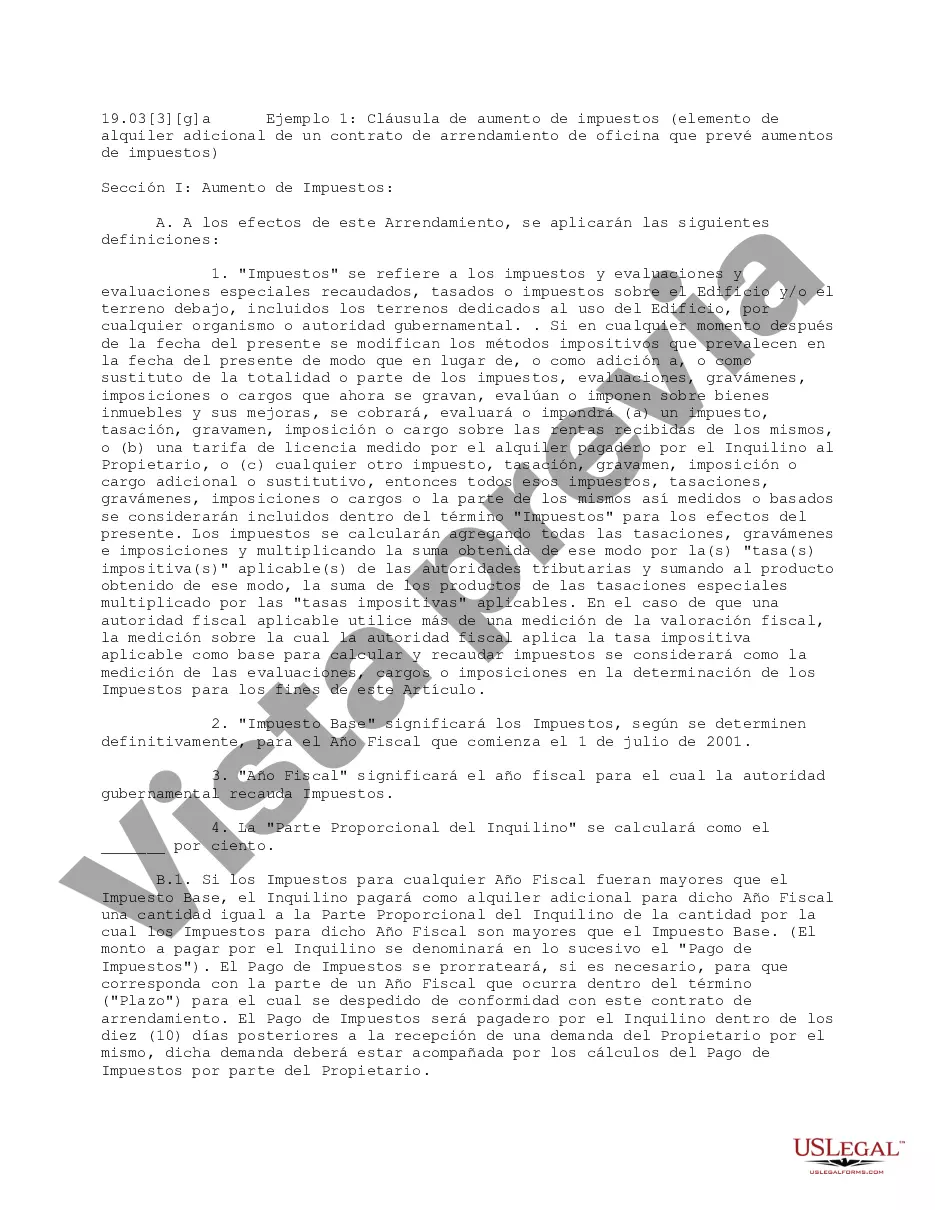

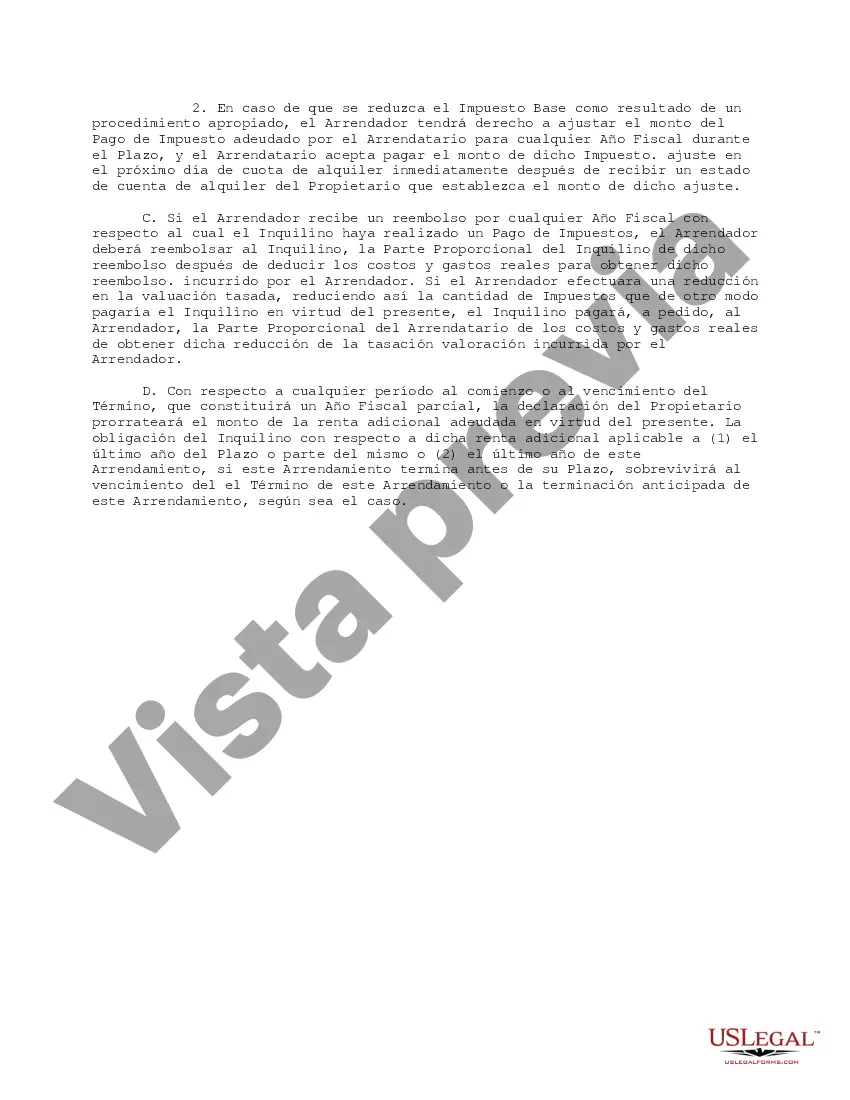

The Suffolk New York Tax Increase Clause is a legal provision specific to the county of Suffolk in the state of New York that allows for potential increases in property taxes. This clause is primarily applicable to residential and commercial real estate properties within the jurisdiction of Suffolk County. Under this clause, the county reserves the right to enact tax increases if deemed necessary to fund essential government services, infrastructure projects, education, public safety, and various community initiatives. The tax increase imposed through this clause is typically based on the assessed value of the property and aims to distribute the tax burden fairly among property owners in the county. There are different types of Suffolk New York Tax Increase Clauses that property owners should be aware of: 1. General Tax Increase Clause: This type of clause enables the county to raise property taxes across the board for all properties within Suffolk County. The increased revenue generated is utilized for funding county-wide projects and services. 2. Special Districts Tax Increase Clause: Suffolk County consists of various special districts, such as water districts, sewer districts, fire districts, and school districts. Each of these districts may have its own dedicated tax increase clauses, allowing them to raise taxes for specific purposes within their jurisdiction. 3. School Tax Increase Clause: Suffolk County encompasses multiple school districts, each with its unique tax increase provision. School districts may increase property taxes to support educational programs, facility improvements, or to meet budgetary requirements. 4. Bonded Debt Tax Increase Clause: Suffolk County may leverage bond issuance to fund important infrastructure projects or capital improvements. The associated tax increase clause enables the county to collect additional revenue from property owners to repay the bond debt. It is important for property owners in Suffolk County to carefully review their tax assessment notices and other official communication from the county assessor's office or tax authorities to understand any potential tax increase imposed under the relevant Suffolk New York Tax Increase Clause. Staying informed about these clauses can help property owners better prepare their finances and plan for any potential tax liability adjustments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Cláusula de aumento de impuestos - Tax Increase Clause

Description

How to fill out Suffolk New York Cláusula De Aumento De Impuestos?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business objective utilized in your region, including the Suffolk Tax Increase Clause.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Suffolk Tax Increase Clause will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to obtain the Suffolk Tax Increase Clause:

- Make sure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Suffolk Tax Increase Clause on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!