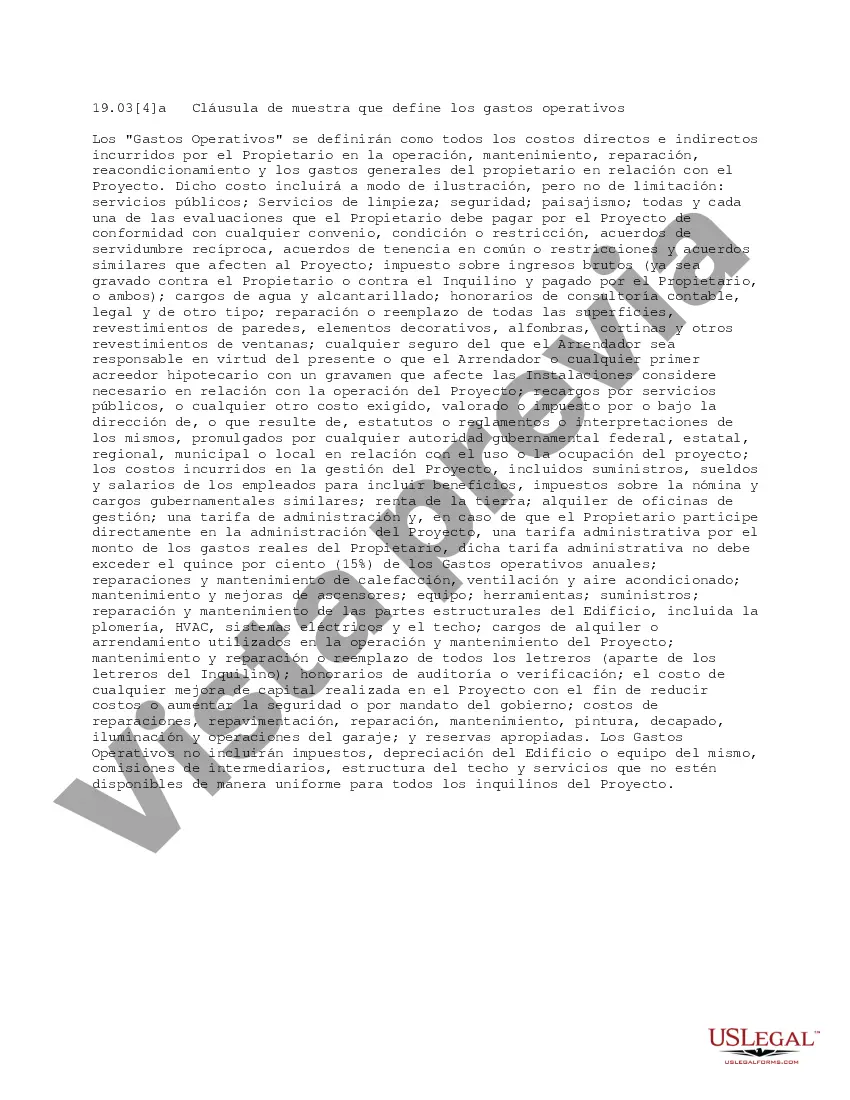

The Cook Illinois Clause Defining Operating Expenses refers to a specific provision within a contract or agreement that outlines the definitions and scope of operating expenses in relation to Cook County, Illinois. This clause is commonly included in lease agreements, specifically for commercial and retail properties within the county. Operating expenses, in the context of this clause, are the expenditures associated with the operation, maintenance, and management of the leased property. This clause serves to clearly define and enumerate the specific expenses that the tenant is responsible for paying, in addition to the base rent. It ensures that the tenant understands their obligations regarding the payment of these expenses. The Cook Illinois Clause Defining Operating Expenses encompasses various types of expenses, commonly including: 1. Property Maintenance: This includes expenses related to the upkeep and repair of the property, such as landscaping, snow removal, parking lot maintenance, and janitorial services. 2. Utilities: Expenses associated with utilities utilized by the leased property, including electricity, gas, water, and sewer services are typically covered under this clause. 3. Common Area Maintenance (CAM): CAM expenses include the costs incurred for the maintenance and repair of common areas shared by multiple tenants, such as lobbies, hallways, elevators, and parking garages. It may also cover the expenses of security services and trash removal. 4. Insurance: This clause often outlines the tenant's responsibility to contribute towards insurance premiums, such as property insurance and liability insurance. 5. Property Taxes: It is common for the Cook Illinois Clause Defining Operating Expenses to include provisions specifying how property taxes will be apportioned between the landlord and tenant. Often, tenants are required to contribute their proportionate share of property taxes applicable to the leased space. 6. Management Fees: In some cases, the clause may also include management fees associated with the overall administration and management of the property. 7. Other Permissible Expenses: The Cook Illinois Clause Defining Operating Expenses might also include provisions for other permissible expenses, not specifically mentioned above, that are reasonably necessary for the operation, maintenance, and management of the leased property. It is important for both landlord and tenant to thoroughly review and understand the terms defined in the Cook Illinois Clause Defining Operating Expenses to avoid any misunderstandings or disputes regarding the payment obligations. Seeking legal advice or utilizing the expertise of a real estate professional is strongly recommended ensuring clarity and accuracy in interpreting and implementing this particular clause.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Cláusula que define los gastos operativos - Clause Defining Operating Expenses

Description

How to fill out Cook Illinois Cláusula Que Define Los Gastos Operativos?

Draftwing paperwork, like Cook Clause Defining Operating Expenses, to take care of your legal affairs is a difficult and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents created for various scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Cook Clause Defining Operating Expenses form. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before getting Cook Clause Defining Operating Expenses:

- Make sure that your document is compliant with your state/county since the regulations for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Cook Clause Defining Operating Expenses isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start using our website and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment details.

- Your template is ready to go. You can try and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

El gasto de operacion consiste en todos los desembolsos que permiten una entidad desarrollar sus diversas actividades y operaciones diarias.

La nocion de gastos de operacion hace referencia al dinero desembolsado por una empresa u organizacion en el desarrollo de sus actividades. Los gastos operativos son los salarios, el alquiler de locales, la compra de suministros y otros.

Gastos de operacion = gastos de distribucion + gastos de administracion + gastos de financiamiento. Costo total = costo de produccion + gastos de operacion.

Los costos operativos fijos son aquellos que no cambian sin importar el nivel de produccion de la empresa. Un ejemplo es el alquiler de las oficinas. Los costos operativos variables, como su nombre lo indica, cambian en funcion de la produccion de la empresa.

Para obtener el dato, la siguiente formula es muy sencilla y te sera de utilidad: Gastos de ventas + Gastos administrativos + Gastos de naturaleza financiera + Otros gastos = Total de gastos de operacion.

Los gastos operacionales se dividen en cuatro tipos: gastos administrativos (sueldos y aquellos servicios de la oficina), gastos financieros (pago por intereses, emision de cheques), gastos hundidos (son aquellos gastos que se realizan antes del comienzo de las operaciones correspondientes a las actividades) y gastos

¿Que son los gastos operativos? Hacen referencia al gasto en el que incurre una empresa para el desarrollo normal de sus actividades diarias, por ejemplo: arriendo, salarios, marketing, costos de inventario, compra de suministros, etc.