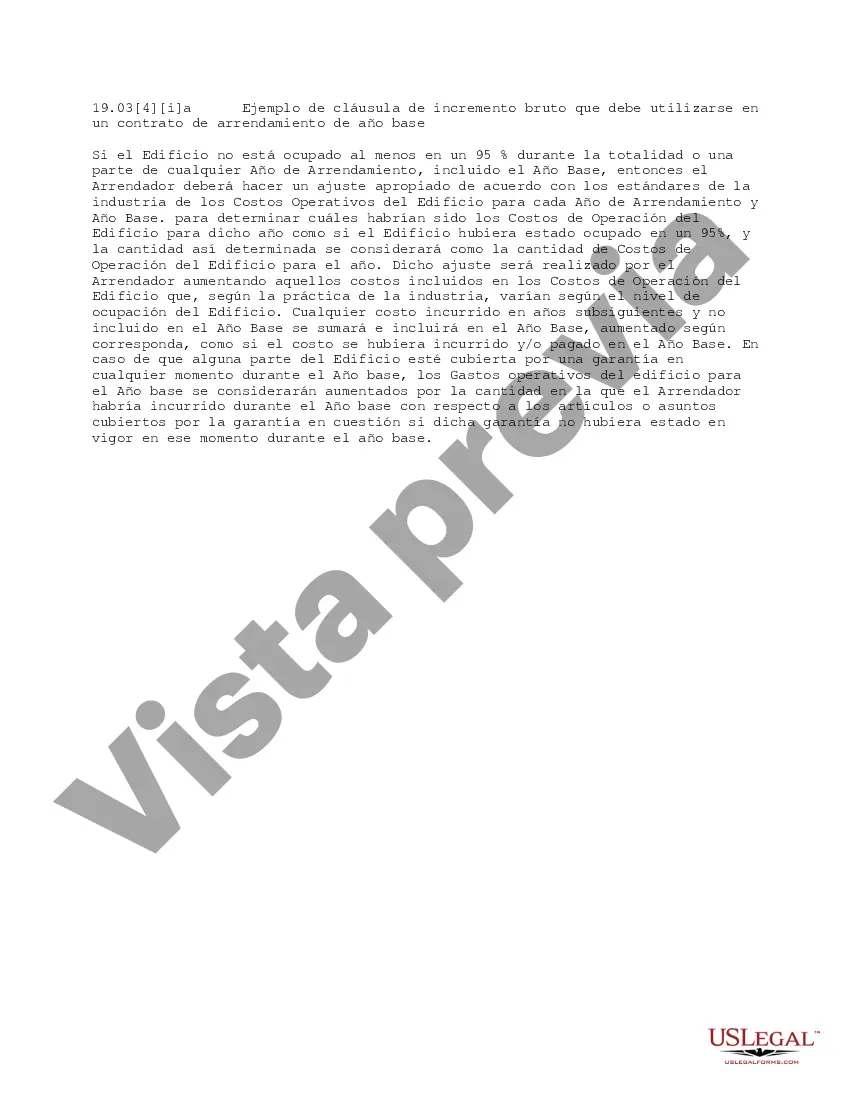

Travis Texas Gross up Clause: Understanding and Types in a Base Year Lease If you are a landlord or tenant dealing with a commercial lease in Travis, Texas, it is essential to be familiar with the concept of a gross up clause. A gross up clause is a provision typically found in base year leases, which allows the landlord to adjust the tenant's base year operating expenses to account for any vacancies or non-paying tenants. In simpler terms, it ensures that the tenant pays their fair share of expenses even if there are empty spaces in the building. The purpose of a Travis Texas gross up clause is to maintain a fair and equitable distribution of operating expenses among all tenants in a multi-tenant property. It ensures that vacant spaces do not unfairly burden the tenants who are occupying and paying rent. By utilizing a gross up clause, landlords can factor in potential lost revenue due to vacancies and still maintain a consistent level of income. There are different types of gross up clauses that can be used in a base year lease, including: 1. Gross-up based on actual occupancy: This type of gross up clause considers the actual occupancy levels during the base year. It calculates the proportionate share of operating expenses based on the actual number of tenants occupying the space during that period. This method provides an accurate representation of expenses during the base year. 2. Gross-up based on stabilized occupancy: In some cases, landlords may choose to use a gross up clause based on stabilized occupancy. This means that they calculate the expenses based on an assumed occupancy level, regardless of the actual number of tenants during the base year. This method aims to provide a more stable and predictable expense allocation, especially in cases where there may be significant fluctuations in occupancy throughout the year. 3. Gross-up based on projected occupancy: This type of gross up clause takes into account the projected occupancy levels for the base year. It relies on estimates and forecasts provided by the landlord or property management, considering anticipated lease agreements and market conditions. This method can be beneficial when the property is undergoing renovations, expansions, or changes in tenancy, as it ensures that anticipated expenses are adequately factored into the base year calculations. It is important to note that the specific language and calculations of a gross up clause may differ from lease to lease. Therefore, it is crucial for both parties to carefully review and negotiate the terms to ensure fairness and accuracy. In conclusion, a Travis Texas gross up clause is a critical component of a base year lease, enabling landlords to distribute operating expenses fairly among tenants. Whether based on actual occupancy, stabilized occupancy, or projected occupancy, the gross up clause ensures that all tenants contribute their fair share, regardless of any vacant spaces. Understanding and utilizing the appropriate type of gross up clause is essential for both landlords and tenants to maintain a balanced financial arrangement in their lease agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Cláusula de aumento bruto que debe usarse en un contrato de arrendamiento de año base - Gross up Clause that Should be Used in a Base Year Lease

Description

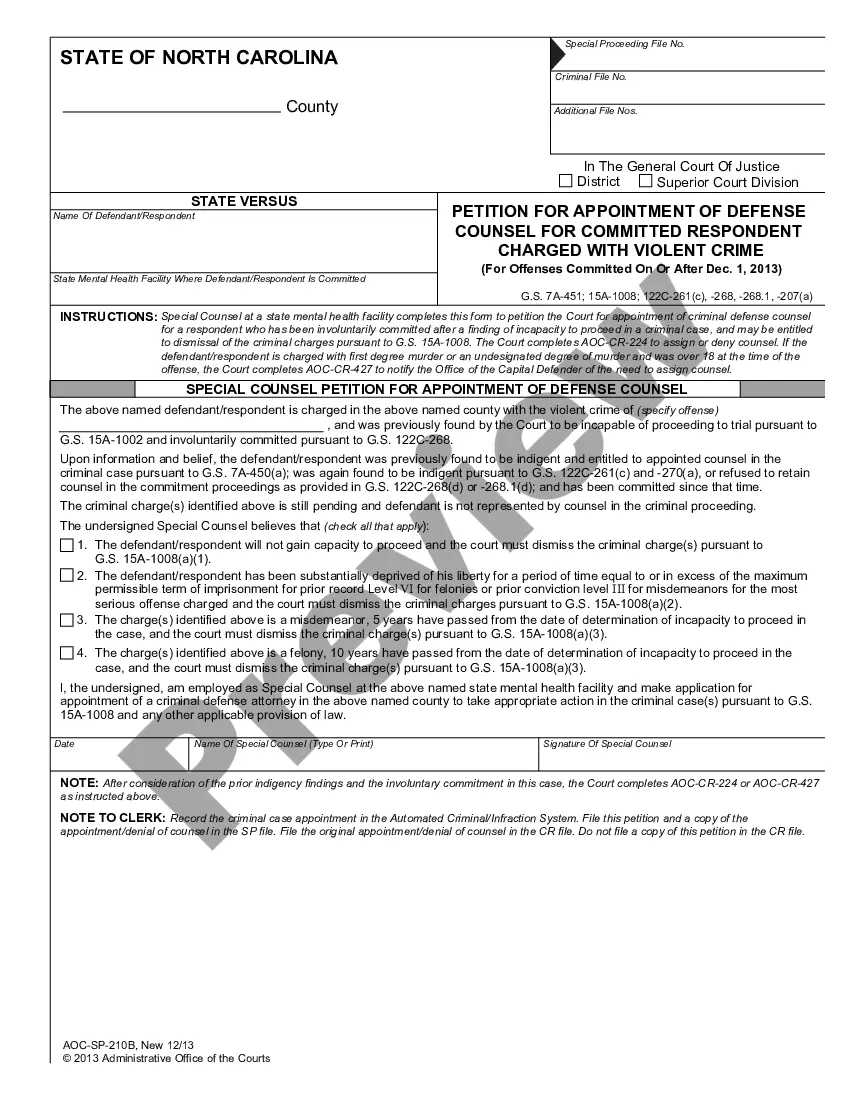

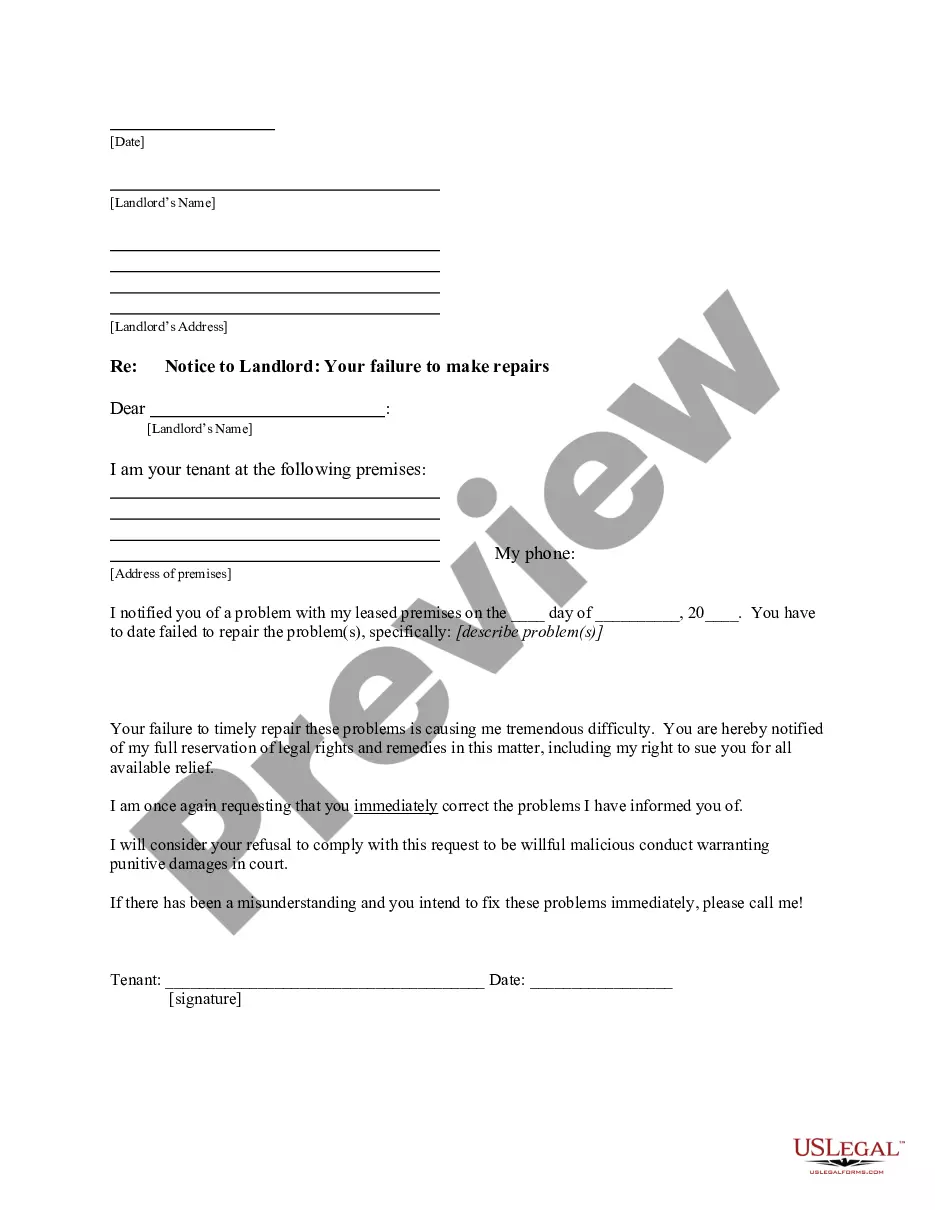

How to fill out Travis Texas Cláusula De Aumento Bruto Que Debe Usarse En Un Contrato De Arrendamiento De Año Base?

If you need to find a trustworthy legal document supplier to get the Travis Gross up Clause that Should be Used in a Base Year Lease, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can search from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support make it easy to locate and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply type to look for or browse Travis Gross up Clause that Should be Used in a Base Year Lease, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Travis Gross up Clause that Should be Used in a Base Year Lease template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less expensive and more affordable. Set up your first business, arrange your advance care planning, create a real estate agreement, or execute the Travis Gross up Clause that Should be Used in a Base Year Lease - all from the convenience of your sofa.

Sign up for US Legal Forms now!