The Tarrant Texas Tax Increase Clause refers to a provision that allows for the potential increase of property taxes in Tarrant County, Texas, under certain circumstances. This clause is an essential component of local tax policies and serves as a means to finance public services and maintain the community's infrastructure. The purpose of the Tarrant Texas Tax Increase Clause is to provide local authorities with the flexibility to adjust property tax rates as necessary to meet the changing needs of the county. It enables the local government to respond to economic fluctuations, inflation, population growth, and increased demand for public services such as schools, roads, parks, and public safety. There are different types of Tarrant Texas Tax Increase Clauses, each with its specific conditions and limitations. Some common types include: 1. Economic Growth Trigger: This type of clause allows property taxes to increase when the county's economy experiences significant growth, such as increased business investment, rising property values, or job creation. It ensures that the local government can adequately fund public services required to support the economic expansion. 2. Inflation Adjustment: This clause permits property tax rates to be adjusted annually in line with the inflation rate, ensuring that the tax revenue keeps up with the increasing cost of providing essential services. It helps prevent a loss in tax revenue due to inflation and maintains the financial stability of the county. 3. Voter-Approved Increase: In certain cases, the Tarrant Texas Tax Increase Clause may require property tax increases to be approved by the county's voters. This ensures that the decision to raise taxes is made democratically and with the involvement of the community. Voter approval may be required for substantial tax increases or for long-term financing of specific projects or public initiatives. It is important to note that the Tarrant Texas Tax Increase Clause is subject to state laws and regulations governing property taxation. These laws aim to strike a balance between the funding needs of local governments and protecting taxpayers from excessive tax burdens. Overall, the Tarrant Texas Tax Increase Clause plays a crucial role in allowing the local government to adapt to changing circumstances and ensure the provision of essential public services. It helps maintain a vibrant and thriving community in Tarrant County, benefiting both residents and businesses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Cláusula de aumento de impuestos - Tax Increase Clause

Description

How to fill out Tarrant Texas Cláusula De Aumento De Impuestos?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Tarrant Tax Increase Clause, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Tarrant Tax Increase Clause from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Tarrant Tax Increase Clause:

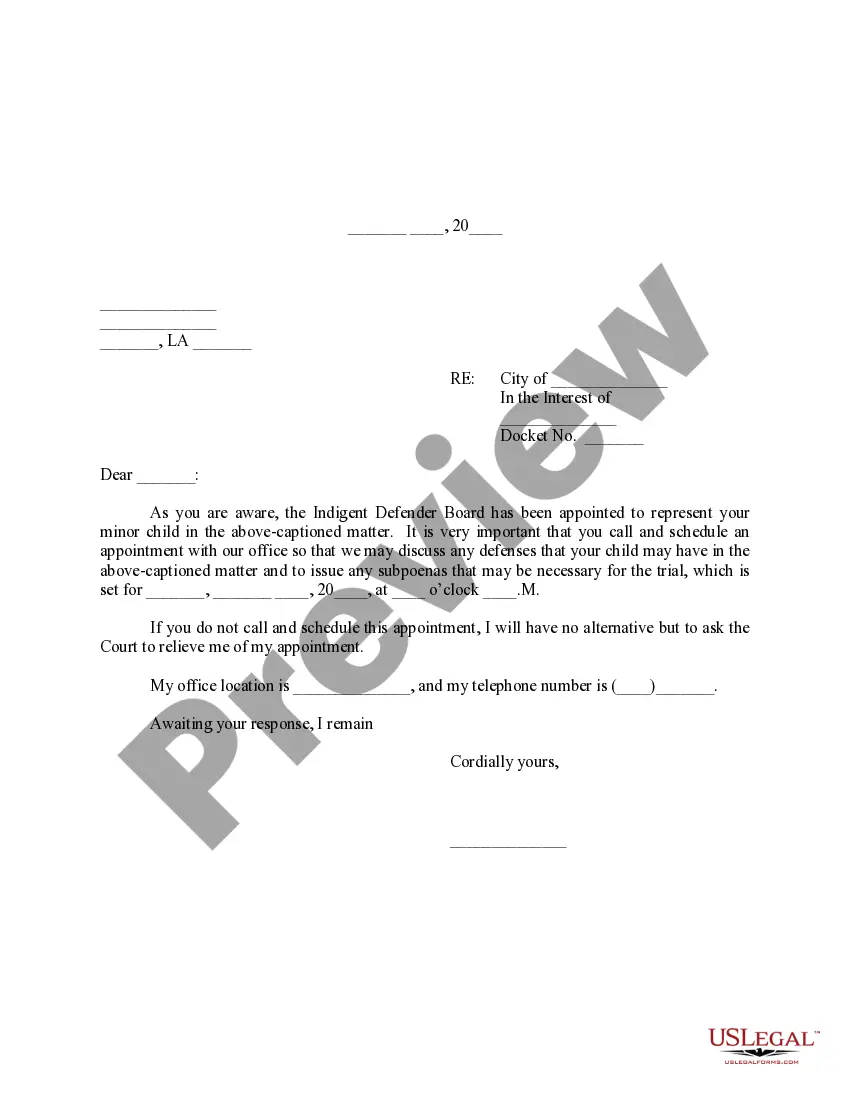

- Take a look at the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!