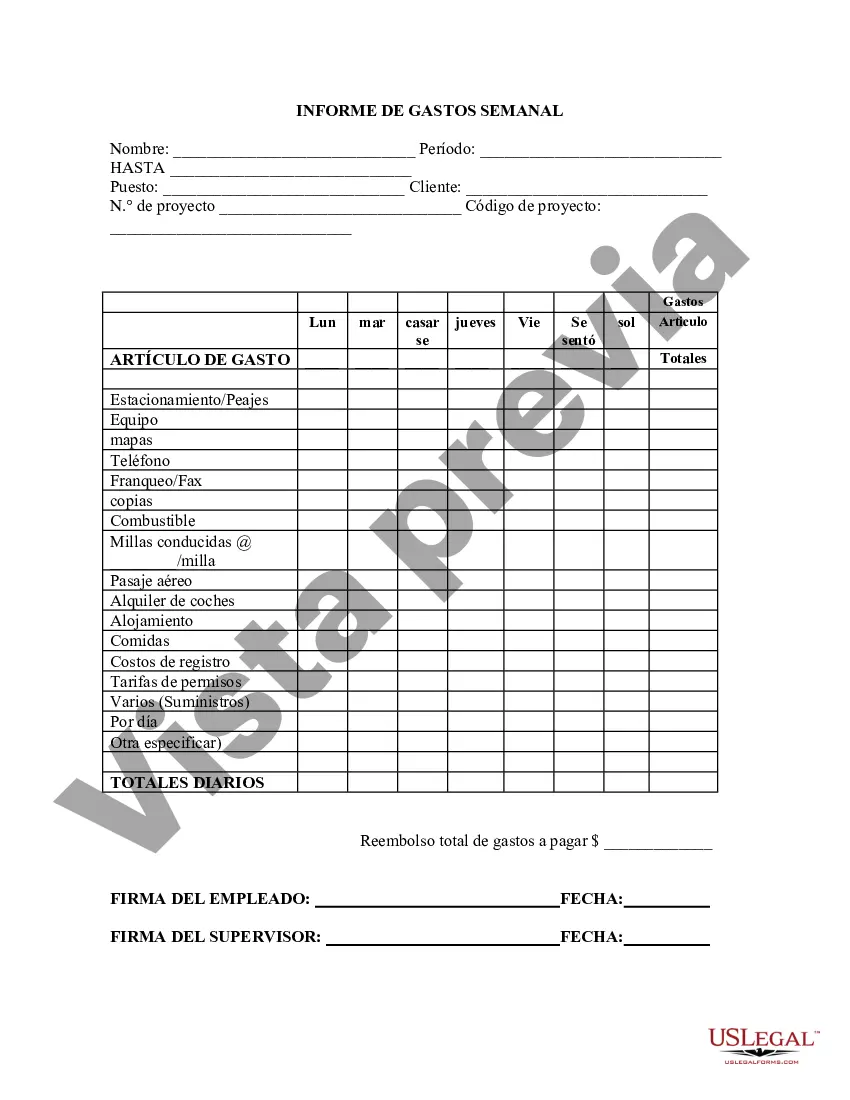

This form is a weekly expense report listing name, period, position, client, project number, project code, the expense items and the daily totals.

The Hennepin Minnesota Weekly Expense Report is a document used for tracking and reporting the expenses incurred by individuals, businesses, or organizations within the county of Hennepin. This report serves as a comprehensive tool for documenting and analyzing financial transactions on a weekly basis. Created to enhance financial transparency and accountability, the Hennepin Minnesota Weekly Expense Report ensures that all expenses are accurately recorded and categorized. The Hennepin Minnesota Weekly Expense Report captures various types of expenses, including but not limited to travel expenses, meal costs, office supplies, utilities, transportation, and other business-related expenditures. It allows individuals and organizations to monitor their spending habits, identify potential cost-saving measures, and make informed financial decisions. Apart from the generic Hennepin Minnesota Weekly Expense Report, there may be different types or formats adapted to specific purposes or sectors within the county. Some variations may include: 1. Individual Expense Report: This type of report is designed for individuals who need to track their personal expenses, such as individuals employed by the county, residents, or taxpayers. It includes categories tailored to personal spending habits like groceries, rent, entertainment, and healthcare. 2. Business Expense Report: Targeted towards businesses operating within Hennepin County, this form is used to document and report business-related expenses such as office rent, advertising costs, employee reimbursement, and equipment purchases. It often adheres to specific reporting guidelines and is helpful for tax purposes and budgeting. 3. Non-profit Expense Report: Developed for non-profit organizations within Hennepin County, this report helps monitor and document expenses related to program activities, fundraising efforts, volunteer reimbursements, donations, and grants. It often requires additional information regarding donors, granters, and program outcomes. 4. County Employee Expense Report: Exclusively for Hennepin County employees, this report ensures that work-related expenses incurred during official duties are efficiently recorded and reimbursed promptly. It often includes sections for mileage reimbursement, training expenses, conferences, and other business-related expenditures. The Hennepin Minnesota Weekly Expense Report, regardless of its type, serves as a crucial financial management tool, allowing individuals, businesses, and organizations to maintain accurate records, analyze spending patterns, make informed budgetary decisions, and demonstrate responsible financial stewardship.The Hennepin Minnesota Weekly Expense Report is a document used for tracking and reporting the expenses incurred by individuals, businesses, or organizations within the county of Hennepin. This report serves as a comprehensive tool for documenting and analyzing financial transactions on a weekly basis. Created to enhance financial transparency and accountability, the Hennepin Minnesota Weekly Expense Report ensures that all expenses are accurately recorded and categorized. The Hennepin Minnesota Weekly Expense Report captures various types of expenses, including but not limited to travel expenses, meal costs, office supplies, utilities, transportation, and other business-related expenditures. It allows individuals and organizations to monitor their spending habits, identify potential cost-saving measures, and make informed financial decisions. Apart from the generic Hennepin Minnesota Weekly Expense Report, there may be different types or formats adapted to specific purposes or sectors within the county. Some variations may include: 1. Individual Expense Report: This type of report is designed for individuals who need to track their personal expenses, such as individuals employed by the county, residents, or taxpayers. It includes categories tailored to personal spending habits like groceries, rent, entertainment, and healthcare. 2. Business Expense Report: Targeted towards businesses operating within Hennepin County, this form is used to document and report business-related expenses such as office rent, advertising costs, employee reimbursement, and equipment purchases. It often adheres to specific reporting guidelines and is helpful for tax purposes and budgeting. 3. Non-profit Expense Report: Developed for non-profit organizations within Hennepin County, this report helps monitor and document expenses related to program activities, fundraising efforts, volunteer reimbursements, donations, and grants. It often requires additional information regarding donors, granters, and program outcomes. 4. County Employee Expense Report: Exclusively for Hennepin County employees, this report ensures that work-related expenses incurred during official duties are efficiently recorded and reimbursed promptly. It often includes sections for mileage reimbursement, training expenses, conferences, and other business-related expenditures. The Hennepin Minnesota Weekly Expense Report, regardless of its type, serves as a crucial financial management tool, allowing individuals, businesses, and organizations to maintain accurate records, analyze spending patterns, make informed budgetary decisions, and demonstrate responsible financial stewardship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.