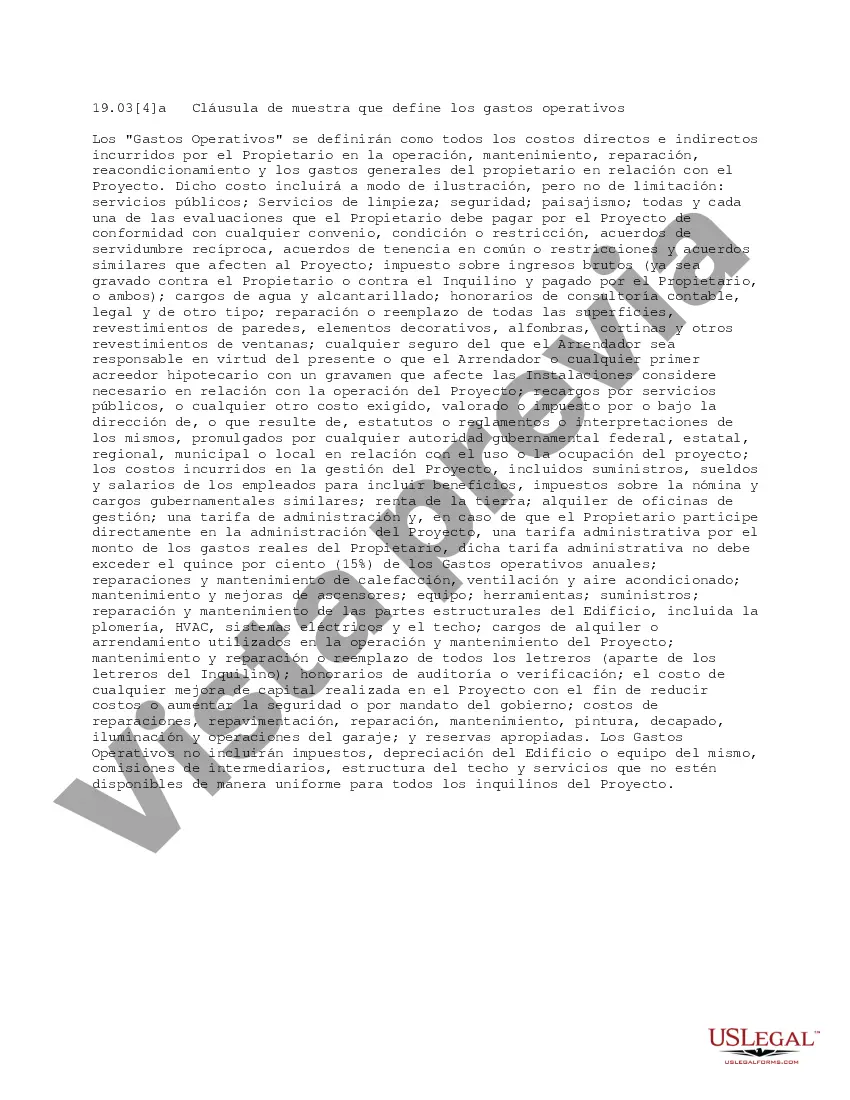

Bexar Texas Clause Defining Operating Expenses: A Comprehensive Guide Introduction: The Bexar Texas Clause Defining Operating Expenses is an essential provision included in many commercial lease agreements. It outlines the specific costs and expenses that the tenant is responsible for in addition to the base rent. This clause ensures clarity and transparency regarding the financial obligations of both the landlord and the tenant. Key Elements of the Bexar Texas Clause: 1. Definition of Operating Expenses: The Bexar Texas Clause starts by defining what constitutes operating expenses for the purposes of the lease agreement. It typically includes expenses associated with the maintenance, operation, repair, and management of the leased property. 2. Examples of Operating Expenses: The clause provides a detailed list of specific operating expenses that fall under its purview. These may vary depending on the type of property, lease terms, and local regulations. Some common examples of operating expenses include property taxes, insurance premiums, common area maintenance costs, utilities, repairs and maintenance, security expenses, and management fees. 3. Exclusions from Operating Expenses: This clause also specifies certain expenses that are excluded from the tenant's responsibility. These exclusions may cover capital improvements, structural repairs, leasing commissions, marketing expenses, and other costs that are typically borne by the landlord. 4. Method of Calculation: The Bexar Texas Clause outlines the methodology for calculating operating expenses. It may include provisions for annual reconciliation, where the tenant is required to pay a proportionate share of actual expenses incurred over a specific period, typically a calendar year. The lease agreement may specify the base year against which subsequent operating expenses will be measured. Different Types of Bexar Texas Clause Defining Operating Expenses: 1. Full-Service Gross Lease: In this type of lease, the tenant pays a flat, all-inclusive rent, and the landlord shoulders all operating expenses, including utilities, taxes, and maintenance costs. 2. Modified Gross Lease: This lease structure typically splits operating expenses between the landlord and tenant, with the base rent covering most expenses, such as property taxes and insurance premiums, while the tenant is responsible for utilities and maintenance costs. 3. Triple Net Lease: This type of lease places the burden of all operating expenses on the tenant. They are responsible for property taxes, insurance, maintenance, repairs, and utilities in addition to the base rent. Conclusion: The Bexar Texas Clause Defining Operating Expenses is a critical component of commercial lease agreements in Bexar County, Texas. It clearly defines the operating expenses for which the tenant is responsible, helps establish a fair allocation of costs between the landlord and tenant, and ensures transparency and accountability in lease management. It is essential for both parties to thoroughly review and understand the clause to avoid any future disputes or financial misunderstandings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Cláusula que define los gastos operativos - Clause Defining Operating Expenses

Description

How to fill out Bexar Texas Cláusula Que Define Los Gastos Operativos?

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life scenario, finding a Bexar Clause Defining Operating Expenses meeting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. In addition to the Bexar Clause Defining Operating Expenses, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Bexar Clause Defining Operating Expenses:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Bexar Clause Defining Operating Expenses.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!