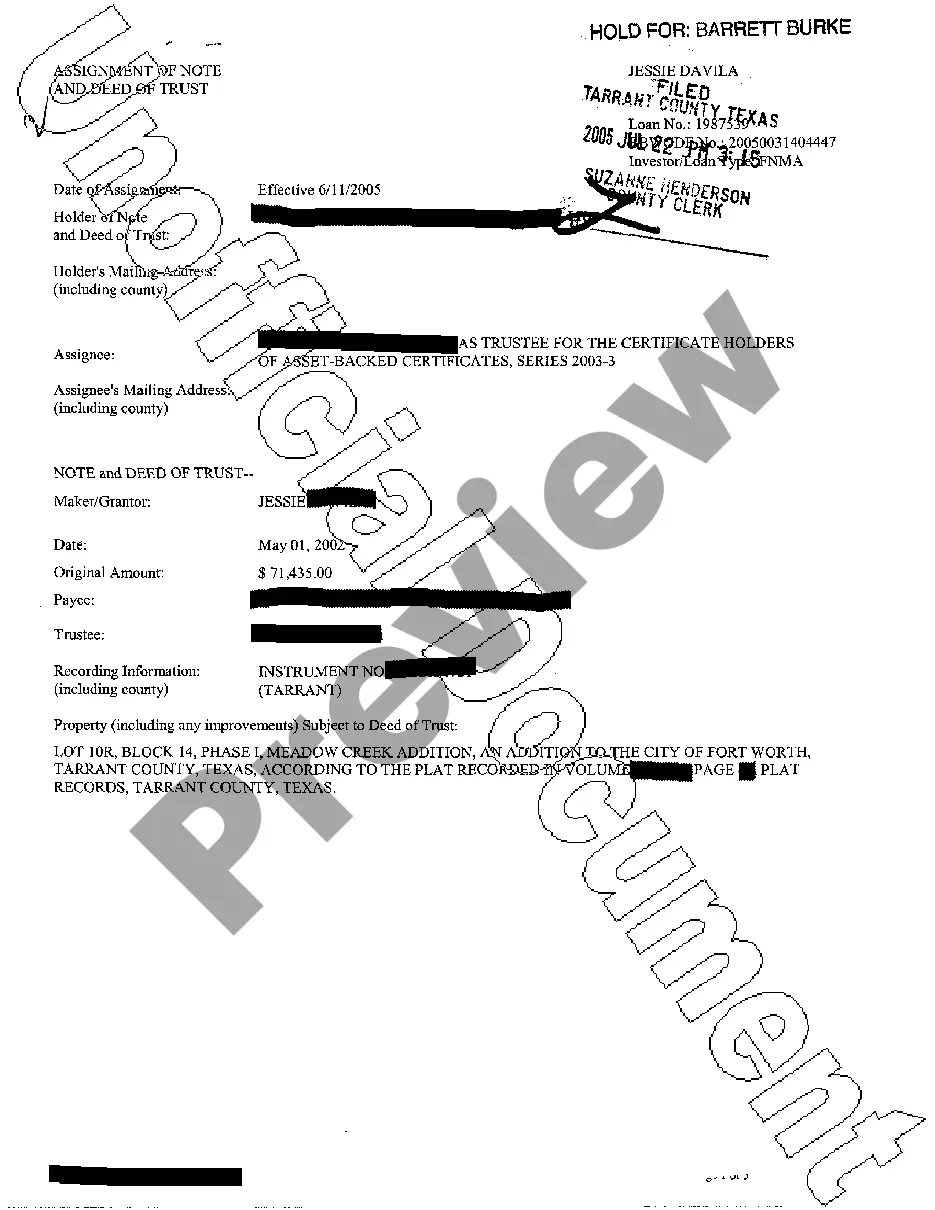

The Harris Texas Tax Increase Clause, also known as the Harris Texas Tax Increase Provision, is a significant component of the local tax legislation in Harris County, Texas. This clause is designed to provide guidelines and regulations for potential tax increases within the county. It plays a crucial role in dictating the county's budget limits, promoting transparency, and ensuring that tax increments are justifiable and thoroughly examined. Under the Harris Texas Tax Increase Clause, any proposal to increase taxes must adhere to specific criteria and go through a rigorous review process. The clause serves as a safeguard to prevent excessive tax hikes and promotes responsible fiscal management within the county. It also helps in maintaining a balance between necessary revenue generation and the financial burden on residents and businesses. The Harris Texas Tax Increase Clause includes several key provisions: 1. Tax Rate Limitation: This provision sets a cap on the maximum tax rate that can be imposed by Harris County. It ensures that tax increases are reasonable and do not disproportionately burden the taxpayers. 2. Voter Approval Requirement: The clause mandates that any proposed tax increase must be approved by the voters in a referendum. This provision empowers the residents to play an active role in deciding the fate of tax increments, making the process more democratic and transparent. 3. Public Disclosure: The Harris Texas Tax Increase Clause enforces transparency by requiring the county authorities to disclose all relevant information regarding proposed tax increases. This includes detailed explanations of the need for the increment, anticipated impacts, and how the additional revenue will be utilized. 4. Exemptions and Limitations: Certain types of taxes, such as those required for essential services like emergency response and education, may be exempted from the scrutiny of the Tax Increase Clause. However, these exemptions are subject to regulation to prevent any misuse. It is important to note that while there may not be different types of the Harris Texas Tax Increase Clause specifically, the provisions of the clause can vary depending on the specific county or region within Harris County. However, the underlying purpose of the clause remains constant: to ensure responsible tax management and protect the interests of the taxpayers. In summary, the Harris Texas Tax Increase Clause is a vital element of the tax legislation in Harris County, Texas. It establishes guidelines and provisions to restrict excessive tax hikes, mandates voter approval, enhances transparency, and promotes responsible fiscal management. By adhering to this clause, Harris County aims to strike a balance between necessary revenue generation and the financial well-being of its residents and businesses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Cláusula de aumento de impuestos - Tax Increase Clause

Description

How to fill out Harris Texas Cláusula De Aumento De Impuestos?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Harris Tax Increase Clause.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Harris Tax Increase Clause will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to get the Harris Tax Increase Clause:

- Ensure you have opened the proper page with your localised form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Harris Tax Increase Clause on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!