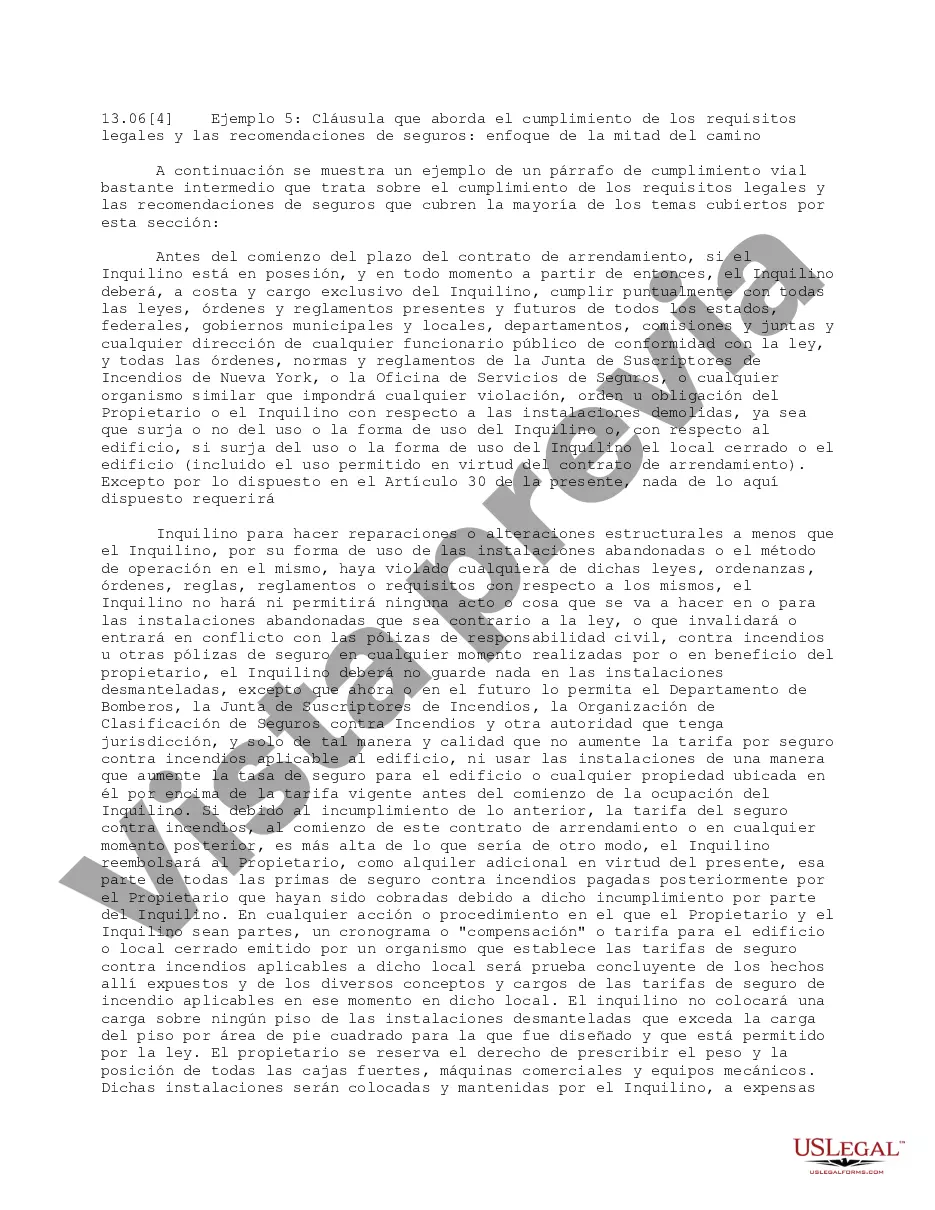

Suffolk New York is a county located on Long Island in the state of New York. It is one of the four counties that make up Long Island and is known for its rich history, diverse cultural attractions, and beautiful coastal landscapes. Clause Addressing Compliance with Legal Requirements in Suffolk New York: In order to operate within Suffolk New York, businesses and individuals must comply with various legal requirements. These legal requirements may include obtaining the necessary permits and licenses, adhering to building codes, zoning regulations, and environmental laws, and ensuring compliance with health and safety regulations. A Suffolk New York Clause Addressing Compliance with Legal Requirements is a contractual provision that explicitly outlines the responsibilities and obligations of the parties involved to meet these legal requirements. Ensuring compliance with these legal requirements not only keeps businesses and individuals in line with the law but also helps to maintain public safety, protect the environment, and foster a conducive business climate within Suffolk County. Insurance Recommendations in Suffolk New York: Insurance plays a crucial role in safeguarding businesses, individuals, and properties in Suffolk New York. Having the right insurance coverage can provide financial protection against unexpected events such as property damage, liability claims, or accidents. Different types of insurance may be necessary depending on the specific industry, type of property, or individual circumstances. Some recommended insurance coverage options in Suffolk New York may include: 1. Property Insurance: This type of insurance provides coverage for damages or losses to physical properties such as buildings, equipment, or inventory. 2. Liability Insurance: Liability insurance protects against claims of bodily injury, property damage, or negligence that may occur on the insured premises. This type of insurance coverage is particularly important for businesses that interact with customers or have employees. 3. Workers' Compensation Insurance: If a business has employees, it is typically required to carry workers' compensation insurance. This coverage provides benefits to employees who suffer work-related injuries or illnesses. 4. Commercial Auto Insurance: Businesses that utilize vehicles for business purposes may require commercial auto insurance to cover potential accidents, property damage, or theft involving their vehicles. 5. Professional Liability Insurance: Professionals, such as doctors, lawyers, architects, or consultants, may need professional liability insurance (also known as errors and omissions insurance) to protect against claims of negligence, mistakes, or professional misconduct. By obtaining the appropriate insurance coverage, businesses and individuals in Suffolk New York can mitigate potential risks and ensure financial security in the face of unforeseen events. It is recommended to consult with insurance professionals or brokers to determine the specific insurance needs based on the nature of the business or individual circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Cláusula sobre Cumplimiento de Requisitos Legales y Recomendaciones de Seguros - Clause Addressing Compliance with Legal Requirements and Insurance Recommendations

Description

How to fill out Suffolk New York Cláusula Sobre Cumplimiento De Requisitos Legales Y Recomendaciones De Seguros?

If you need to get a trustworthy legal document provider to get the Suffolk Clause Addressing Compliance with Legal Requirements and Insurance Recommendations, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support make it easy to find and complete different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply select to search or browse Suffolk Clause Addressing Compliance with Legal Requirements and Insurance Recommendations, either by a keyword or by the state/county the form is intended for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Suffolk Clause Addressing Compliance with Legal Requirements and Insurance Recommendations template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less pricey and more affordable. Create your first company, organize your advance care planning, create a real estate agreement, or complete the Suffolk Clause Addressing Compliance with Legal Requirements and Insurance Recommendations - all from the comfort of your home.

Sign up for US Legal Forms now!