Dallas Texas Detailed Tax Increase Clause is a crucial aspect of the tax regulation framework that governs the city of Dallas in the state of Texas. The clause is designed to outline specific provisions and guidelines regarding tax increases in Dallas and ensure transparency and fairness in the tax system. The Dallas Texas Detailed Tax Increase Clause is a legislative measure that establishes the conditions and procedures under which tax rates can be increased. It sets forth a comprehensive framework that requires any proposed tax increase to be thoroughly evaluated, debated, and approved by the appropriate authorities. The aim is to strike a balance between meeting the evolving needs of the city and its residents while minimizing the burden on taxpayers. There are several types of Dallas Texas Detailed Tax Increase Clauses that apply to different aspects of taxation within the city. These include: 1. Property Tax Increase Clause: This clause entails rules and regulations specific to property taxes in Dallas. It outlines the conditions under which property tax rates can be increased, the factors that are taken into consideration, and the mechanisms by which property owners are notified about any potential changes. 2. Sales Tax Increase Clause: Dallas also has a dedicated clause that addresses the possibility of increasing sales tax rates. This clause lays out the legal procedures that must be followed to propose and approve any increase in sales tax, highlighting the need for public hearings, community input, and evaluation of the economic impact before implementing any changes. 3. Income Tax Increase Clause: Although Texas does not levy a personal income tax, the Dallas Texas Detailed Tax Increase Clause encompasses provisions for potential income tax increases should the state legislature ever approve such a tax. 4. Corporate Tax Increase Clause: Similar to income tax, this clause addresses the possibility of an increase in corporate tax rates in Dallas. It ensures that any proposed corporate tax increase is subject to thorough scrutiny and consideration of the potential effects on businesses and the overall economy of the city. Regardless of the type, Dallas Texas Detailed Tax Increase Clauses always emphasize transparency and accountability in the decision-making process. They provide opportunities for public engagement and establish clear protocols for proposing, evaluating, and implementing any tax rate adjustments. In conclusion, the Dallas Texas Detailed Tax Increase Clause is a crucial legislative measure that regulates tax increases in the city of Dallas. By providing a comprehensive framework and guidelines, it ensures that any proposed tax rate hikes undergo careful scrutiny and consideration, ultimately promoting fairness and transparency in the taxation system.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Cláusula detallada de aumento de impuestos - Detailed Tax Increase Clause

Description

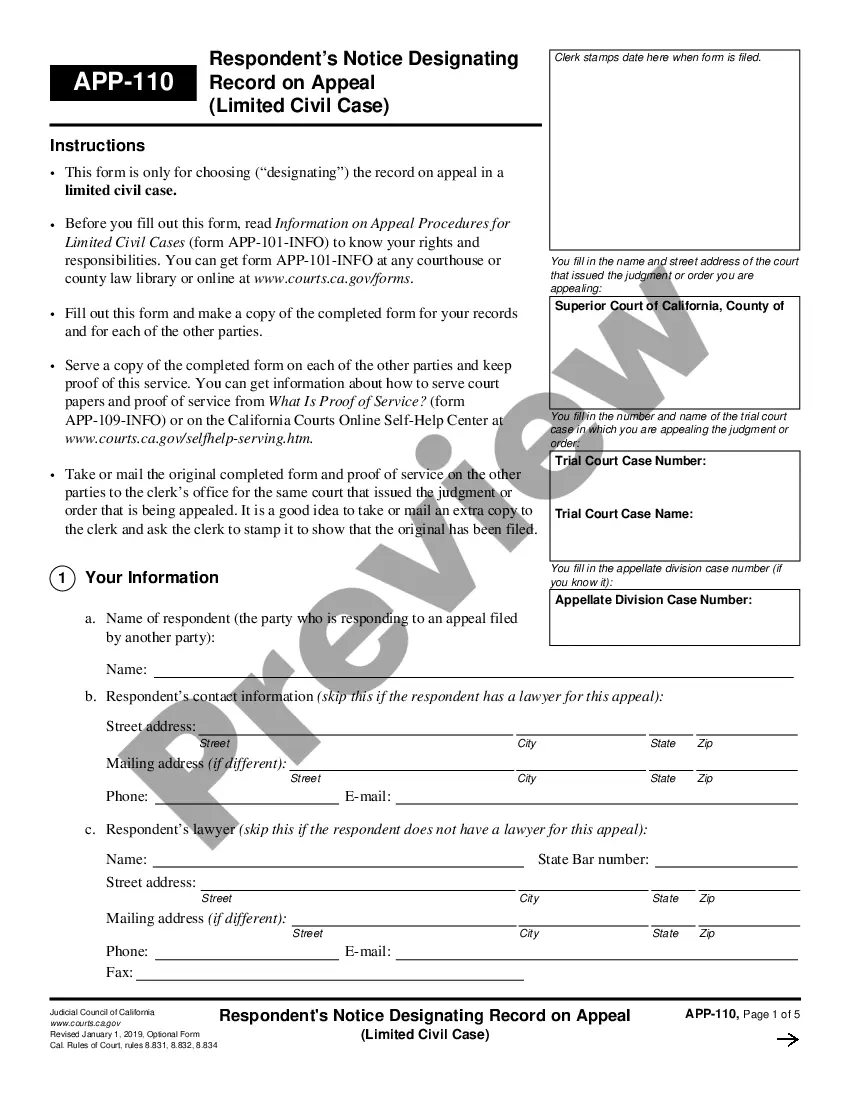

How to fill out Dallas Texas Cláusula Detallada De Aumento De Impuestos?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business objective utilized in your county, including the Dallas Detailed Tax Increase Clause.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Dallas Detailed Tax Increase Clause will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Dallas Detailed Tax Increase Clause:

- Ensure you have opened the right page with your local form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Dallas Detailed Tax Increase Clause on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!