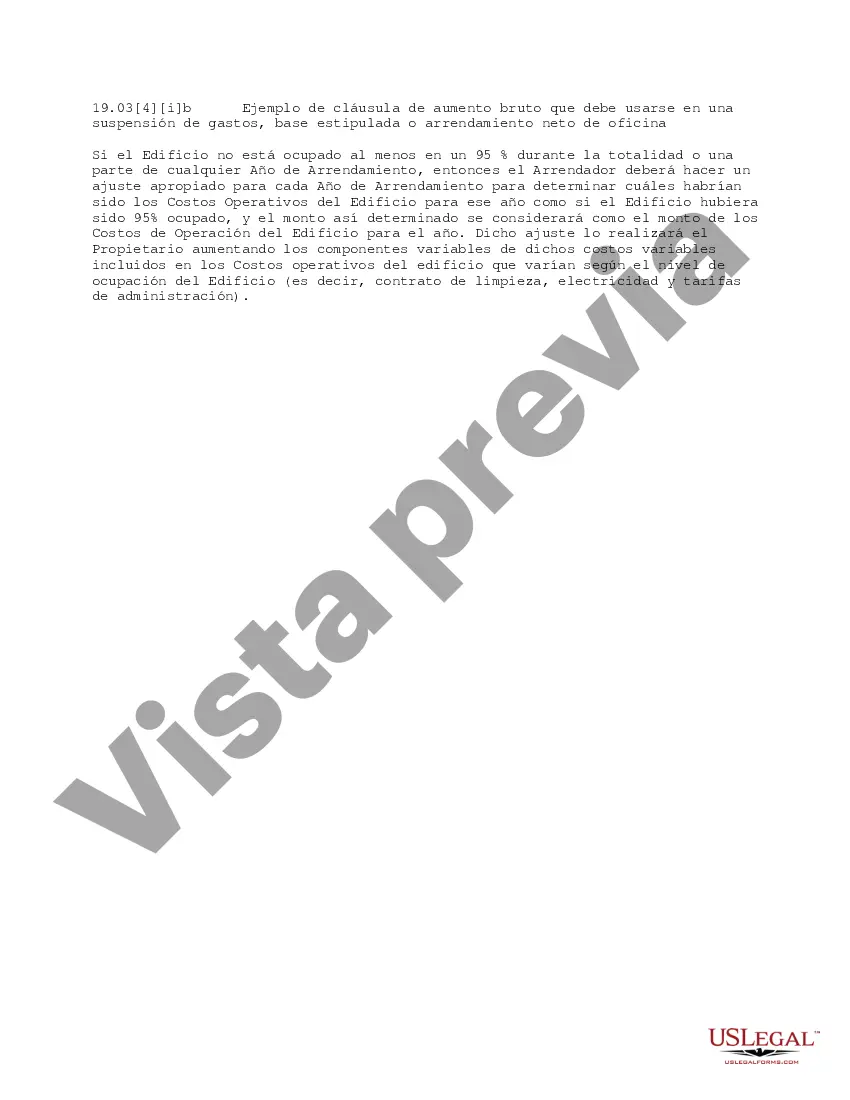

The King Washington Gross up Clause is a crucial component often included in an Expense Stop Stipulated Base or Office Net Lease agreement. It establishes how certain expenses are calculated and allocated among the tenants and landlords of a commercial property. This clause helps ensure fairness and transparency in expense allocation, especially when there are different types of leases involved. There are several types of King Washington Gross up Clauses commonly used in Expense Stop Stipulated Base or Office Net Lease agreements. These include the following: 1. Full Gross up Clause: This type of clause specifies that expenses for the property will be calculated as if the property is fully occupied, regardless of the actual occupancy level. The landlord is responsible for covering any difference between the actual expenses and the pro rata share of expenses based on full occupancy. 2. Partial Gross up Clause: In this case, the expenses are calculated based on a specified level of occupancy, usually the average occupancy for the property or a predetermined standard. If the property's occupancy falls below this specified level, the landlord will gross up the expenses to account for the difference. 3. Escalation Gross up Clause: This clause takes into account the escalation or increase in expenses over time. It ensures that the expenses considered in the lease are grossed up to reflect any increase, protecting the tenants from suddenly shouldering a significant rise in expenses. 4. Stop Loss Gross up Clause: This type of clause sets a cap on the expenses that a tenant is required to pay. If the expenses go beyond the specified limit, the landlord is responsible for covering the excess amount. It provides tenants with financial protection by ensuring they aren't burdened with unreasonably high expenses. In conclusion, the King Washington Gross up Clause is an essential aspect of an Expense Stop Stipulated Base or Office Net Lease agreement. It aims to determine how expenses are calculated and allocated, ensuring fairness and financial protection for both tenants and landlords. Different types of clauses such as Full Gross up, Partial Gross up, Escalation Gross up, and Stop Loss Gross up can be utilized based on the specific circumstances of the lease.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Cláusula de aumento total que se debe utilizar en una base estipulada de parada de gastos o arrendamiento neto de oficina - Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease

Description

How to fill out King Washington Cláusula De Aumento Total Que Se Debe Utilizar En Una Base Estipulada De Parada De Gastos O Arrendamiento Neto De Oficina?

Draftwing paperwork, like King Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease, to take care of your legal affairs is a difficult and time-consumming task. Many cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for various cases and life circumstances. We ensure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the King Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting King Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease:

- Ensure that your document is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Find out more about the form by previewing it or reading a quick description. If the King Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net Lease isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start using our website and get the document.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can try and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Para finalizar, la formula que se debe aplicar es el total del alquiler dividido por el indice con fecha de cuando se firmo el contrato, multiplicado por el indice del dia en que se aplica el aumento sobre el mismo. Ese valor que arroje sera el importe del alquiler que el inquilino debera abonar durante todo el ano.

El arrendatario debe contabilizar el bien adquirido mediante leasing financiero, como un activo y un pasivo. El canon mensual de arrendamiento se debe dividir en abono a capital y en gasto financiero.

Los arrendatarios pueden aumentar el canon de arrendamiento siempre y cuando, este aumento sea inferior al incremento que haya tenido el IPC, que, segun la cifra divulgada por el DANE, para el 2022 es de 5.62 %.

Incremento anual de renta 2022 establecido por la ley Los contratos de arrendamiento generalmente se realizan por periodos anuales, y al concluir ese tiempo se pueden renovar. No obstante, el casero puede realizar un incremento de hasta 10% sobre el monto vigente.

(621) Arrendamientos: los devengados por el alquiler o arrendamiento operativo de bienes muebles o inmuebles en uso o a disposicion de la empresa.

En sintesis, el metodo es dividir el valor total del alquiler por el indice correspondiente a la ultima actualizacion de los 12 meses posteriores y multiplicarlo por el indice del 2022 de la misma fecha. El numero que arroje esta cuenta sera el valor que los inquilinos tendran que pagar por todo el ano.

183 Alquileres Comprende el alquiler de bienes muebles e inmuebles , cuya utilizacion se efectuara en el futuro, no clasificados como activos por derecho de uso, los que se reconocen en la cuenta 32.

La factura de alquiler de local debe contabilizarse en la cuenta (Tipo de Gasto): 621. Arrendamientos y Canones (costes de los alquileres). La factura de alquiler debe contabilizarse como Factura Recibida y normalmente llevara retencion del 19%.

El incremento se calcula multiplicando la renta base inicial del inquilino por el porcentaje de incremento permisible anual.

La cantidad que suele aumentar va de acuerdo a la inflacion, que suele colocarse entre 5 y 8%. La ley especifica que tambien se debe ajustar el deposito dado inicialmente ya que debe corresponder al valor de la renta mensual.