Travis Texas Detailed Tax Increase Clause refers to a specific aspect of tax regulations pertaining to the jurisdiction of Travis County, Texas. This clause outlines the provisions and conditions under which taxes can be increased within the county. The Travis Texas Detailed Tax Increase Clause is crucial for taxpayers and local government officials as it lays down the framework for how tax rates may be modified. Specifically, the Travis Texas Detailed Tax Increase Clause defines the circumstances under which a tax increase can be initiated. These circumstances usually include budgetary constraints, rising costs of public services, infrastructure development projects, or economic fluctuations. Moreover, the clause outlines the transparent procedure that local government entities must follow in order to implement a tax increase. The Travis Texas Detailed Tax Increase Clause ensures transparency and accountability in tax-related matters. It requires public disclosures, public hearings, and ample opportunities for community participation and feedback before any tax increase can be approved. This provision aims to protect the interests of taxpayers and prevent arbitrary tax hikes. There are different types of tax increase clauses within the Travis County jurisdiction. These may include: 1. Residential Property Tax Increase Clause: This clause specifically addresses tax increases for residential properties, focusing on factors like property value assessments, homestead exemptions, and residential tax rates. 2. Commercial Property Tax Increase Clause: This clause deals with tax increases for commercial or business properties. It considers factors such as commercial property assessments, tax rates applicable to businesses, and potential tax incentives for certain industries. 3. Sales Tax Increase Clause: This clause pertains to the potential increase in sales tax rates within Travis County. It involves discussions on the proposed sales tax rate increase, how it aligns with state regulations, and its implications for local businesses and consumers. 4. Income Tax Increase Clause: As Texas does not have a state income tax, this clause does not apply to Travis County. However, it may be relevant in other states or counties where income tax is a significant revenue source. To summarize, the Travis Texas Detailed Tax Increase Clause is a crucial element of tax regulations within Travis County. It sets the guidelines for when and how tax rates can be increased, ensuring transparency, community involvement, and accountability. The various types of tax increase clauses specific to Travis County include residential property tax, commercial property tax, sales tax, and income tax (which is not applicable here).

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Cláusula detallada de aumento de impuestos - Detailed Tax Increase Clause

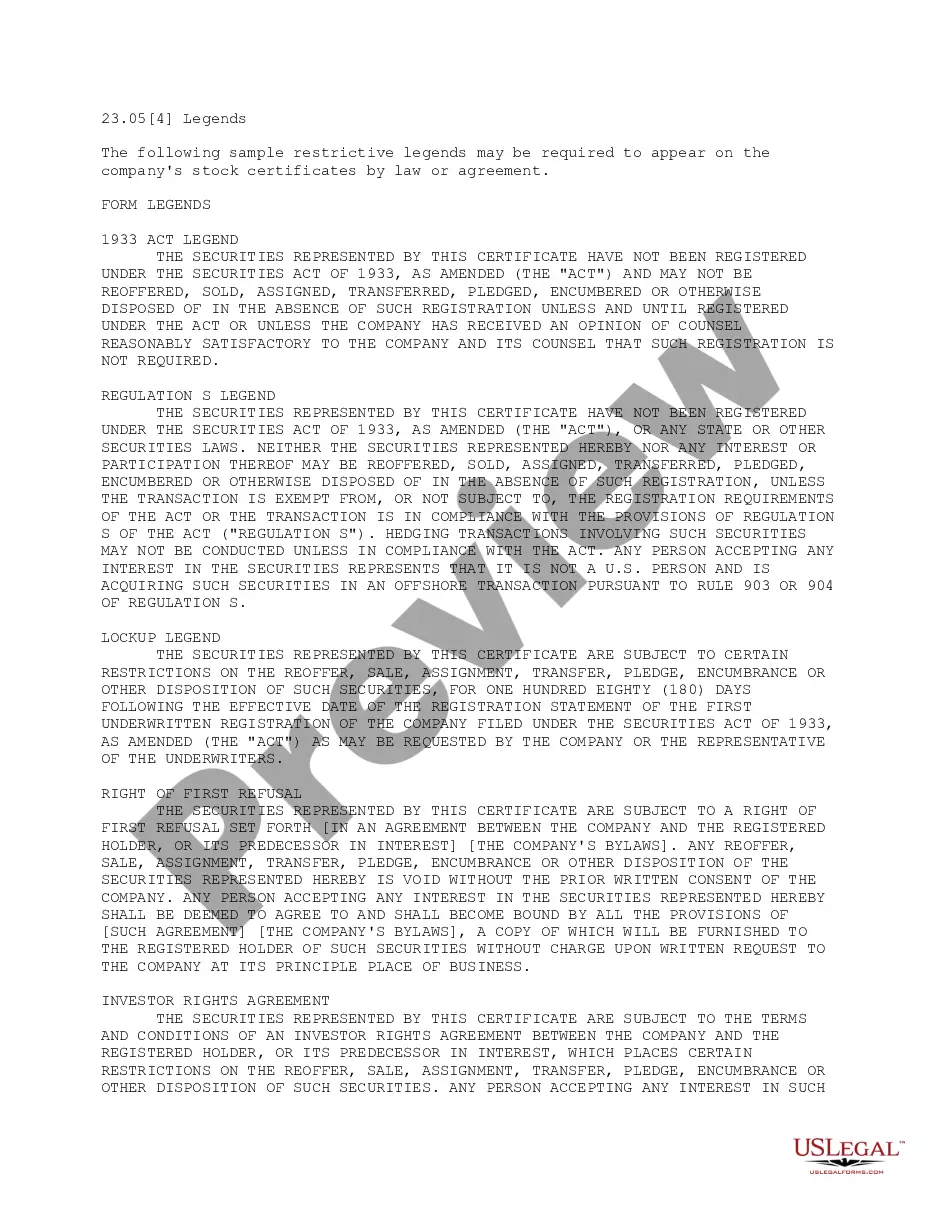

Description

How to fill out Travis Texas Cláusula Detallada De Aumento De Impuestos?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Travis Detailed Tax Increase Clause, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Travis Detailed Tax Increase Clause from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Travis Detailed Tax Increase Clause:

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!