This form is pursuant to The Act of February 25, 1920, as amended and supplemented, authorizes communitization or drilling agreements communitizing or pooling all or a portion of a Federal oil and gas lease, with other lands, whether or not owned by the United States, when separate tracts under the Federal lease cannot be independently developed and operated in conformity with an established well-spacing program for the field or area.

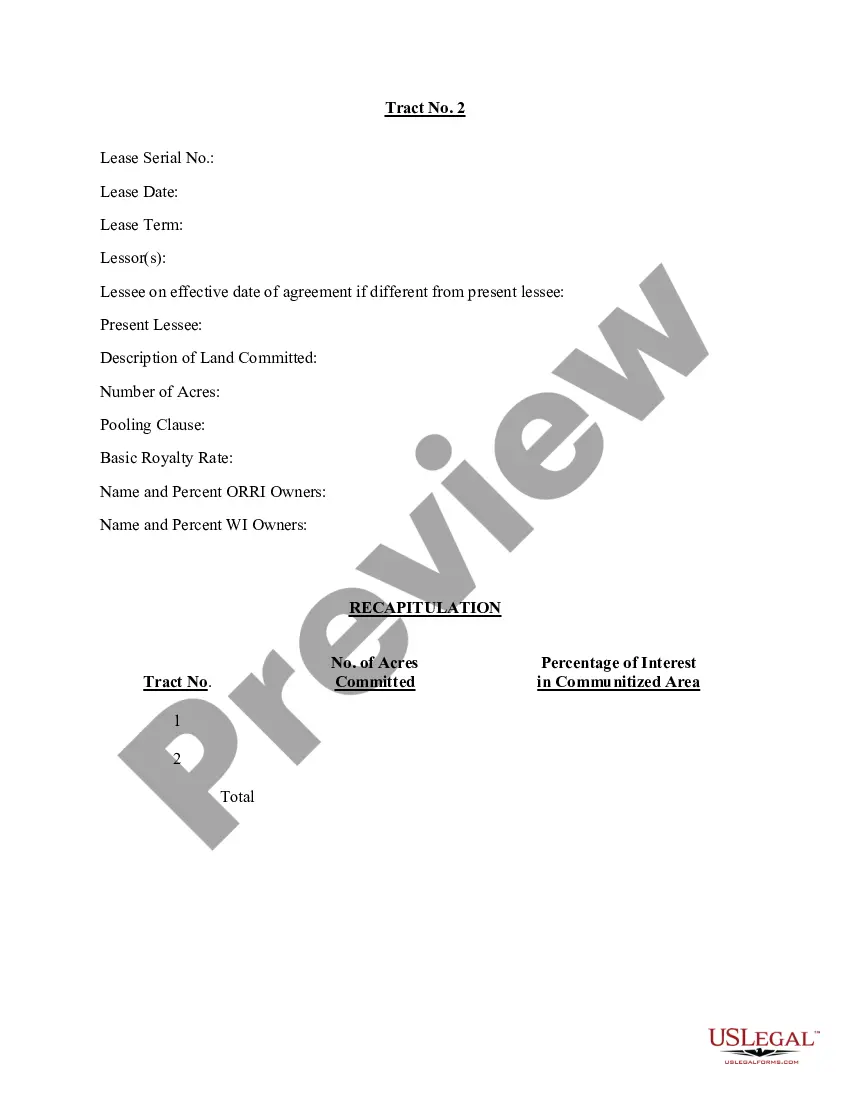

Fairfax Virginia Commoditization Agreement is a legal document created to promote effective and efficient development of oil and gas resources in the area. This agreement facilitates the pooling of land parcels and mineral rights to explore and produce hydrocarbons collectively, avoiding fragmentation of geological formations and enabling comprehensive development. The Fairfax Virginia Commoditization Agreement helps foster collaboration and cooperation among landowners, oil and gas companies, and regulatory authorities, ensuring transparency and fair distribution of royalty payments. It serves as a framework for negotiating the terms and conditions of drilling operations, pooling arrangements, lease agreements, and unitization plans. By pooling resources, parties involved can maximize production and minimize the environmental impact associated with multiple independent operations. There are two common types of Fairfax Virginia Commoditization Agreement: 1. Traditional Commoditization Agreement: This type enables landowners to pool their mineral interests with neighboring properties, forming a single drilling unit. It allows for the sharing of production costs, profits, and expenses, and ensures equitable distribution of royalties among participants. Traditional agreements promote efficiency by enabling the drilling of fewer wells while collectively maximizing hydrocarbon recovery. 2. Horizontal Commoditization Agreement: This type of agreement is specifically designed for horizontal drilling operations, which have become increasingly prevalent in modern oil and gas exploration. Horizontal drilling involves drilling a well bore horizontally through a formation, extracting hydrocarbons efficiently. A horizontal Commoditization Agreement enables landowners with horizontally situated mineral rights to collaboratively develop these resources, sharing costs, risks, and rewards. Key terms and elements often found within Fairfax Virginia Commoditization Agreements include: 1. Unitized Tract: This refers to the land area pooled together for collective development. 2. Participating Interest: Represents the portion of ownership or share of production a party holds in the unit. 3. Drilling and Operating Obligations: Defines the responsibilities, costs, and liabilities related to exploration, drilling, and operational activities. 4. Royalty Distribution: Establishes the formula or methodology for distributing royalty payments among participants. 5. Lease Termination: Outlines the conditions that may result in the termination of the agreement, such as non-compliance with regulations or failure to meet operational obligations. 6. Force Mature: Includes provisions to address unforeseen events or circumstances beyond the control of the parties, such as natural disasters or governmental regulations. 7. Governing Law: Specifies the jurisdiction and laws under which the agreement will be interpreted and enforced. Overall, the Fairfax Virginia Commoditization Agreement serves as a crucial tool for consolidating efforts in oil and gas development, allowing for the efficient extraction of resources while maintaining environmental stewardship and ensuring equitable benefits for landowners and operators.Fairfax Virginia Commoditization Agreement is a legal document created to promote effective and efficient development of oil and gas resources in the area. This agreement facilitates the pooling of land parcels and mineral rights to explore and produce hydrocarbons collectively, avoiding fragmentation of geological formations and enabling comprehensive development. The Fairfax Virginia Commoditization Agreement helps foster collaboration and cooperation among landowners, oil and gas companies, and regulatory authorities, ensuring transparency and fair distribution of royalty payments. It serves as a framework for negotiating the terms and conditions of drilling operations, pooling arrangements, lease agreements, and unitization plans. By pooling resources, parties involved can maximize production and minimize the environmental impact associated with multiple independent operations. There are two common types of Fairfax Virginia Commoditization Agreement: 1. Traditional Commoditization Agreement: This type enables landowners to pool their mineral interests with neighboring properties, forming a single drilling unit. It allows for the sharing of production costs, profits, and expenses, and ensures equitable distribution of royalties among participants. Traditional agreements promote efficiency by enabling the drilling of fewer wells while collectively maximizing hydrocarbon recovery. 2. Horizontal Commoditization Agreement: This type of agreement is specifically designed for horizontal drilling operations, which have become increasingly prevalent in modern oil and gas exploration. Horizontal drilling involves drilling a well bore horizontally through a formation, extracting hydrocarbons efficiently. A horizontal Commoditization Agreement enables landowners with horizontally situated mineral rights to collaboratively develop these resources, sharing costs, risks, and rewards. Key terms and elements often found within Fairfax Virginia Commoditization Agreements include: 1. Unitized Tract: This refers to the land area pooled together for collective development. 2. Participating Interest: Represents the portion of ownership or share of production a party holds in the unit. 3. Drilling and Operating Obligations: Defines the responsibilities, costs, and liabilities related to exploration, drilling, and operational activities. 4. Royalty Distribution: Establishes the formula or methodology for distributing royalty payments among participants. 5. Lease Termination: Outlines the conditions that may result in the termination of the agreement, such as non-compliance with regulations or failure to meet operational obligations. 6. Force Mature: Includes provisions to address unforeseen events or circumstances beyond the control of the parties, such as natural disasters or governmental regulations. 7. Governing Law: Specifies the jurisdiction and laws under which the agreement will be interpreted and enforced. Overall, the Fairfax Virginia Commoditization Agreement serves as a crucial tool for consolidating efforts in oil and gas development, allowing for the efficient extraction of resources while maintaining environmental stewardship and ensuring equitable benefits for landowners and operators.