The Wayne Michigan Tax Increase Clause is a provision in property tax assessments that allows for the imposition of tax rate increases in certain circumstances. It is important to understand this clause in order to fully grasp the potential impact on property owners in the Wayne Michigan area. The Tax Increase Clause in Wayne Michigan is designed to provide flexibility in the assessment of property taxes. It enables the local government to adjust tax rates to meet the funding needs for various public services and infrastructure improvements. This clause allows the authorities to raise property tax rates beyond the statutory limits set by the state legislature, ensuring that the financial requirements of the community are adequately met. The Wayne Michigan Tax Increase Clause is typically activated when there is a pressing need for additional revenue to support public services, such as schools, roads, or emergency services. In many cases, these increases are implemented to address budget shortfalls or to fund specific projects that benefit the community at large. The tax revenue generated through the clause is essential for maintaining and improving the quality of life in Wayne Michigan. There are different types of Wayne Michigan Tax Increase Clauses, each with its own set of conditions and limitations. Some clauses may specify a maximum percentage by which tax rates can be increased, while others may have a specified time limit for the increased rates. Additionally, certain clauses may require public hearings or the approval of local governing bodies before tax rate increases can be imposed. One type of Tax Increase Clause commonly found in Wayne Michigan is the Emergency Services Tax Increase Clause. This provision allows the local government to raise property tax rates temporarily in the event of a crisis or emergency situation. The additional revenue generated through this clause helps fund emergency response services and ensures the community's safety and well-being. Another type is the Infrastructure Improvement Tax Increase Clause. This clause authorizes the local government to increase property tax rates to finance construction projects, repairs, or upgrades to essential infrastructure, such as roads, bridges, and public transportation systems. The revenue generated from this clause directly contributes to the enhancement and development of the local infrastructure, benefiting residents and businesses alike. It is crucial for property owners in Wayne Michigan to be aware of the Tax Increase Clause and its potential implications. When considering property investments, it is important to account for possible tax rate increases and their associated financial burdens. Staying informed about local government policies and participating in public hearings or discussions regarding tax increases can help individuals better understand and navigate this important aspect of property ownership in Wayne Michigan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Cláusula de aumento de impuestos - Tax Increase Clause

Description

How to fill out Wayne Michigan Cláusula De Aumento De Impuestos?

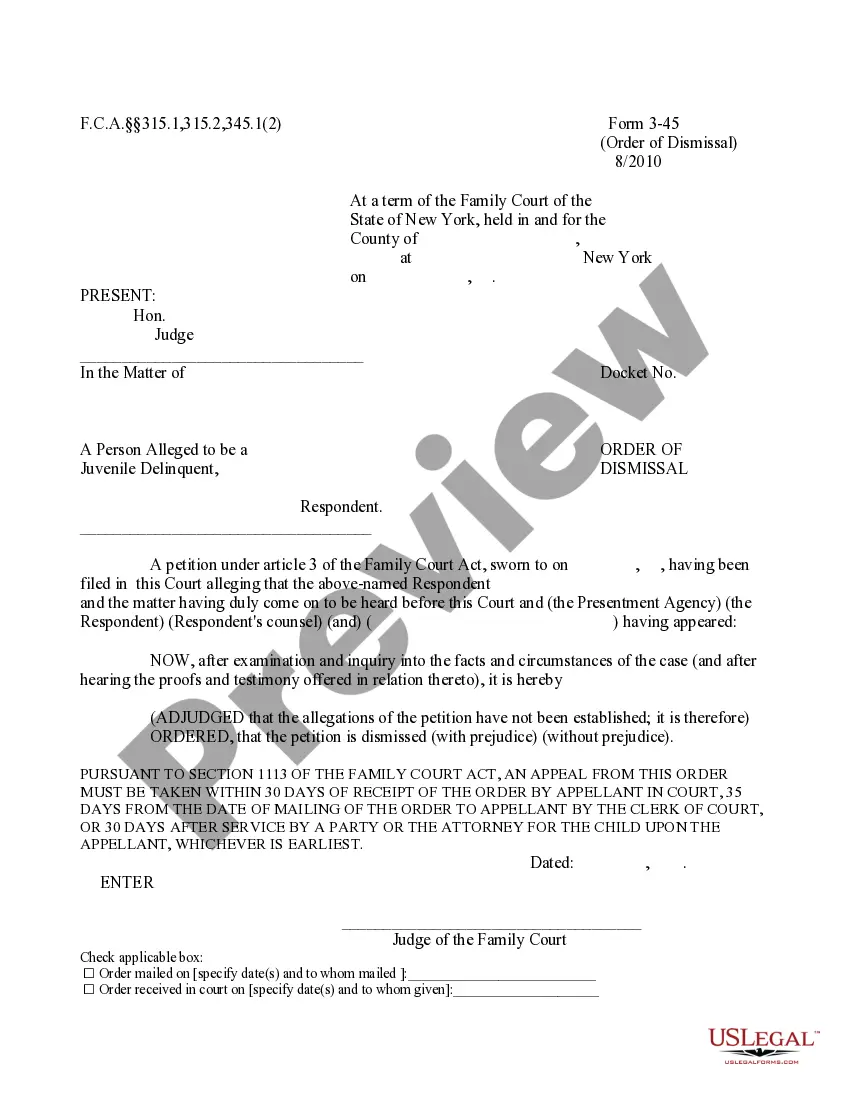

Whether you intend to open your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Wayne Tax Increase Clause is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Wayne Tax Increase Clause. Follow the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the sample when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Wayne Tax Increase Clause in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!