The Maricopa Arizona Tax Increase Clause, also known as the Maricopa Tax Increase Authorization Clause, is a provision that allows for the potential increase of taxes in the Maricopa County region of Arizona. This clause grants the county government the authority to impose and potentially raise taxes in order to fund various public projects and services, including infrastructure development, education, healthcare, and public safety. The Maricopa Tax Increase Clause is a crucial tool for local government in generating revenue to support the growth and development of the county. It provides the necessary legal framework to assess and collect taxes from residents and businesses within the region, ensuring the availability of funds to meet the various needs of the community. There are different types of Maricopa Arizona Tax Increase Clauses, including: 1. County Sales Tax Increase Clause: This clause enables the county government to increase the sales tax rate on goods and services offered within Maricopa County. The generated revenue from sales tax can be utilized to finance essential public services and projects. 2. Property Tax Increase Clause: With this clause, the county can raise property tax rates for residential, commercial, and industrial properties located within Maricopa County. The additional funds collected through property taxes can be allocated to education, public transportation, healthcare services, and other vital initiatives. 3. Income Tax Increase Clause: Although Arizona does not currently impose a state income tax, Maricopa County has the authority to impose an income tax on its residents and businesses. The income tax increase clause allows the county to raise taxes on individuals and corporations based on their income levels, which can be utilized to fund various county projects and services. 4. Special District Tax Increase Clause: This clause allows for the creation and implementation of special district taxes within Maricopa County. Special districts can be established to fund specific public projects or services, such as parks and recreation, libraries, or water management systems. The tax increase clause provides the legal basis to impose and potentially raise taxes within these special districts. In conclusion, the Maricopa Arizona Tax Increase Clause is an essential component of local governance that enables the county government to impose and raise taxes for the purpose of funding various public projects and services. It encompasses various types of tax increase provisions, including sales tax, property tax, income tax, and special district taxes, each serving a unique function in generating revenue and supporting the community's needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Cláusula de aumento de impuestos - Tax Increase Clause

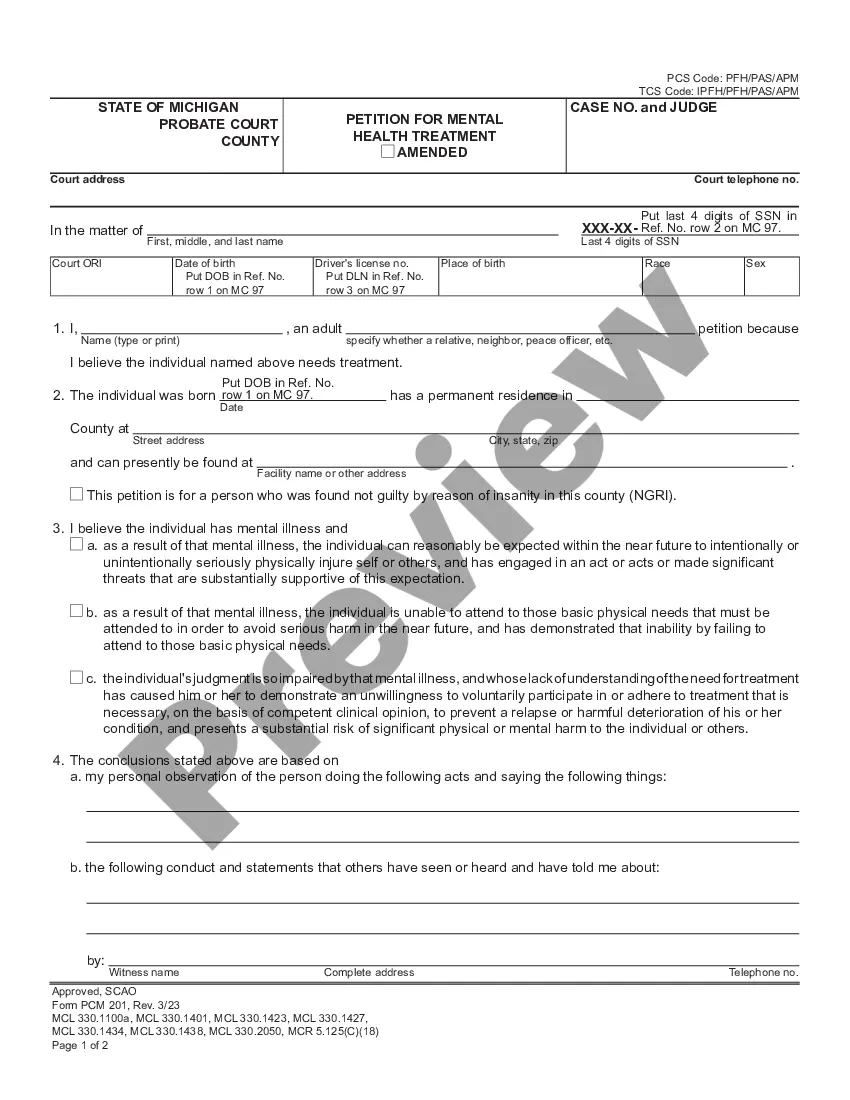

Description

How to fill out Maricopa Arizona Cláusula De Aumento De Impuestos?

Draftwing documents, like Maricopa Tax Increase Clause, to manage your legal matters is a difficult and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for various scenarios and life situations. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Maricopa Tax Increase Clause template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Maricopa Tax Increase Clause:

- Ensure that your form is compliant with your state/county since the rules for writing legal documents may differ from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Maricopa Tax Increase Clause isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our website and download the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!