Fairfax Virginia is a bustling city located in the Commonwealth of Virginia, United States. Known for its rich history, vibrant culture, and diverse population, Fairfax is also subject to various tax regulations and policies. One of these is the Fairfax Virginia Detailed Tax Increase Clause, which plays a crucial role in outlining tax increase procedures and guidelines in the region. The Fairfax Virginia Detailed Tax Increase Clause is a legally binding provision embedded within the local tax laws. It serves as a comprehensive guide for governing bodies, taxpayers, and local officials, providing detailed instructions on how tax increases may be implemented and managed across different sectors. Key aspects covered in the Fairfax Virginia Detailed Tax Increase Clause include the methodology for determining tax increases, the prerequisites for implementing such increases, and the overall decision-making process involved. Its purpose is to promote transparency, accountability, and fairness when levying additional taxes within the jurisdiction. There are various types of Fairfax Virginia Detailed Tax Increase Clauses, depending on the specific tax category or purpose. Some common clauses pertain to property taxes, sales taxes, income taxes, and even specialty taxes like hotel occupancy or car rental taxes. Each clause outlines the specific details and conditions under which tax increases can be pursued in the respective domain. For instance, the Fairfax Virginia Detailed Property Tax Increase Clause focuses on the valuation of properties, the frequency of reassessments, and the factors that could trigger a potential increase in property taxes. This clause ensures that property tax adjustments are conducted fairly based on accurate assessments, preventing undue burden on property owners. Similarly, the Fairfax Virginia Detailed Sales Tax Increase Clause outlines the conditions under which sales tax rates may be modified and the process for implementing such changes. This includes considerations like economic conditions, legislative requirements, and public input to ensure that sales tax increases are justified and beneficial for the local economy. In summary, the Fairfax Virginia Detailed Tax Increase Clause provides a comprehensive framework for various types of tax increases within the jurisdiction. It ensures that tax adjustments are transparent, fair, and thoroughly evaluated before implementation, benefiting both the local government and taxpayers. By adhering to the specific guidelines outlined in the clause, Fairfax aims to maintain a balanced tax structure that supports the community's needs while stimulating economic growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Cláusula detallada de aumento de impuestos - Detailed Tax Increase Clause

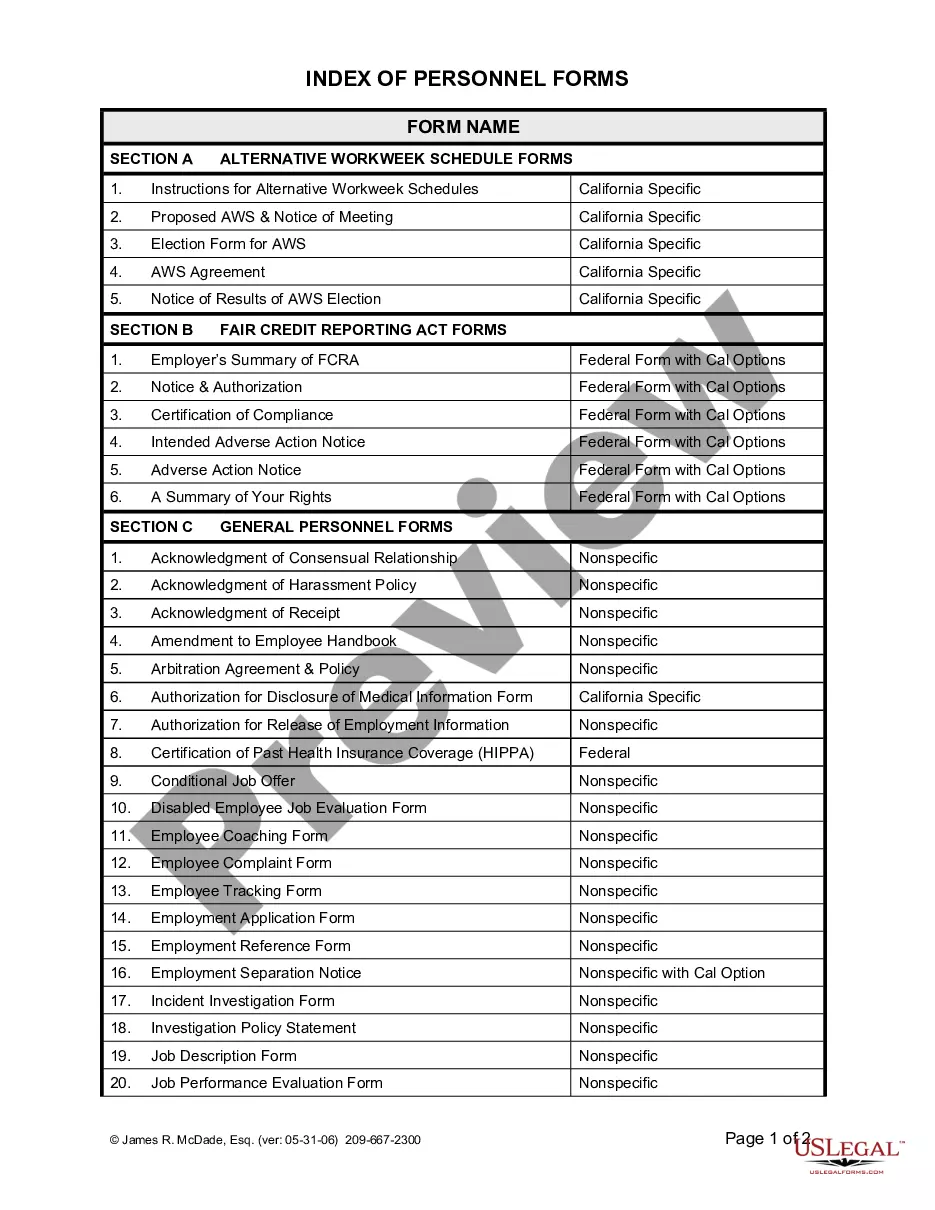

Description

How to fill out Fairfax Virginia Cláusula Detallada De Aumento De Impuestos?

Whether you intend to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Fairfax Detailed Tax Increase Clause is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Fairfax Detailed Tax Increase Clause. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Fairfax Detailed Tax Increase Clause in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!