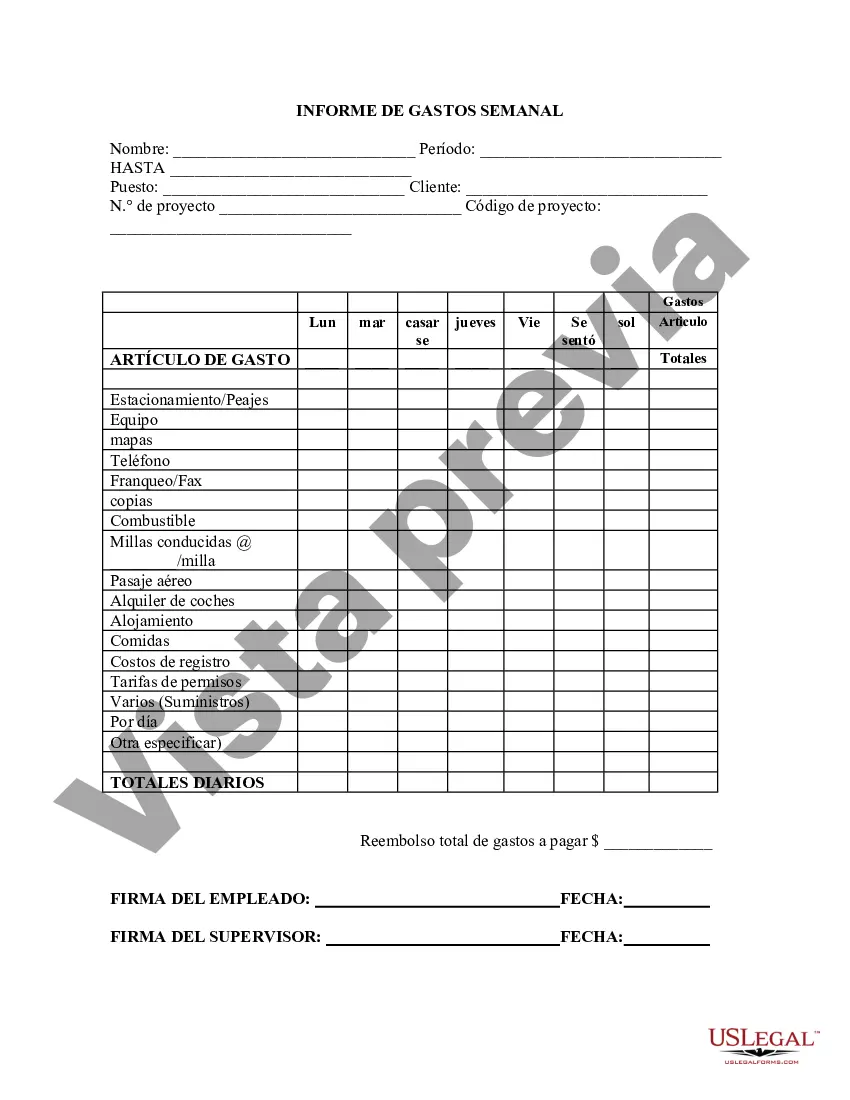

This form is a weekly expense report listing name, period, position, client, project number, project code, the expense items and the daily totals.

Riverside California Weekly Expense Report is a comprehensive financial document that provides a detailed breakdown of expenses incurred by individuals or organizations residing in Riverside, California, on a weekly basis. This report enables users to track and analyze their spending patterns, identify areas of overspending, and make informed financial decisions. Keywords: Riverside California, weekly expense report, expenses, financial document, breakdown, incurred, individuals, organizations, track, analyze, spending patterns, overspending, financial decisions. The Riverside California Weekly Expense Report offers several types of expense categories to ensure a comprehensive overview of expenditures. These categories may include but are not limited to: 1. Housing Expenses: This category covers all costs related to housing, such as rent or mortgage payments, property taxes, homeowners' insurance, and maintenance expenses. 2. Transportation Expenses: This category encompasses expenses associated with commuting, such as fuel costs, public transportation fares, vehicle maintenance and repairs, parking fees, and car insurance. 3. Food and Grocery Expenses: Here, individuals track their spending on groceries, dining out, and other food-related expenses, including takeout or deliveries. 4. Utilities and Bills: This category covers monthly bills for electricity, water, gas, internet, cable, phone services, and any other recurring utility expenses. 5. Healthcare Expenses: This category accounts for medical bills, health insurance premiums, prescription medications, and other healthcare-related costs. 6. Entertainment and Recreation Expenses: This category tracks expenses for leisure activities, such as movies, concerts, hobbies, gym memberships, sports events, and vacations. 7. Personal Care Expenses: This category includes expenditures on personal grooming, salon visits, spa treatments, skincare products, and other self-care services. 8. Education and Learning Expenses: Individuals can record expenses related to tuition fees, textbooks, courses, workshops, and any other educational investments. 9. Miscellaneous Expenses: This category covers any additional costs that do not fit into the above categories, such as gifts, charitable donations, home improvement expenses, or unexpected/emergency costs. By utilizing the Riverside California Weekly Expense Report, individuals or organizations can gain a comprehensive understanding of their financial standing, manage their expenses effectively, and make informed decisions to improve their financial health and stability.Riverside California Weekly Expense Report is a comprehensive financial document that provides a detailed breakdown of expenses incurred by individuals or organizations residing in Riverside, California, on a weekly basis. This report enables users to track and analyze their spending patterns, identify areas of overspending, and make informed financial decisions. Keywords: Riverside California, weekly expense report, expenses, financial document, breakdown, incurred, individuals, organizations, track, analyze, spending patterns, overspending, financial decisions. The Riverside California Weekly Expense Report offers several types of expense categories to ensure a comprehensive overview of expenditures. These categories may include but are not limited to: 1. Housing Expenses: This category covers all costs related to housing, such as rent or mortgage payments, property taxes, homeowners' insurance, and maintenance expenses. 2. Transportation Expenses: This category encompasses expenses associated with commuting, such as fuel costs, public transportation fares, vehicle maintenance and repairs, parking fees, and car insurance. 3. Food and Grocery Expenses: Here, individuals track their spending on groceries, dining out, and other food-related expenses, including takeout or deliveries. 4. Utilities and Bills: This category covers monthly bills for electricity, water, gas, internet, cable, phone services, and any other recurring utility expenses. 5. Healthcare Expenses: This category accounts for medical bills, health insurance premiums, prescription medications, and other healthcare-related costs. 6. Entertainment and Recreation Expenses: This category tracks expenses for leisure activities, such as movies, concerts, hobbies, gym memberships, sports events, and vacations. 7. Personal Care Expenses: This category includes expenditures on personal grooming, salon visits, spa treatments, skincare products, and other self-care services. 8. Education and Learning Expenses: Individuals can record expenses related to tuition fees, textbooks, courses, workshops, and any other educational investments. 9. Miscellaneous Expenses: This category covers any additional costs that do not fit into the above categories, such as gifts, charitable donations, home improvement expenses, or unexpected/emergency costs. By utilizing the Riverside California Weekly Expense Report, individuals or organizations can gain a comprehensive understanding of their financial standing, manage their expenses effectively, and make informed decisions to improve their financial health and stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.