The Orange California Tax Increase Clause, also referred to as the Orange CA Tax Increase Clause, is a legal provision that allows the government to impose an increase in taxes on properties located within the jurisdiction of Orange, California. This clause serves as a mechanism for local authorities to generate additional revenue to fund public services, infrastructure development, and maintenance. The Tax Increase Clause in Orange California can take several forms, including: 1. Property Tax Increase Clause: This type of tax increase clause allows the local government to raise property taxes for residential, commercial, and industrial properties within Orange, California. The tax increase is typically calculated based on the assessed value of the property and can be implemented annually or periodically. 2. Sales Tax Increase Clause: The government may enact a sales tax increase clause to raise the sales tax rate on goods and services purchased within Orange, California. This clause affects both local residents and visitors, as they are required to pay a higher percentage of tax on their purchases. 3. Transient Occupancy Tax Increase Clause: Commonly known as a hotel tax, this clause enables the city to raise the tax rate imposed on hotel rooms and short-term rentals within Orange, California. The increased tax revenue is often utilized to promote tourism, improve accommodations, and support local tourist attractions. 4. Municipal Services Tax Increase Clause: Under this clause, the government can raise taxes on specific municipal services, such as water, sewage, trash collection, and other utilities provided by the city. The increased tax revenue is primarily directed towards maintaining and improving the quality of these services. It's important to note that the actual implementation and specific terms of the Tax Increase Clause can vary depending on local ordinances, state laws, and the needs of the Orange, California community. This provision typically requires careful consideration and approval by the local governing body, such as the city council or board of supervisors, ensuring transparency and accountability in tax-related matters. Overall, the Orange California Tax Increase Clause is a vital tool for the local government to generate additional revenue needed to sustain and enhance public services, infrastructure, and overall community development.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Cláusula de aumento de impuestos - Tax Increase Clause

Description

How to fill out Orange California Cláusula De Aumento De Impuestos?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Orange Tax Increase Clause, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you pick a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Orange Tax Increase Clause from the My Forms tab.

For new users, it's necessary to make some more steps to get the Orange Tax Increase Clause:

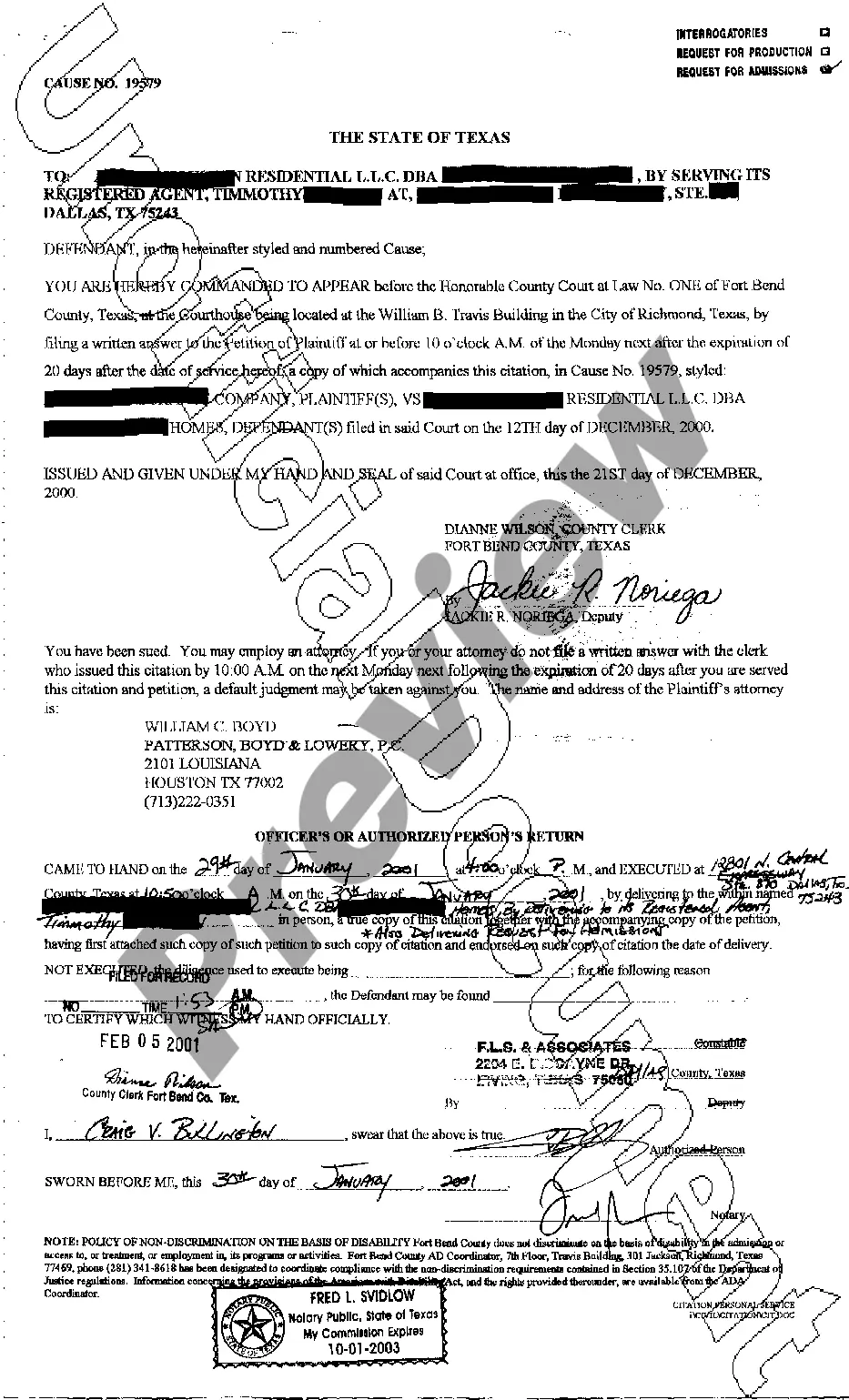

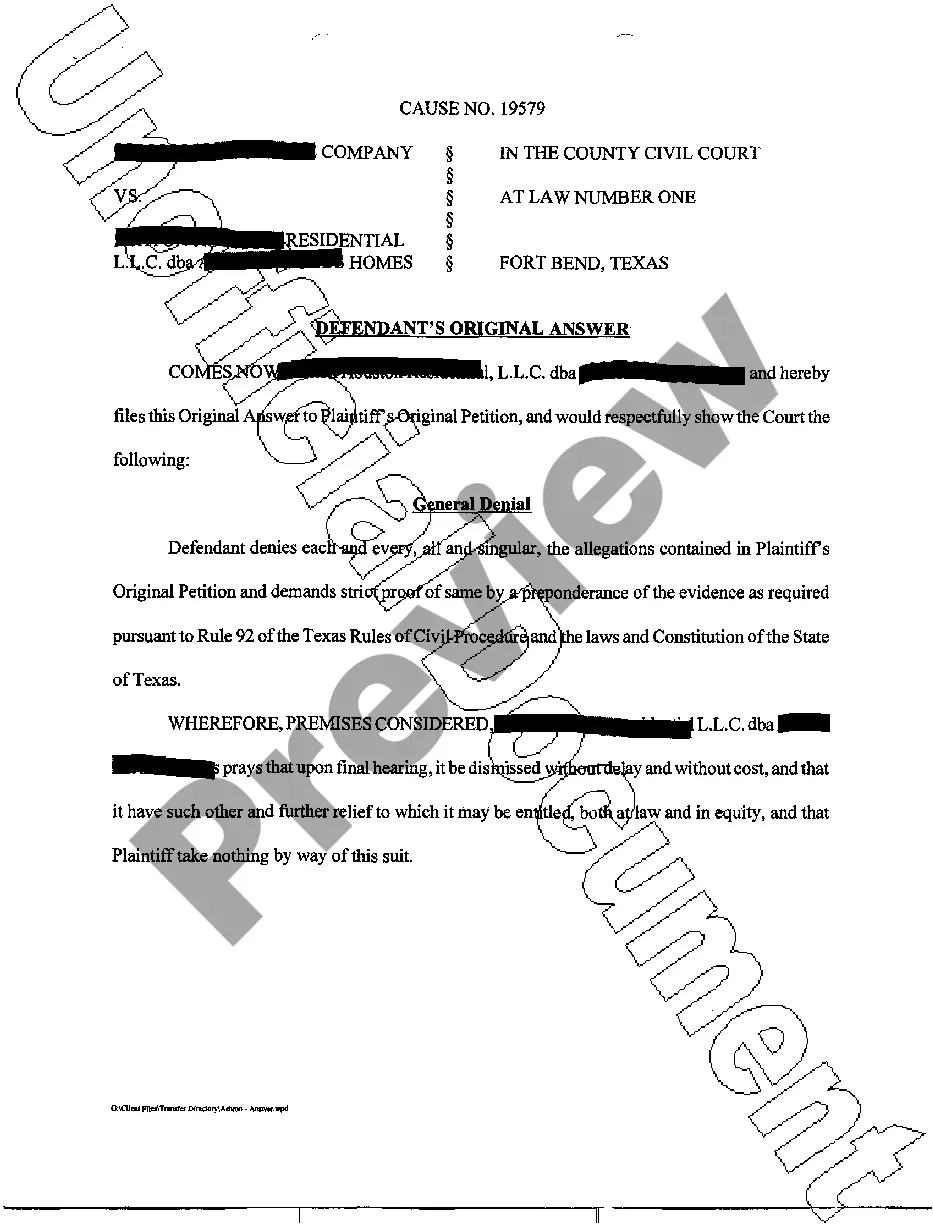

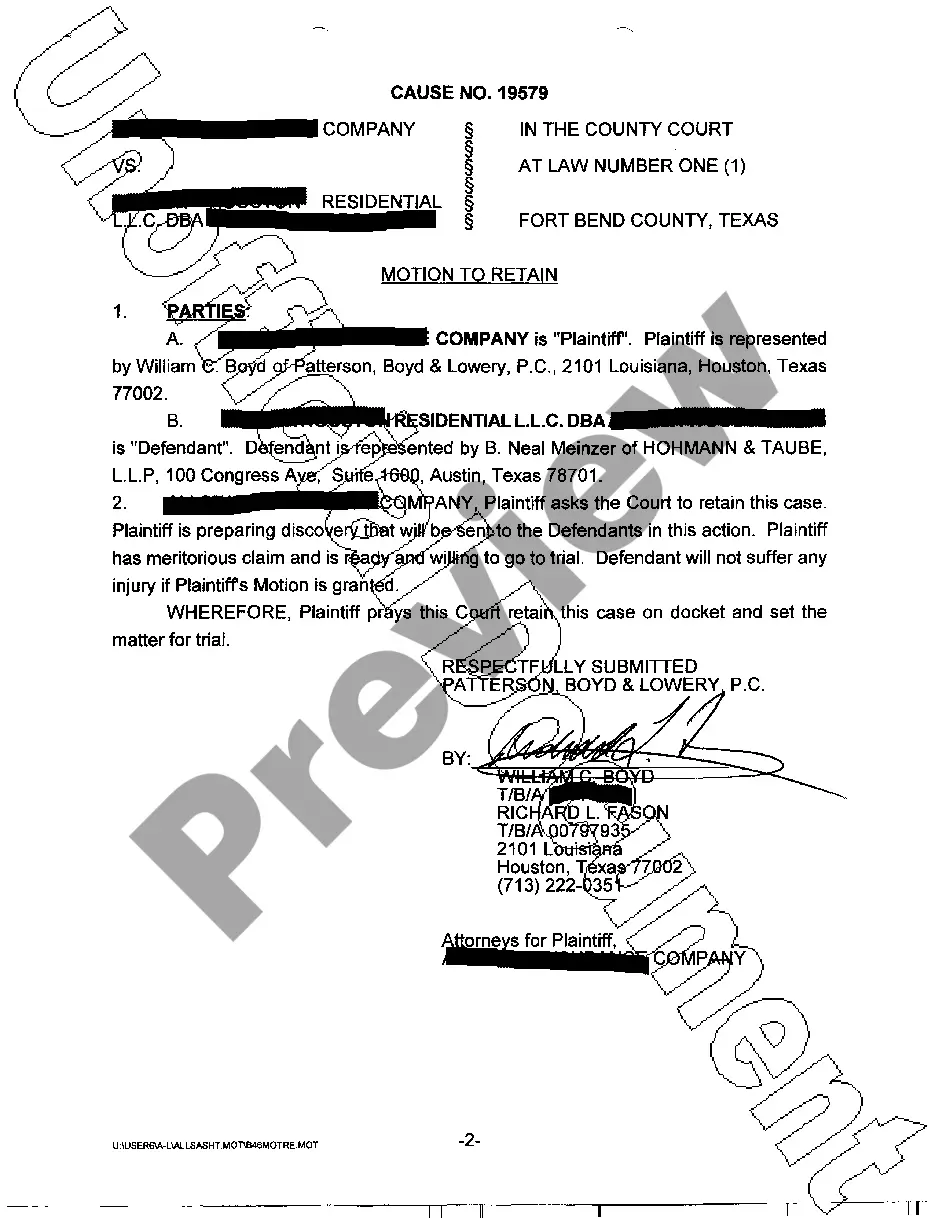

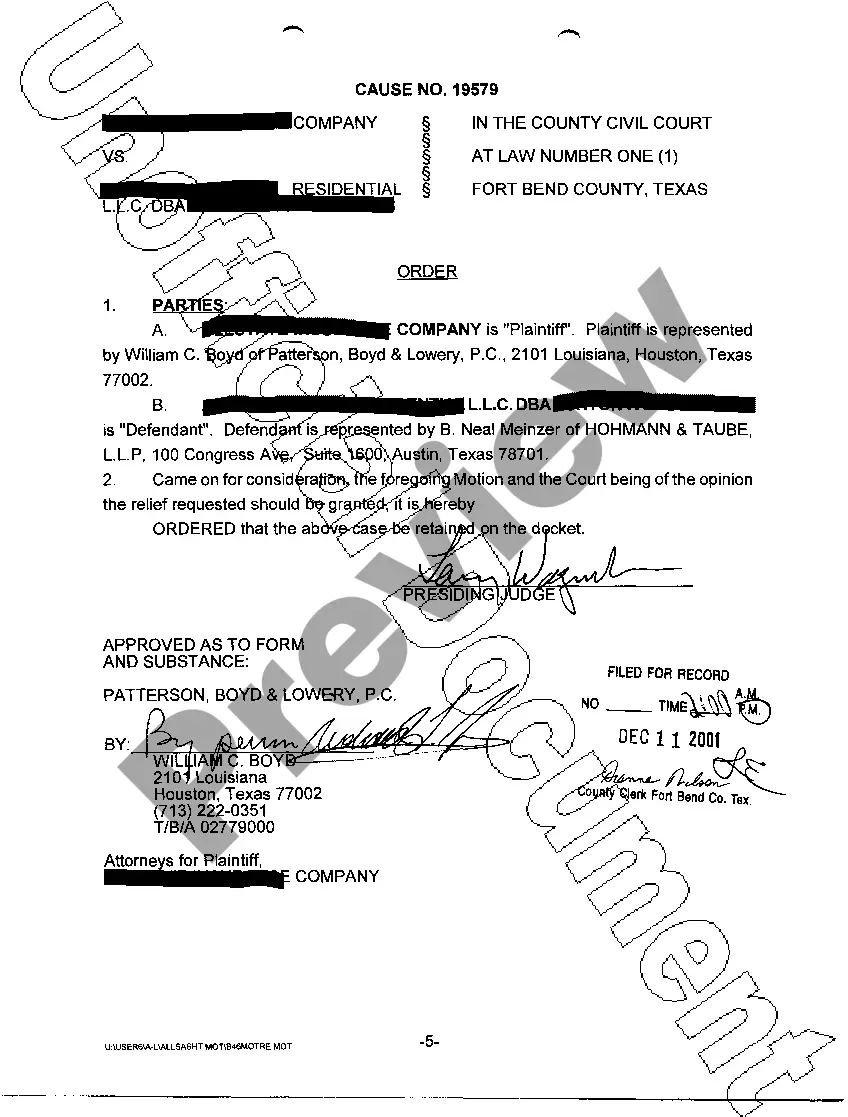

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!