San Diego California Clause Dealing with Fire Damage: Understanding Your Rights and Coverage In San Diego, California, it is crucial for homeowners and business owners to be aware of the clauses in their insurance policies that specifically address fire damage. Given the region's dry climate and frequent wildfires, having comprehensive coverage and understanding the specific terms of your policy is essential. 1. Basic Fire Damage Clause: This clause typically covers damages caused directly by fire, including structural damage, smoke and soot damage, and the destruction of personal belongings. The policy may also cover additional expenses incurred due to temporary relocation, such as hotel stays or rental costs. 2. Wildfire Exclusion Clause: Due to the high risk of wildfires in San Diego County, some insurance policies may include a wildfire exclusion clause. This clause restricts coverage for damages specifically caused by wildfires, requiring homeowners to obtain separate wildfire insurance or additional endorsements to safeguard against this specific peril. 3. Replacement Cost Clause: A replacement cost clause is important to consider, as it determines whether the insurance policy will cover the full cost of rebuilding or repairing your property to its original condition before the fire. It is crucial to thoroughly review this clause since its absence may result in a reduced payout, leaving you responsible for the remaining expenses. 4. Dwelling Extension Clause: A dwelling extension clause allows for coverage of additional costs associated with rebuilding or repairing your property if the initial insurance coverage limit is insufficient. This clause ensures that your policy takes into account inflation and rising construction costs, sparing you from potential out-of-pocket expenses. 5. Business Interruption Clause: For business owners affected by fire damage, a business interruption clause is vital. This clause covers the loss of income and other expenses that arise due to temporary closure or relocation during the restoration process. It helps mitigate the financial impact of a fire by providing compensation to maintain operations while repairs are being conducted. 6. Extra Coverage for Content Restoration: Some policies offer specific clauses that focus on the restoration of your personal belongings and contents damaged by fire. These clauses cover the costs associated with cleaning, repairing, or replacing damaged items, allowing you to return to normalcy more quickly after a fire. Remember, each insurance policy may vary, making it imperative to carefully examine your contract to understand the specific terms and clauses outlined by your insurance provider. If you have any doubts or questions about your coverage, it is advisable to contact your insurance agent or seek legal assistance to ensure that you fully comprehend your rights and receive the maximum compensation, particularly in the event of fire damage in San Diego, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Cláusula sobre daños por incendio - Clause Dealing with Fire Damage

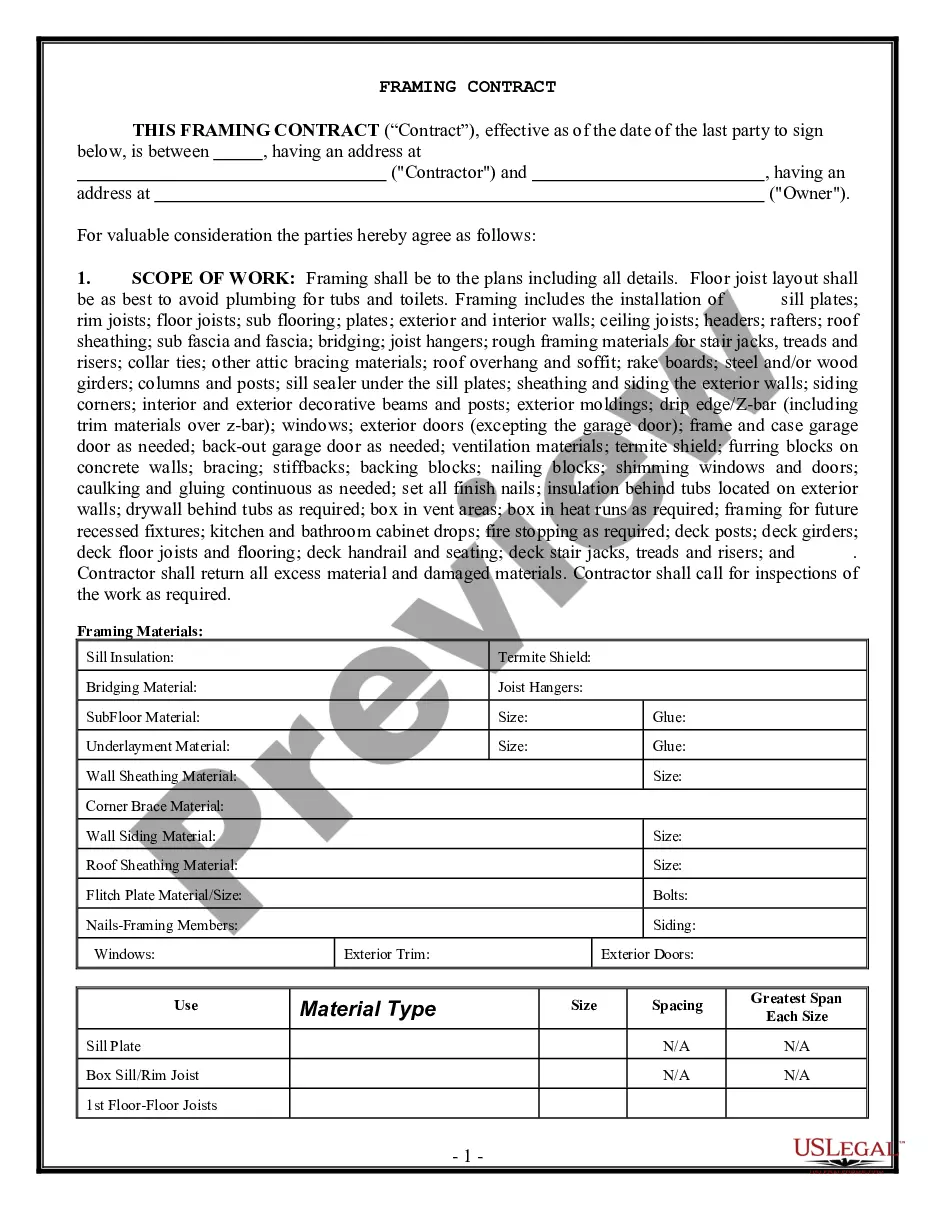

Description

How to fill out San Diego California Cláusula Sobre Daños Por Incendio?

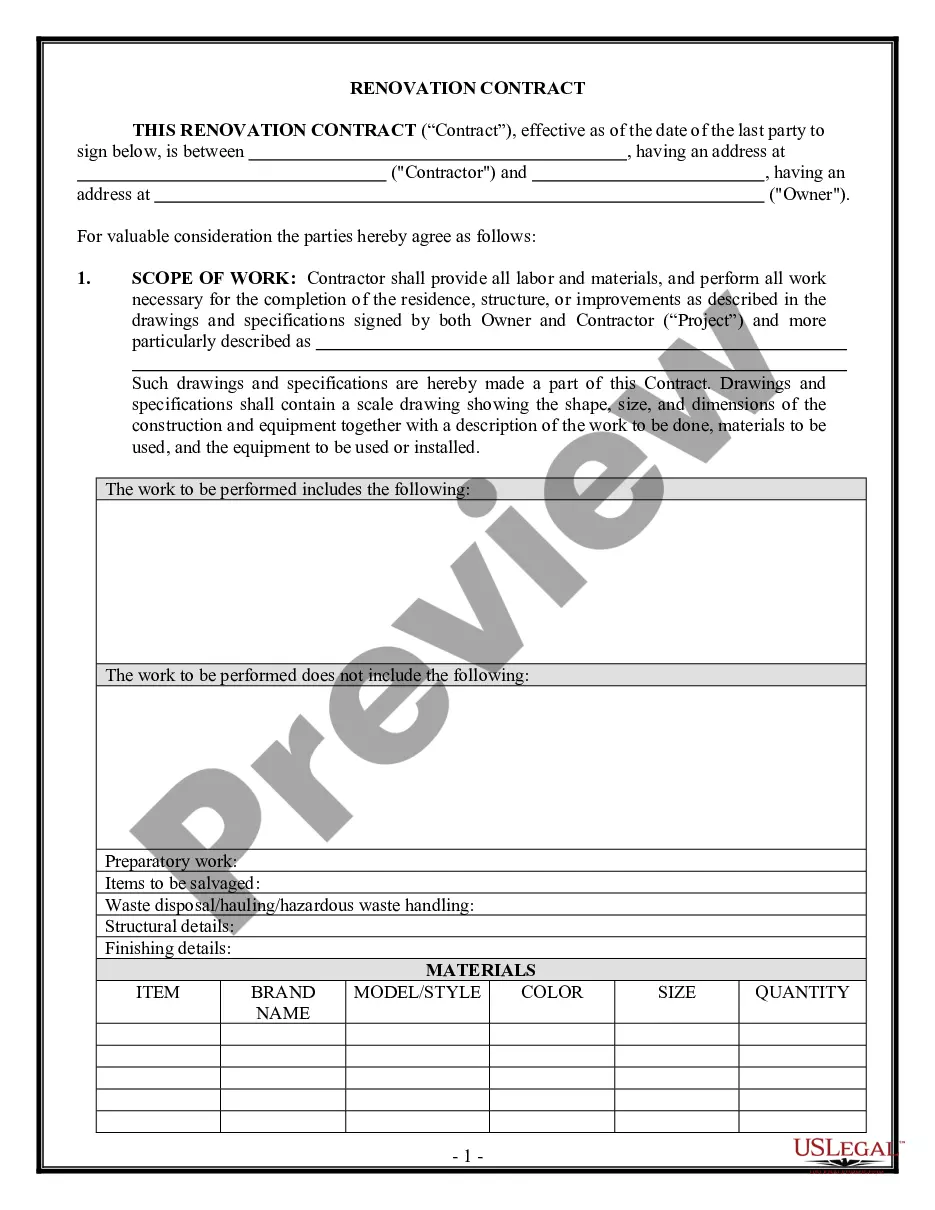

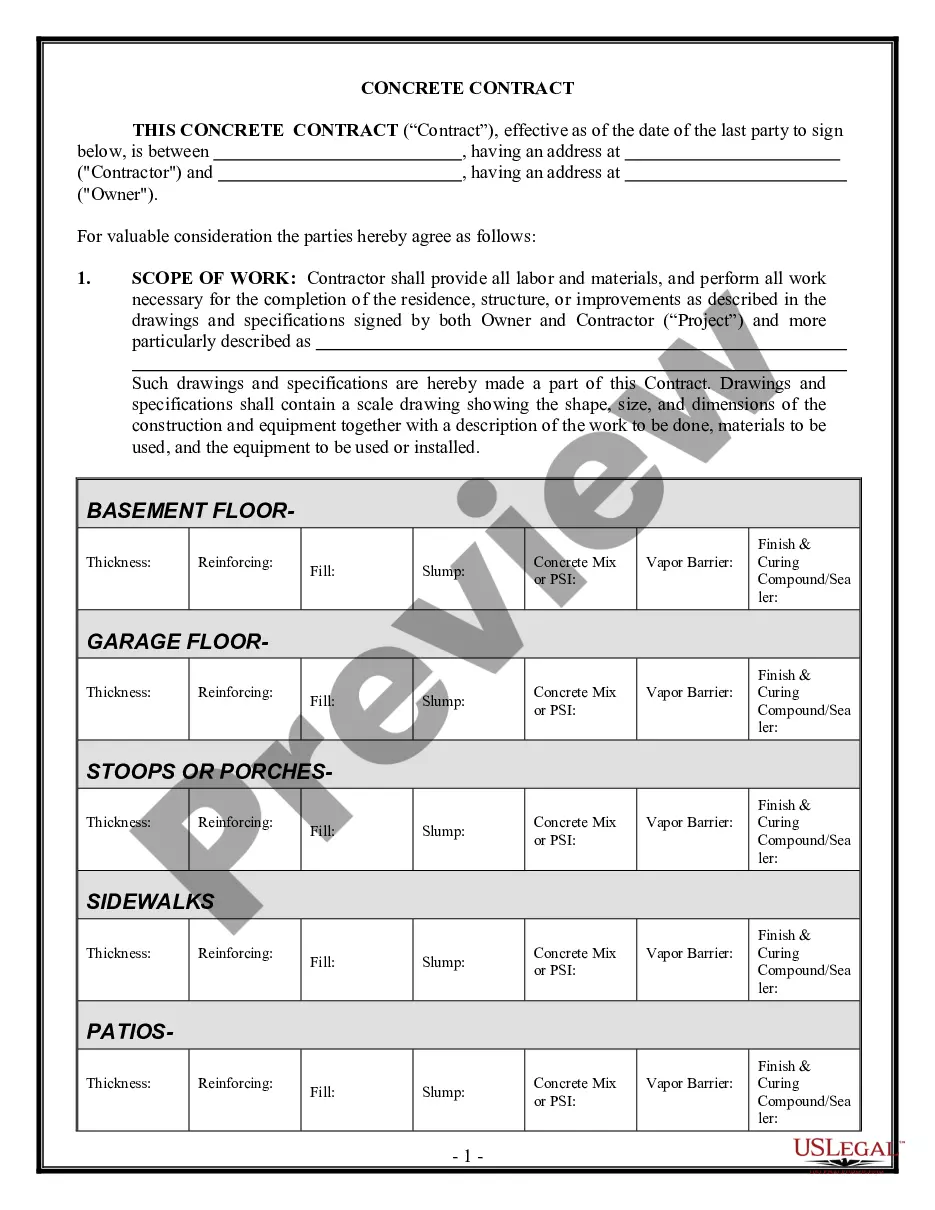

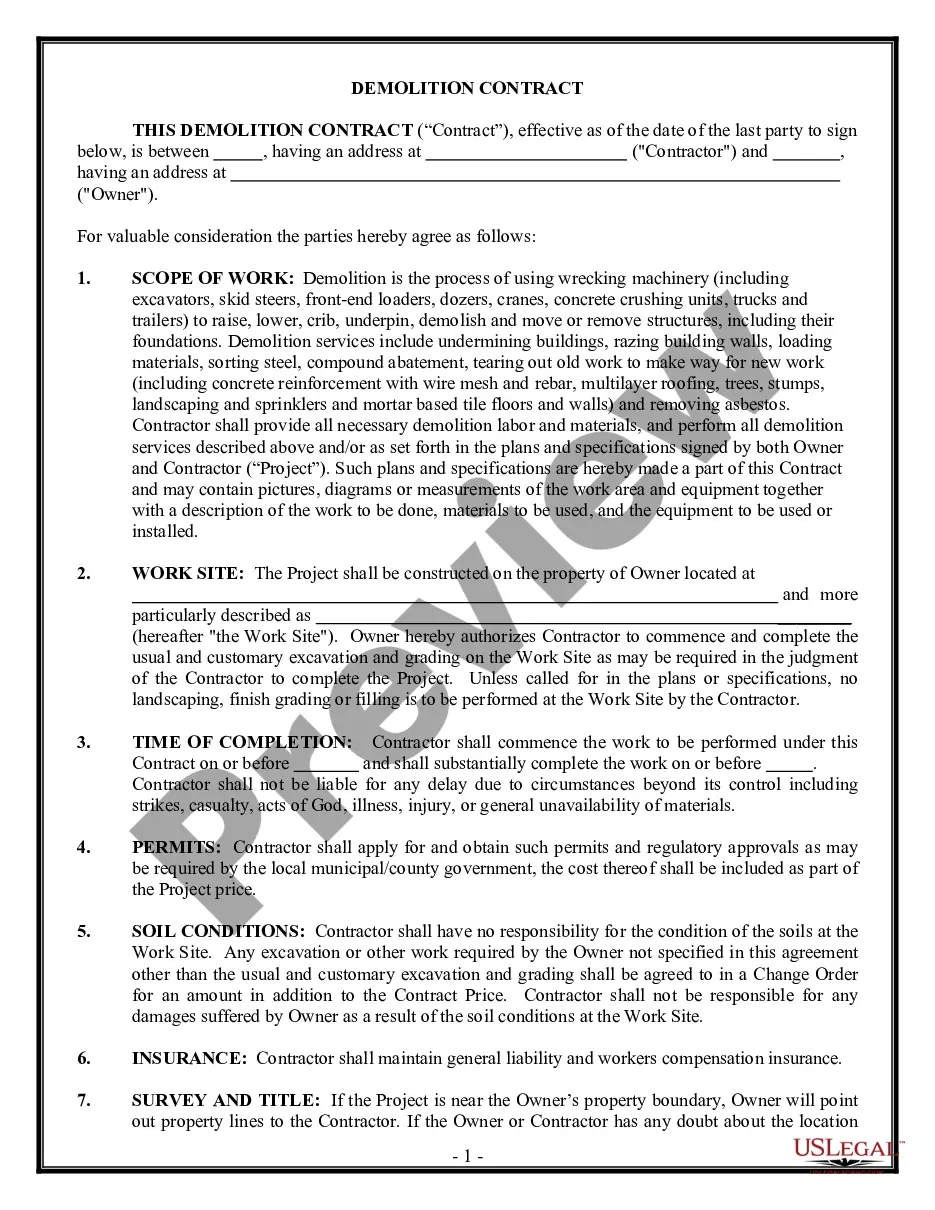

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including San Diego Clause Dealing with Fire Damage, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information materials and guides on the website to make any activities associated with document execution straightforward.

Here's how you can find and download San Diego Clause Dealing with Fire Damage.

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the related forms or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy San Diego Clause Dealing with Fire Damage.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate San Diego Clause Dealing with Fire Damage, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer entirely. If you need to deal with an extremely challenging situation, we recommend getting a lawyer to examine your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and get your state-compliant paperwork with ease!