Salt Lake Utah Detailed Tax Increase Clause: Understanding the Basics and Types In Salt Lake City, Utah, the Detailed Tax Increase Clause is an important component of the local tax regulations. This clause outlines the specific conditions and processes through which the local government can modify or increase taxes imposed on businesses, individuals, and properties within the jurisdiction. Understanding this clause is crucial for taxpayers, local businesses, and real estate owners alike. Let's explore the key aspects of the Salt Lake Utah Detailed Tax Increase Clause and its various types. What is the Salt Lake Utah Detailed Tax Increase Clause? The Detailed Tax Increase Clause acts as a legal provision within the local taxation system, granting the Salt Lake City government the authority to adjust tax rates and impose new taxes when necessary. This clause ensures transparency and accountability, as it establishes the set of procedures that must be followed before any tax changes are implemented. By adhering to this clause, the government aims to strike a balance between meeting the financial needs of the city and protecting the interests of taxpayers. Types of Salt Lake Utah Detailed Tax Increase Clause: 1. General Tax Increase Clause: This type of clause allows Salt Lake City to raise taxes across all sectors and industries uniformly. It applies to both businesses and individuals and may be used to address overall budgetary requirements, economic fluctuations, or unforeseen circumstances. 2. Sector-Specific Tax Increase Clause: Salt Lake City may introduce this type of clause when targeted tax adjustments are required in particular sectors or industries. For example, the local government may implement a sector-specific tax increase to support the development of renewable energy sources or to stimulate growth in the technology sector. 3. Property Tax Increase Clause: This clause provides the Salt Lake City government with the ability to raise property taxes when necessary. The revenue generated from such tax increases is often earmarked for specific purposes, such as funding public infrastructure projects, improving schools, or enhancing community services. Key Considerations and Implications: Taxpayers and property owners in Salt Lake City must be aware of the detailed tax increase clause to anticipate potential changes in their taxation obligations. The clause is typically subject to public hearings and legislative review, providing opportunities for citizen input and advocacy. Understanding the factors that may trigger tax increases, such as changes in economic conditions or city expenditures, allows residents and businesses to plan their financial strategies accordingly. Conclusion: The Salt Lake Utah Detailed Tax Increase Clause is a crucial legal provision that empowers the local government to adjust taxes when required. With its different types, including the general, sector-specific, and property tax increase clauses, the city's tax system aims for equitable and sustainable revenue generation. Awareness of this clause, its implications, and participation in public hearings can help taxpayers navigate tax changes effectively and contribute to the overall growth and development of Salt Lake City.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Cláusula detallada de aumento de impuestos - Detailed Tax Increase Clause

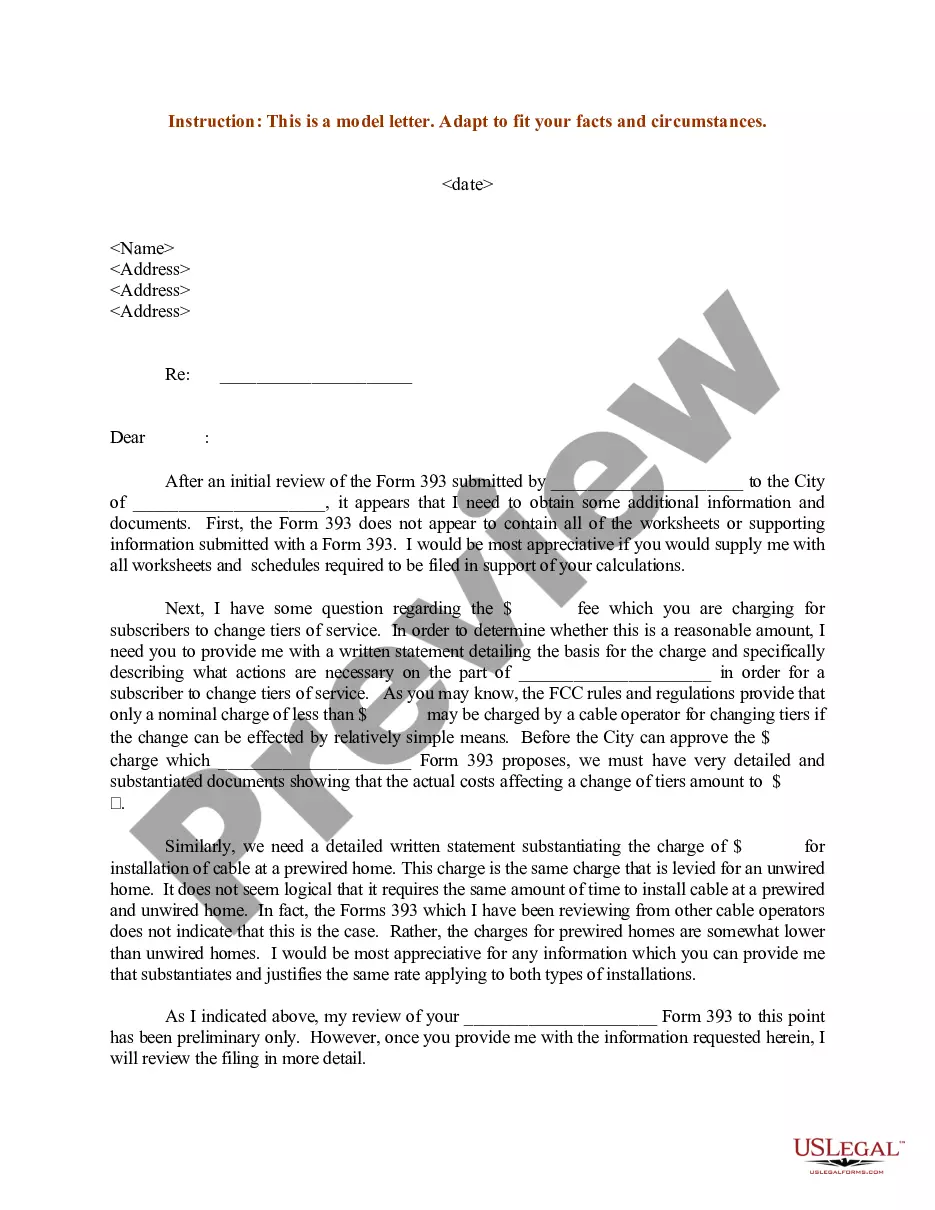

Description

How to fill out Salt Lake Utah Cláusula Detallada De Aumento De Impuestos?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Salt Lake Detailed Tax Increase Clause, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Therefore, if you need the current version of the Salt Lake Detailed Tax Increase Clause, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Detailed Tax Increase Clause:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Salt Lake Detailed Tax Increase Clause and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!