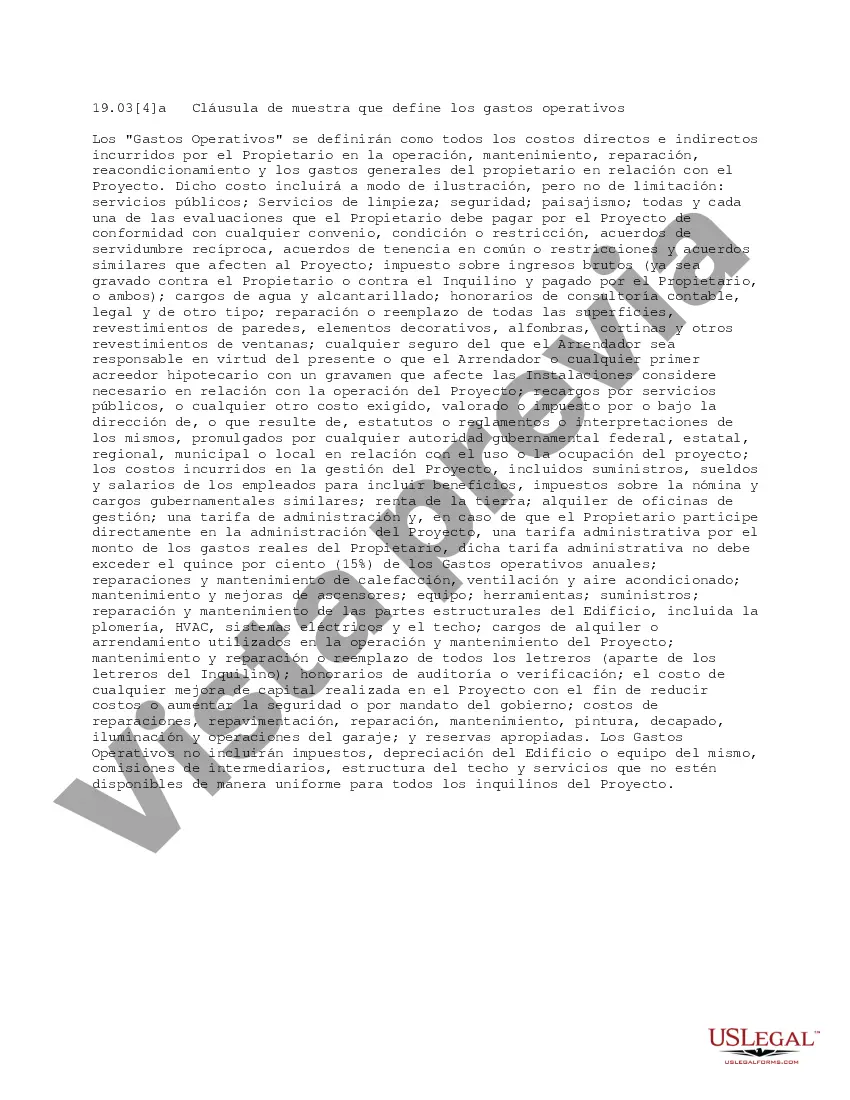

Dallas Texas Clause Defining Operating Expenses refers to a specific provision or clause included in legal agreements, such as commercial leases or contracts, that outlines the expenses that a tenant or lessee is responsible for paying in addition to the base rent. This clause is commonly found in lease agreements for commercial properties located in Dallas, Texas, and helps define the financial responsibilities of both the landlord and tenant. The Dallas Texas Clause Defining Operating Expenses typically includes explicit definitions and categorizations of operating expenses, which may vary depending on the specific lease agreement or property type. Some key operating expense categories commonly addressed in this clause are: 1. Common Area Maintenance (CAM) Expenses: CAM expenses include costs associated with the maintenance, repair, and cleaning of common areas, such as parking lots, hallways, elevators, and shared facilities. These costs can encompass landscaping, janitorial services, security, and general upkeep of the property. 2. Property Taxes: This category covers the tenant's share of property taxes assessed on the leased premises. It may be divided based on the prorated square footage or a predetermined formula stipulated in the lease agreement. 3. Insurance Premiums: Operating expenses related to insurance premiums typically include the tenant's contribution towards liability insurance, property insurance, or any other types of coverage required by the landlord. 4. Utilities: Expenses associated with utility services that serve the leased premises, such as electricity, water, gas, sewage, and waste management, may fall under this category. The lease agreement may specify how these costs are allocated between the landlord and the tenant. 5. Repairs and Maintenance: This covers expenses related to the repair, upkeep, and general maintenance of the leased property, such as HVAC system maintenance, plumbing, electrical repairs, and other necessary renovations or replacements. It is important to note that the specific types and details of the Dallas Texas Clause Defining Operating Expenses may vary from lease to lease. It is crucial for both the landlord and tenant to carefully review and negotiate the terms and definitions outlined in this clause to clarify the financial obligations of each party. By including this clause in the lease agreement, both the landlord and tenant can work together to ensure transparency and accountability in terms of allocating and managing the financial burden of various operating expenses associated with the leased premises in Dallas, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Cláusula que define los gastos operativos - Clause Defining Operating Expenses

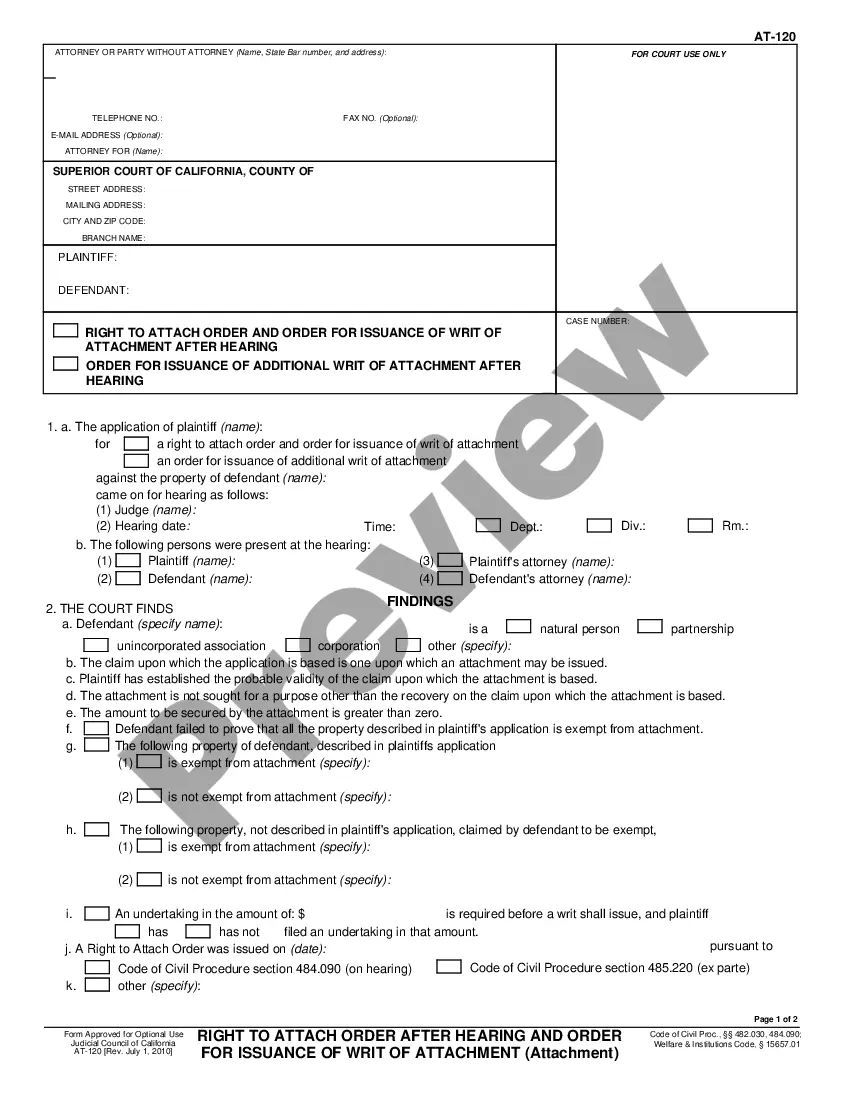

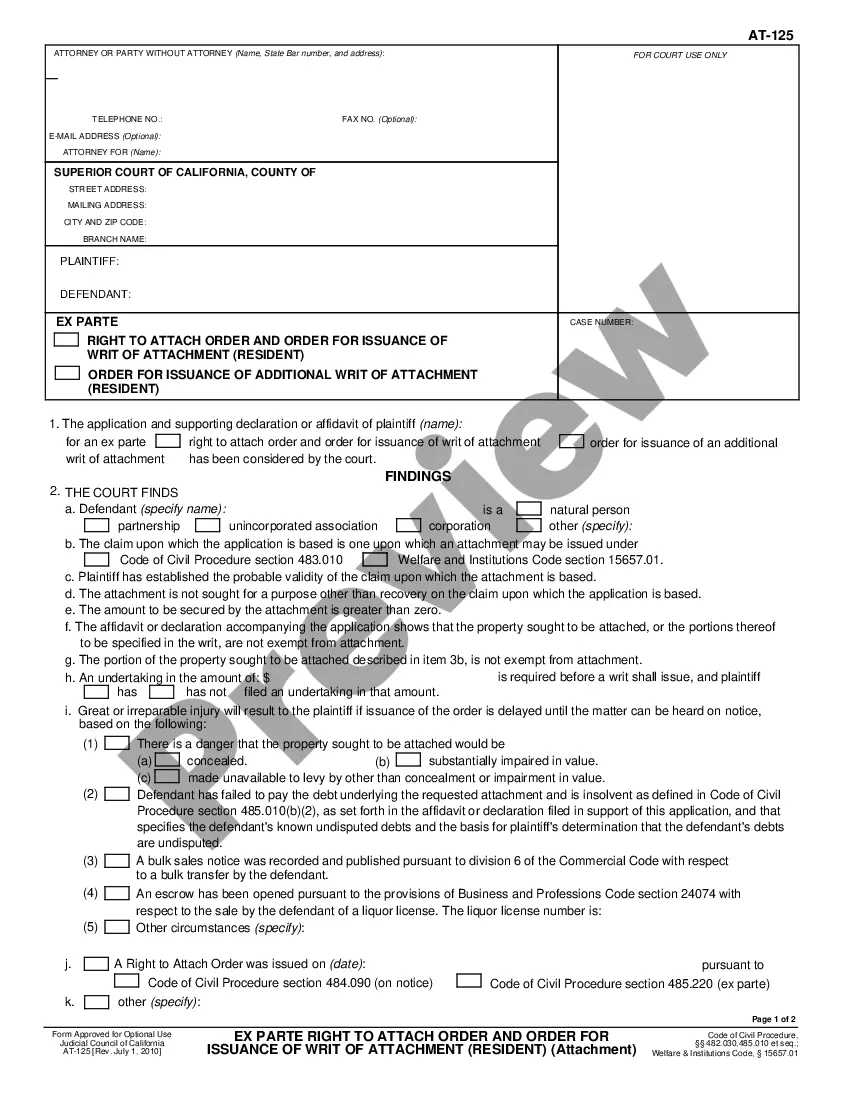

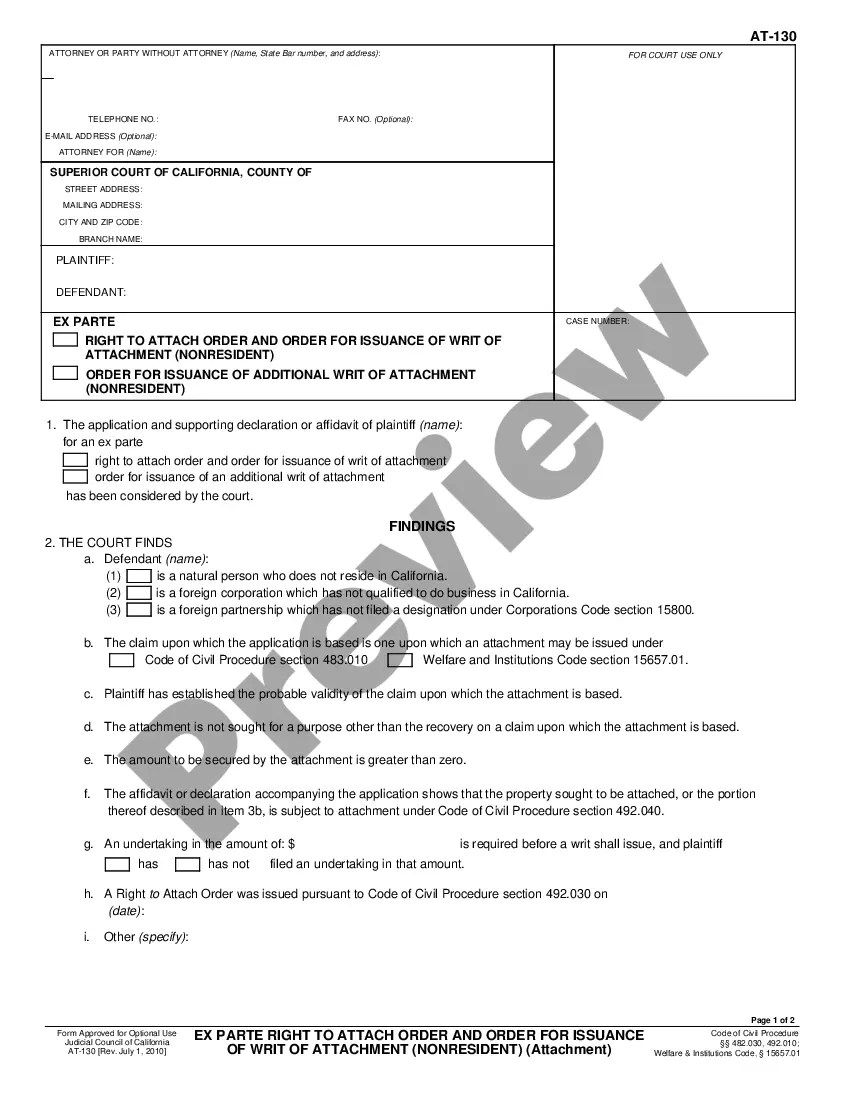

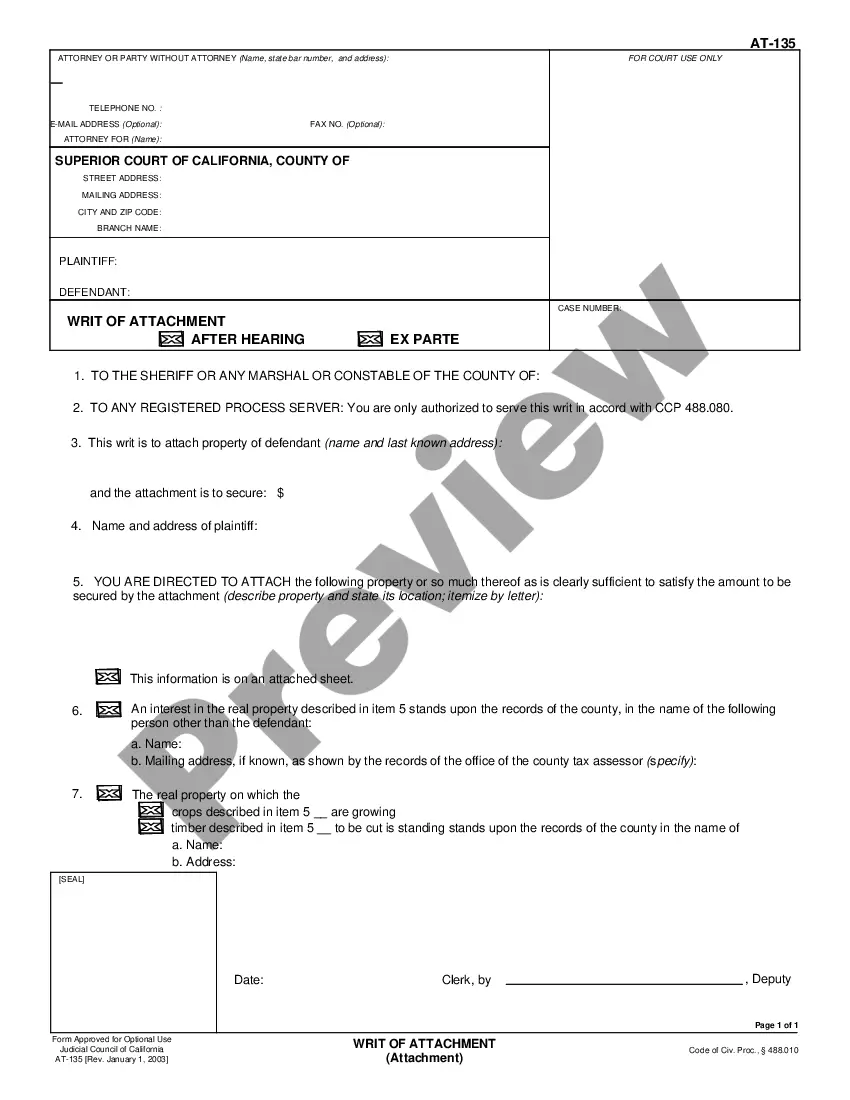

Description

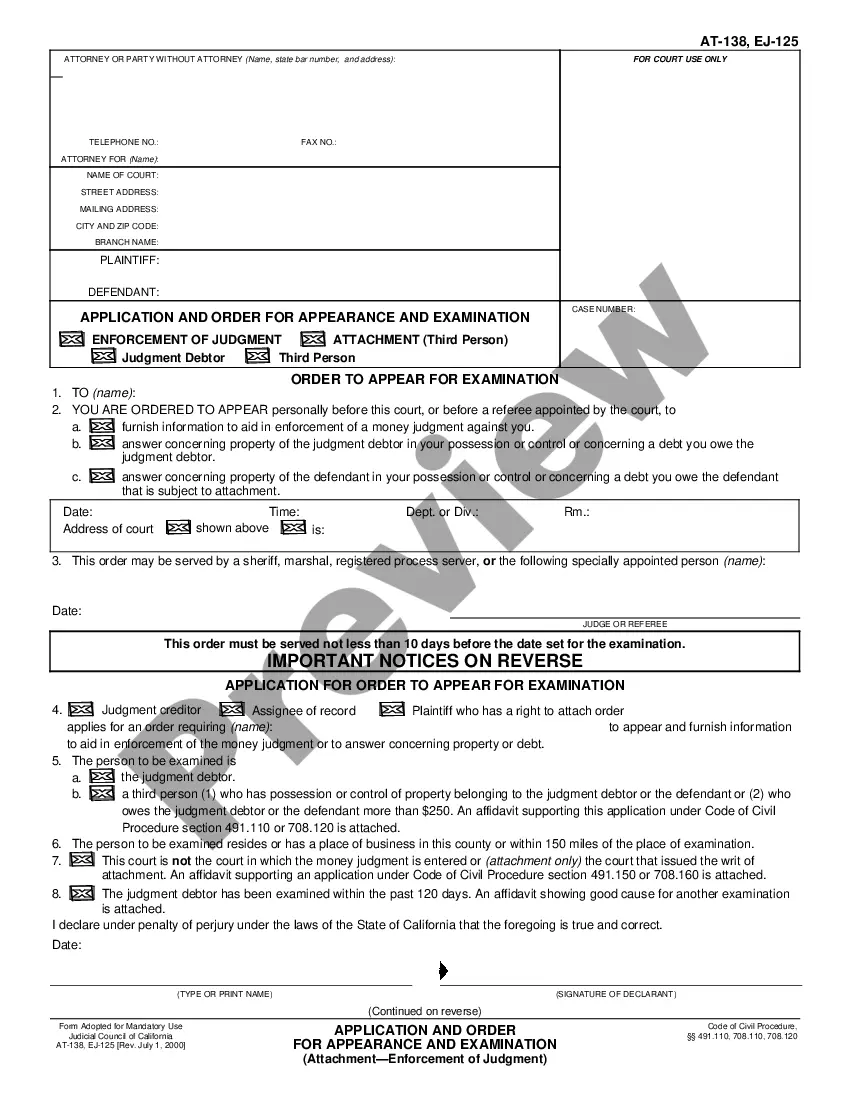

How to fill out Dallas Texas Cláusula Que Define Los Gastos Operativos?

Preparing papers for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to create Dallas Clause Defining Operating Expenses without expert assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Dallas Clause Defining Operating Expenses by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Dallas Clause Defining Operating Expenses:

- Examine the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any use case with just a few clicks!