The Dallas Texas Tax Increase Clause is a provision that allows for a potential increase in property taxes for residents of Dallas, Texas. This clause is an important aspect of property ownership and taxation within the city, and understanding the various types of tax increase clauses can help homeowners navigate and plan for potential changes in their tax obligations. The main purpose of the Dallas Texas Tax Increase Clause is to outline the conditions under which property taxes may increase, ensuring transparency and fairness in the taxation system. It specifies the circumstances and procedures that trigger a tax increase, providing homeowners with a clear understanding of their tax liabilities and potential changes in the future. There are different types of tax increase clauses that homeowners in Dallas, Texas should be aware of: 1. General Tax Increase Clause: This type of tax increase clause allows for an increase in property taxes based on certain factors such as changes in property value or changes in the city's tax rate. Property owners should review the details of their tax increase clause to understand the specific conditions that may lead to a fluctuation in their property tax rates. 2. Maintenance and Improvement Tax Increase Clause: This clause allows for tax increases when there is a need for maintenance or improvement of public infrastructure within the city, such as repairing roads or upgrading public facilities. Property owners may see their tax rates increase temporarily to fund these necessary projects. 3. Bond Tax Increase Clause: A bond tax increase clause enables tax changes related to paying off bonds issued by the city for specific purposes, such as financing new schools, parks, or other public projects. Property owners may experience a temporary increase in taxes to cover the payments associated with these bonds. It is important for homeowners in Dallas, Texas, to review their property tax statements and consult with local tax authorities or legal professionals to fully understand the implications of the tax increase clause in their specific circumstances. By staying informed and aware of the different types of tax increase clauses, property owners can effectively plan and manage their financial obligations to the city of Dallas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Cláusula de aumento de impuestos - Tax Increase Clause

Description

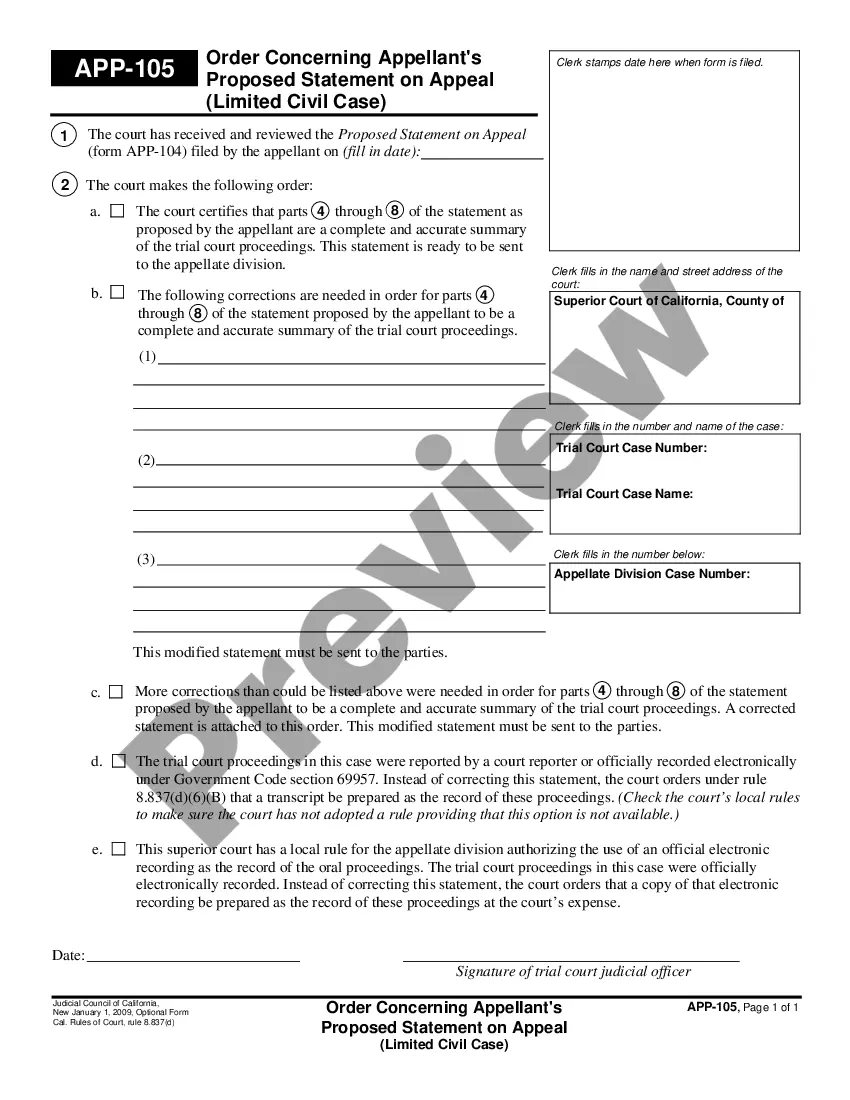

How to fill out Dallas Texas Cláusula De Aumento De Impuestos?

If you need to find a reliable legal paperwork supplier to get the Dallas Tax Increase Clause, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it simple to locate and execute various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to search or browse Dallas Tax Increase Clause, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Dallas Tax Increase Clause template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less expensive and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or complete the Dallas Tax Increase Clause - all from the convenience of your sofa.

Sign up for US Legal Forms now!