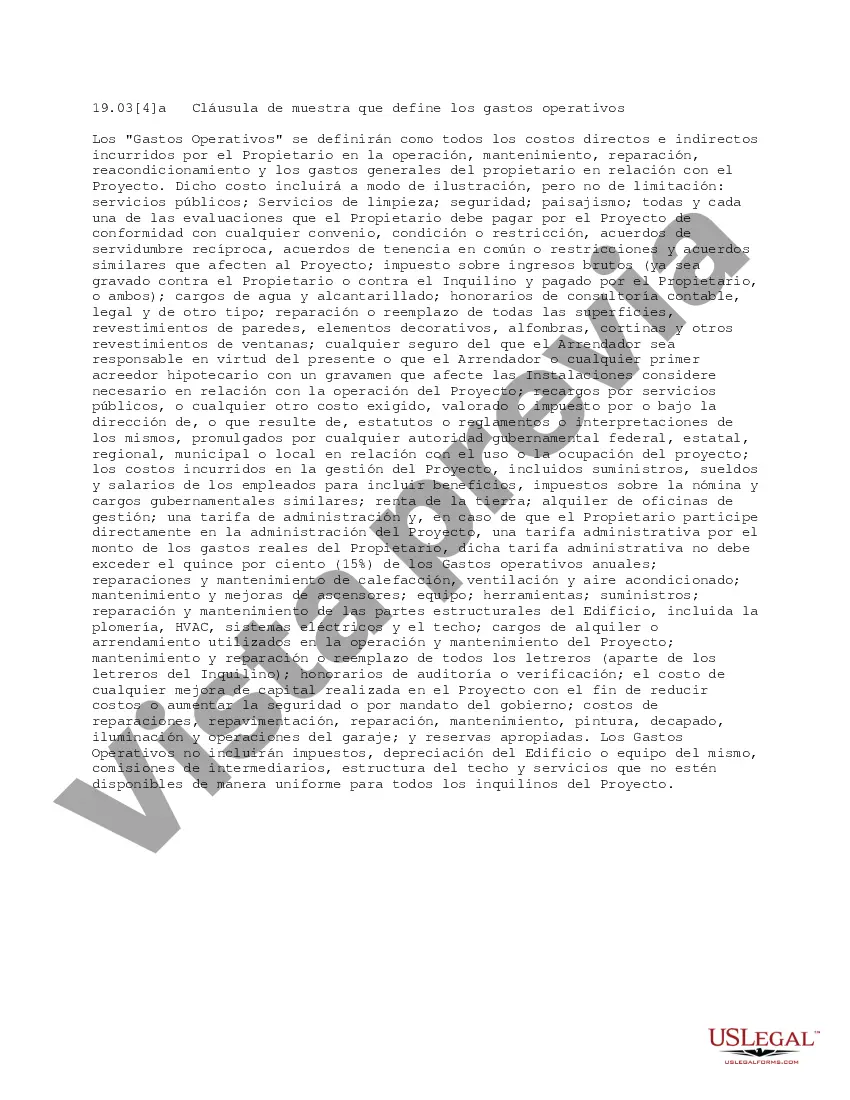

Orange California Clause Defining Operating Expenses refers to a legal provision found in a lease agreement that specifically outlines the tenant's responsibility regarding the payment and allocation of various operating expenses associated with the leased property in Orange, California. This clause ensures clarity and transparency between the landlord and tenant regarding their financial obligations and helps prevent conflicts or misunderstandings arising from misunderstandings or vague language in the lease contract. Operating expenses, as defined by the Orange California Clause, may include but are not limited to: 1. Utilities: This covers expenses related to electricity, gas, water, sewer, trash removal, and other essential utility services necessary for the functioning of the property. 2. Property Taxes: This category includes property taxes imposed by the local government on the rented property. The clause outlines whether the tenant is responsible for these taxes or if they are the landlord's responsibility. 3. Maintenance and Repairs: The clause outlines the tenant's contribution towards routine maintenance and repairs of the property, such as cleaning, landscaping, painting, and other general upkeep. It may also address who is responsible for major repairs and the procedures for reporting and addressing such issues. 4. Insurance Premiums: This clause specifies whether the tenant is required to obtain and maintain insurance coverage for the leased property, or whether the landlord carries insurance and allocates a portion of the premiums to the tenant. 5. Common Area Expenses: In situations where the leased property is part of a larger building or complex with shared common areas, such as parking lots, lobbies, elevators, or shared hallways, the clause dictates the tenant's share of the expenses incurred in maintaining these common areas. 6. Management Fees: In cases where a property management company oversees the day-to-day operations of the leased property, this clause establishes the tenant's portion of the management fees, if applicable. It is essential to note that the specific details and variations of the Orange California Clause Defining Operating Expenses may differ from one lease to another. It is crucial for both parties to thoroughly review the clause, understand its implications, and negotiate any terms they may find ambiguous or requires clarification before signing the lease agreement. Seeking legal advice is advisable for both landlords and tenants to ensure fair and equitable allocation of operating expenses in Orange, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Cláusula que define los gastos operativos - Clause Defining Operating Expenses

Description

How to fill out Orange California Cláusula Que Define Los Gastos Operativos?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Orange Clause Defining Operating Expenses, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the recent version of the Orange Clause Defining Operating Expenses, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Orange Clause Defining Operating Expenses:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Orange Clause Defining Operating Expenses and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!